Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Being a Frequent Floater, that is, someone who loves cruise ships, I am always looking forward to my favorite cruise, my “next one.” I am constantly on the lookout for ways to lower the cost out of pocket for my adventure.

One of my favorite ways of doing this is using my Chase Ultimate Rewards® points in conjunction with my Chase Sapphire Reserve®* card to get 1.5 cents per point value in not just booking and paying for the cruise but also doing things like prepaying onboard daily service charges and even loading up my onboard account with cash – again getting 1.5 cents value in doing so.

Having been on countless cruises, I tend to arrive a day or many days early before the ship departs because, as we all know, the ship will not wait on you if you are late. That means not just hotel nights but also meals and dining out can get expensive. But take a look at this:

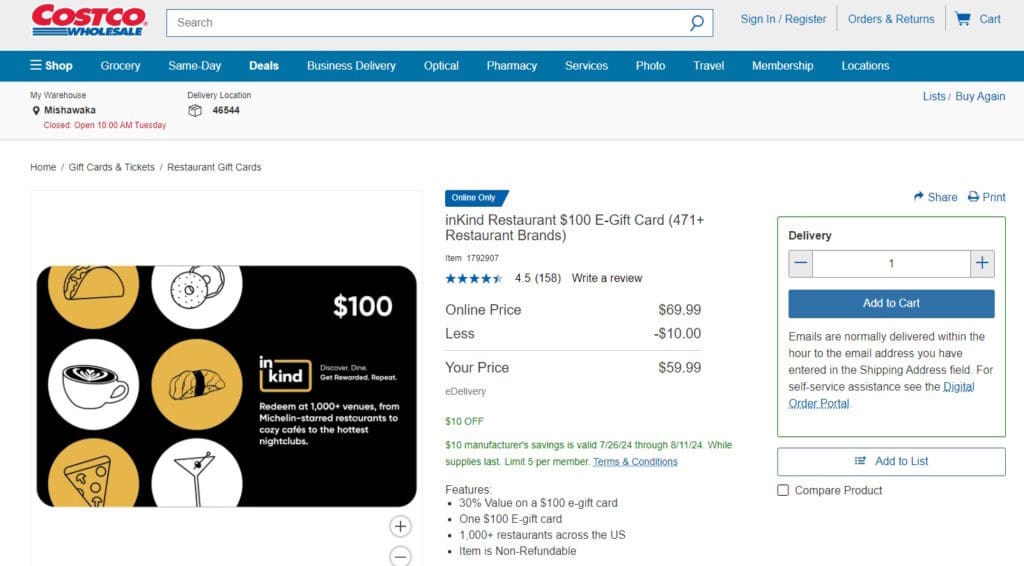

I am a big fan of INKIND (use this link to get $25 off when you spend $50) and have used them all over the place for great savings. Well, right now, Costco is offering a sweet discount on a $100 dining credit from INKIND.

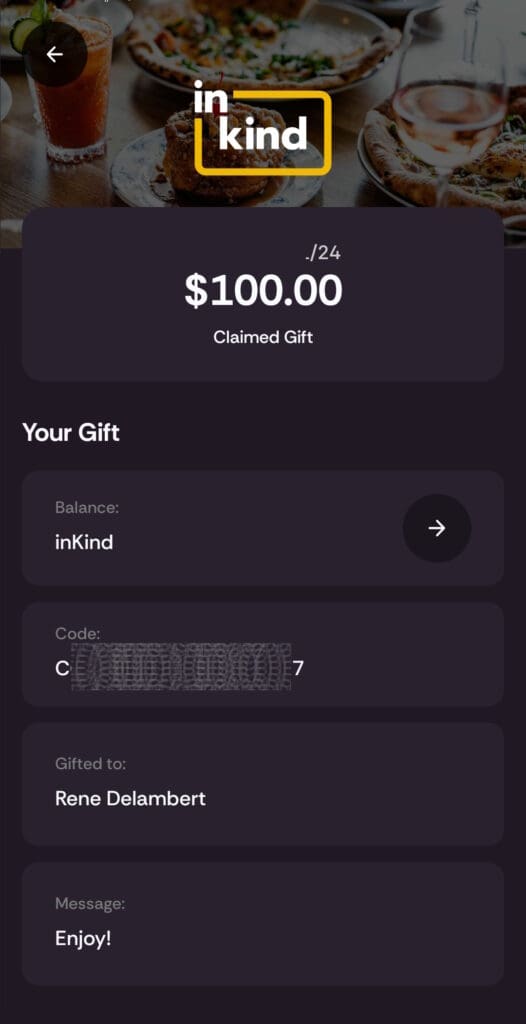

And before you ask – yes – you can buy it for yourself and load it into your app. But then comes the next fun part. Take a look:

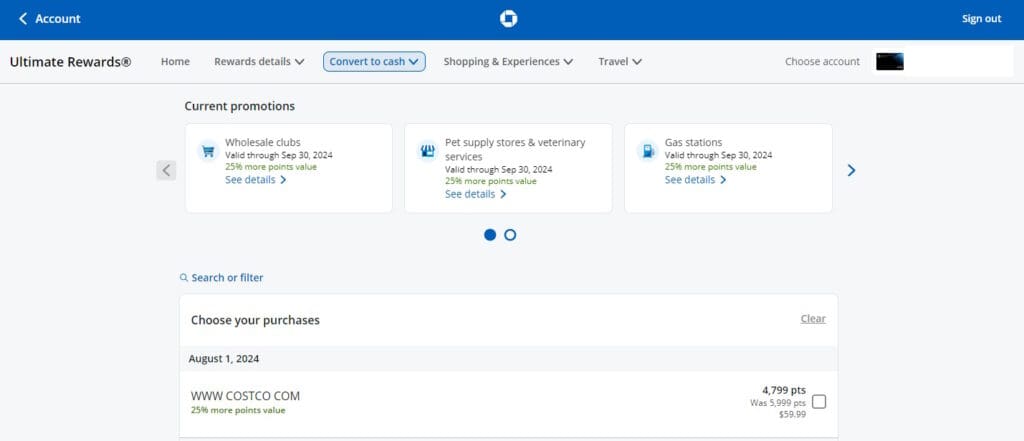

Currently warehouse stores, like Costco, are allowing those of us with Chase Sapphire Reserve® cards to “pay yourself back” for charges. While not getting 1.5 cents value like when booking travel and cruises and such I am still happy to knock out this buy at 1.25 cents.

There are so many outstanding Ultimate Rewards earning cards you should be considering if you’re like me and travel in style (but do so without going into debt!)

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card*

- Chase Freedom Unlimited®*

- Chase Freedom Flex®*

- Ink Business Cash® Credit Card*

- Ink Business Preferred® Credit Card*

- Ink Business Unlimited® Credit Card*

Back when I started learning about the points possibilities of discounting my travel so many years ago, I would do all I could to build up my balances to amazing sums – in 2024, not so much. Now I earn and burn once I have reached my whatever points goal for whatever trip and then start over again.

Are you taking advantage of Ultimate Rewards points to offset your travel costs too? – René

*All information about this card was collected independently by Eye of the Flyer. It was neither provided by nor reviewed by the card issuer.Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.