Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

There is an absolutely fantastic rewards credit card (good for cash back that can be applied toward travel) that is perfect for entertainment lovers.

Don’t worry. There’s no annual fee.

My wife and I use it and have earned a few hundred dollars back in the past year and a half.

So, if you love concerts, live theatre (Broadway and touring shows), sporting events, or even going to the movies every now and then, you should really consider getting the Capital One Savor Cash Rewards Credit Card.

Entertainment: 3% Cash Back

The Capital One Savor Cash Rewards Credit Card awards unlimited 3% cash back on entertainment purchases.

What exactly constitutes “entertainment” spending? Per Capital One:

- Theatrical promoter

- Concert promoter

- Movie theatres

- Commercial sports promoter (professional or semi-professional live sporting events)

- Tourist attractions

- Amusement parks

- Bowling alleys

- Zoos

- Record stores

- Video rental location (excluding digital streaming and subscription services)

- Don’t worry — some of those are covered in a separate category

- Aquariums

- Dance halls (I’m curious what “dance halls” are out there)

- Billiard and pool establishments

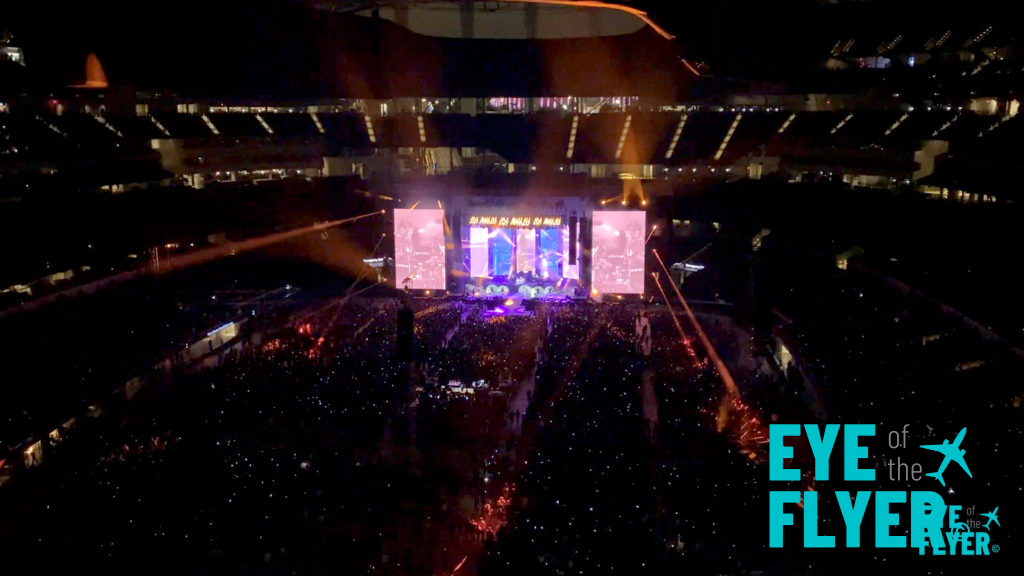

For example, some friends are joining my wife and me to see a Def Leppard and Journey concert this summer. I was in charge of buying the tickets.

The total after TicketBastar— I mean, Ticketmaster — service fees and charges came to $977.25. I paid with my Savor Cash Card and earned just over $29 cash back.

That’s basically a free $29 because the card has no annual fee. (At least, it’s free when you pay your bills on time and don’t trigger interest charges.) That $29 I earned back might be enough for domestic beer and a half at the show! 😉

Here’s another example. My wife brought our daughter to her first concert, Kidz Bop, at the YouTube Theater in Los Angeles. They went with a group that had tickets through some promotion. I gave her my Savor Cash Card and told her to charge all their expenses to it. Mrs. Carley bought two adult beverages (one for the host, one for her) and some chicken fingers for our kiddo.

Naturally, the total was about $75 after tax. We earned about $2.25 cash back.

“A little over two bucks? That’s it?” some will scoff. But that’s better than what you’ll earn on many other cards. To put this in context, high-end cards like the The Platinum Card® from American Express and Chase Sapphire Reserve® would earn 76 points, as the above charge would fall under the “all other eligible purchases” category that earns 1X points. Those 76 points are worth between $.76 and $1.25-ish, depending on how you value and redeem them.

Granted, the Amex Platinum and Sapphire Reserve are more benefit-oriented cards (except the CSR offers good travel and dining earnings). But you see the point.

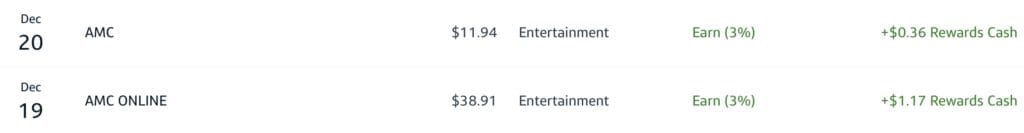

Our third example: my kiddo and I had a Daddy-and-daughter date to see the movie Wish. (Quick review: I treasured the experience, not the movie.)

I charged the AMC tickets (via the AMC app) to my Savor Cash Card, which I also used to pay for our popcorn and drink.

I earned back a little more than $1.50. But it’s pretty much a $1.50 found.

8% on Capital One Entertainment

All that said, you might be able to earn even more cash back on live entertainment purchases.

Capital One Entertainment is like an online travel agency for live events. It doesn’t feature every event (not even close to it, actually). But before you go to our Ticket-you-know-you, check out Capital One Entertainment. Those purchases earn 8% cash back on the Capital One Savor Cash Rewards Credit Card.

More 3% Cash Back Options

The Capital One Savor Cash Rewards Credit Card features three other actually-practical-and-helpful 3% cash back categories:

- 3% on dining

- 3% at grocery stores (excluding superstores like Walmart® and Target®)

- 3% on popular streaming services

You can also earn 5% on hotels and rental cars booked through Capital One Travel (terms apply).

Redeem Cashback Toward Travel

You can use your Capital One Savor Cash Rewards Credit Card cash back balance toward purchasing travel through Capital One Travel. Both my Capital One Savor Cash Rewards Credit Card and Capital One Venture X Rewards Credit Card are on the same account, so I can combine both balances to pay for trips. (Though I prefer to look for points transfers through the Capital One Venture X Rewards Credit Card.)

What’s the Current Early Spend Bonus?

If you don’t yet hold the card, you can earn Capital One Savor Cash Rewards Credit Card. That’s relatively easy to achieve. (Especially if you want to buy concert tickets. Goodness gracious.)

Final Approach

I really like my Capital One Savor Cash Rewards Credit Card card. The 3% entertainment cash back earnings are fantastic.

If you’re like my family and love entertainment, I think you’ll like this card.

To see rates and fees for The Platinum Card® from American Express, please visit this link. Terms apply.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.