Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Last year, about this time, I went for a Delta SkyMiles® Platinum Business American Express Card for the huge new card bonus points. I got the points quickly but also enjoyed some of the other perks like 15% off booking award tickets.

This year, Amex has jumped the yearly fee for the card to $350 (See Rates and Fees.) and I am not willing to keep it. Why? About six months ago, I went for a Delta SkyMiles® Gold Business American Express Card because there was no family language and the welcome offer was so good. Plus, I will still get the 15% off award travel from holding that card.

For what it’s worth, you can check out the current Delta Amex welcome offers here.

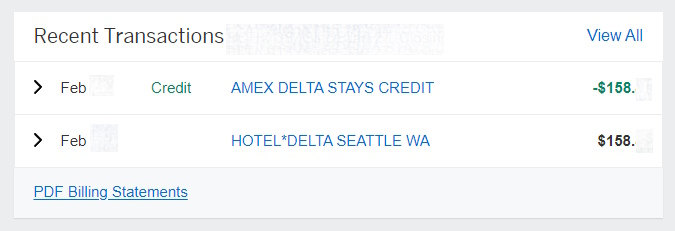

But Amex also added some new perks to Delta Amex cards this year. For example, with the Delta Amex Business Platinum Card, as of the 1st of the year, I get up to $200 in statement credits for eligible bookings on Delta Stays via delta.com (and the credits post very quickly, FYI). Will they claw back this credit if I cancel the card?

The simple answer is no!

Let’s look at another example. Say you book an award ticket during the time you held a Delta Amex card that gave you 15% off your award. If you cancel your card will Delta claw back the extra 15% miles they comped you?

Again, the answer is no!

Even if there is a schedule change and they have to reissue your ticket (and you no longer hold any kind of Delta Amex card) they will not charge you one point more for your ticket. The only exclusion would be if you canceled and had the points re-deposited and then went to rebook without a Delta Amex – then clearly you would not get the 15% off as before when you did hold one of their cards.

Now, there is a condition you do want to avoid at all costs, as it will very likely result in an ugly clawback of your new card bonus points, and that is canceling a card before the first year is up. So NEVER, EVER cancel an Amex card before the first year is up and an annual fee bills for the next year.

You may say” “but I don’t want to pay the second year’s fee!” Fear not, once the fee bills, you have 30 days to request it back and close the card without paying the next year’s fee. But keep in mind that it’s usually not that difficult to earn back cards’ annual fees. Even some of the big ticket cards aren’t that difficult to earn back.

The simplest way to do this is to wait for the fee to bill, then use the online chat – on a weekend – to have them close the card. They may push back to call back on a weekday, but if you stay firm, it works just fine. The only downside of this move is you have no chance at a retention offer that may be very lucrative and have you reconsidering if holding the card for another year may be a wise move after all!

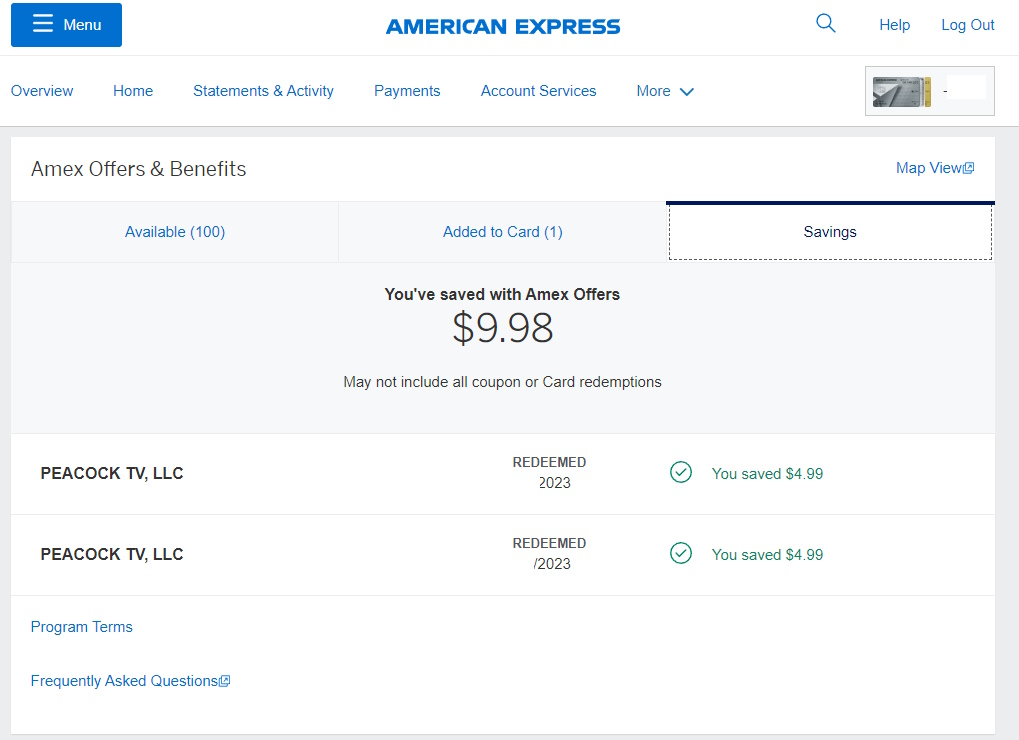

What about Amex Offers I have loaded and redeemed? Will they be clawed back even if they just posted the credits to your card? As long as the credits have been posted before you close the card, the credits will stick. They will not claw back old ones or new ones as long as settled. Do not expect credit to post after you close the card.

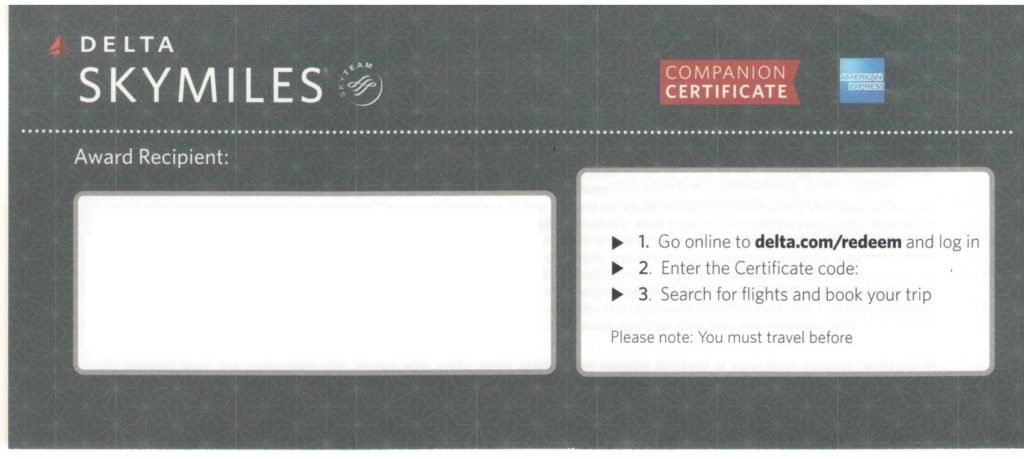

OK, what about the BOGO cert that showed up in my account? The rep said it would go away? Is this true? I mean, the BOGO cert on its own is worth holding the card. I don’t want it to go poof!

Again, the answer is no! It will not go away.

Once your BOGO has loaded into your Delta SkyMiles account it is good till the expiration date. You can fly it with two seats for you or you can let two of your friends use it (you have to book for them) and you can pay for the ticket with ANY Amex card in fact even anyone’s Amex card i.e. it does not have to be a Delta Amex card to pay for the tickets.

Bottom line – if you are smart about it – there is very little risk of any claw backs in the form of points or cash! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.