Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a regular feature on the Eye of the Flyer blog. This blog series covers in a “rookie” way either a Delta or travel-related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to our featured topic.

When Chase rolled out the Chase Freedom Flex® and updated the Chase Freedom Unlimited®, it introduced a new bonus category: 3% cash back (or 3X Ultimate Rewards) at drugstores. ((All information about the Chase Freedom Flex® and Chase Freedom Unlimited® was collected independently by Eye of the Flyer. It was neither provided nor reviewed by the card issuer.) )

But depending on where you purchase prescriptions and other pharmaceuticals, you might not earn the bonus points or cashback you expect.

Here’s why.

Not All Pharmacies are Located in Drugstores

That headline may sound confusing to some and obvious to others.

We all know CVS, Wallgreens, Rite Aid, and other drugstores have pharmacies. But plenty of other merchants also dispense prescriptions: grocery stores (like Ralphs), retail stores (i.e. Walmart), and warehouse clubs (think Costco).

So you may earn a drugstore bonus, a grocery store bonus, a warehouse store bonus — or no bonus at all.

Let’s take a quick look.

Ralphs Pharmacy: American Express Gold vs. Chase Freedom Flex®

My family currently uses the pharmacy at a local Ralphs supermarket. So any spending — including pharmacy purchases — made inside the store will code as supermarket/grocery store.

Here are a couple of examples.

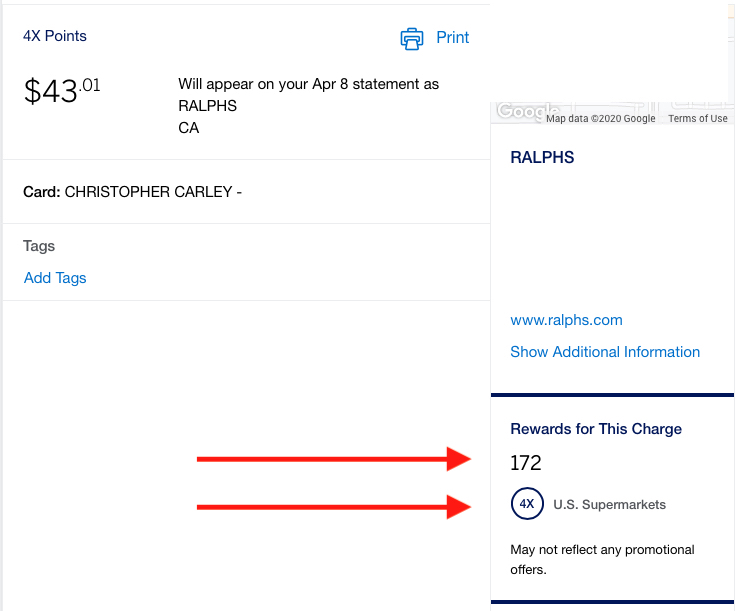

In April, I used my American Express® Gold Card to pay for some prescriptions at Ralphs.

Because the Ralphs Pharmacy codes as a U.S. Supermarket (which earns 4X on the Amex Gold Card, on up to $25,000 per calendar year in purchases, then 1X. I received 172 Membership Rewards for my $43.01 spend.

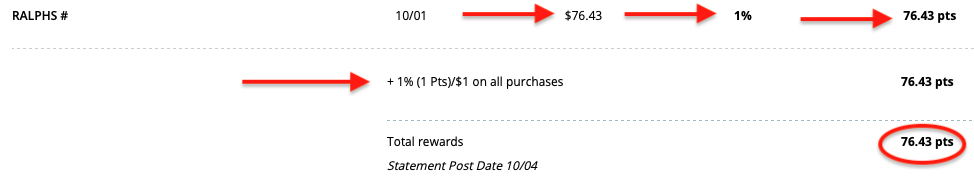

I used my Chase Freedom Flex® when I recently bought some prescriptions at the same location. I was pretty sure I wouldn’t receive a bonus but wanted to give it a shot. You know, for science and blogging sake.

It was one of those times I hated being right.

My $76.43 earned me a whole 76.43 Ultimate Rewards points. But because my pharmacy is inside a supermarket, I didn’t receive the drugstore bonus.

So Which Card Should You Use at Your Pharmacy?

At CVS, Rite Aid, Wallgreens, etc, I use my Chase Freedom Flex® for any purchase.

If your pharmacy is in a supermarket or other grocery store, probably your best shot. If you’re a Costco member and get your drugs there, check out their credit card (which is somewhere on this page’s “See More Offers” section).

Final Approach

The drugstore bonus categories on credit cards such as the Chase Freedom Flex® and updated the Chase Freedom Unlimited® are definitely a plus. (And if you don’t have one of those cards yet, remember that new approvals receive 5% cashback on grocery purchases for the first 12 months, though some caps apply).

As with everything in the points and miles hobby, make sure you’re using the right card at the right place.

For rates and fees of the American Express® Gold Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Why did you only get 1x at the grocery store with Chase Flex? They pay 5x on groceries for the first year.

I product changed from the Chase Freedom.

A few months ago I purchased contact lens solution from Costco online expecting this to trigger the warehouse club category bonus on Discover, but it was coded as Costco Pharmacy, so no 5X.

Interesting — thanks for the data point.

I recently purchased medicine at a CVS pharmacy that is located inside a Target. I used the Freedom Flex card. It gives me only 1% cash back, not 3%, because the bill shows the item was purchased at Target and not CVS 🙁