Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I still miss the days gone by before Marriott slurped up SPG and destroyed what was simply a fantastic hotel chain. That included the Sheraton brand and its discount little brother Four Points.

After my first-ever Alaska Cruise, which I am detailing on FreqentFloaters in a longish series of posts, I wanted to stay a few days in Vancouver. I booked and paid for my stay on points (30,000 per night) and that brought my Marriott points balance down to near zero.

Perfect.

Wait – Not so fast!

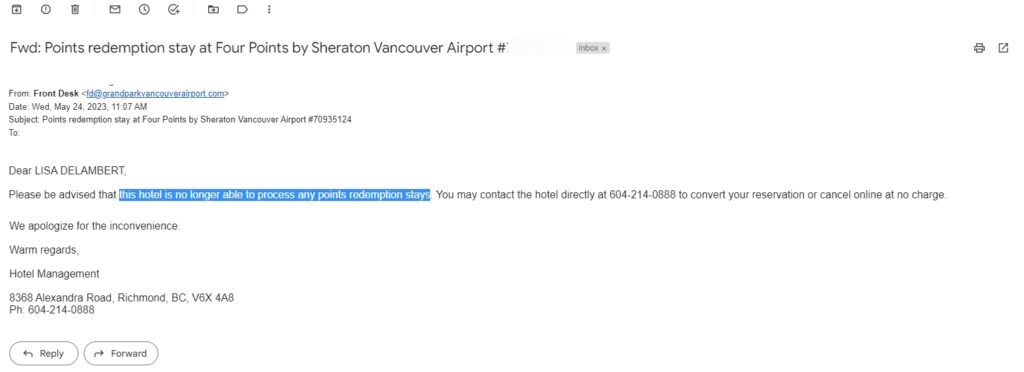

On the cruise ship, I had spotty wifi. Even in ports, my T-Mobile signal was not the greatest. To be specific, this hotel stay was from my wife’s account and she did not have wifi onboard. So, a few days before the cruise was over, when at port, she took her phone out of airplane mode and first got a nice e-mail confirming our stay. But seconds later:

Yep – we were BONVOYED!

The next e-mail said they had to cancel my reservation. Really? After just getting the latest confirmation e-mail? What gives?

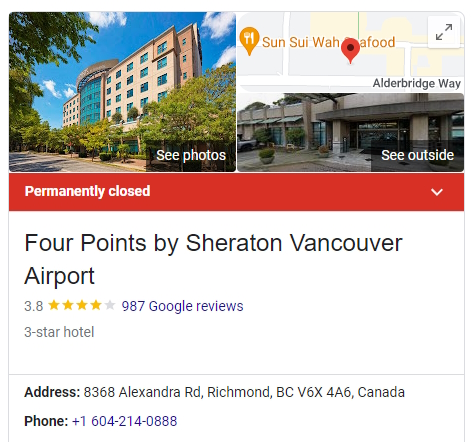

It seems that this hotel had chosen to depart from the Marriott family, and thus my prepaid stay on points would not be honored. I’d be on my own, as my stay was canceled. It is now called the “Grand Park Vancouver Airport Hotel” and not sure how “grand” a Four Points can ever be nor a “gateway to comfort”! 🙁

So, gee-thanks, Marriott for being so aware of your affiliates’ participation in your program that A) you would let me book and pay for this room on points and B) days before my arrival, tell me I am confirmed to C) giving me no options other than to be canceled, that is, BONVOYED!

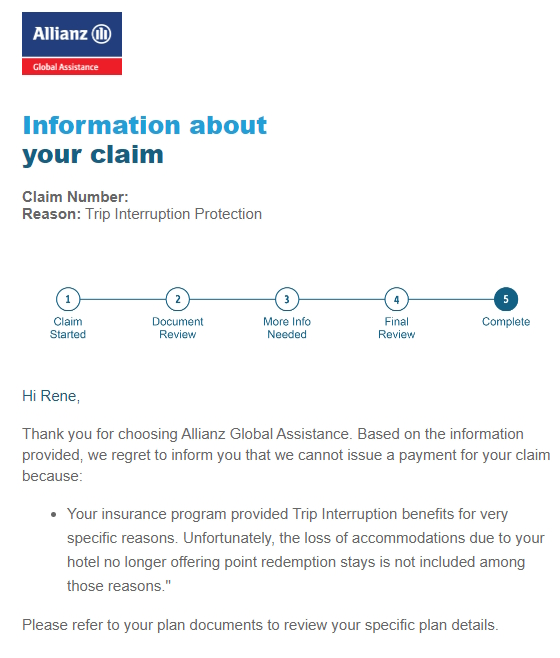

My first thought was maybe this is covered by my Allianz yearly blanket travel policy. I was not sure about this kind of event. So, I called and talked to a very nice rep who, after I described the situation, asked for my policy number, looked it up, and told me I was, in fact, covered and to submit the bill for the hotel stay and I would be reimbursed up to but not more than the maximum coverage of my policy.

Fantastic!

Sadly, I was next BONVOYED! by Allianz (or should I say Allianzed?)!

After about two weeks of waiting, I was denied and told my yearly policy does NOT cover a situation like this and there was nothing they could do – no matter what I was told by the representative of the company. The frustrating part of this for me is the bad information I was given. Had I been told when I called the first time that, sadly, no, this is not a covered event, I would have found another solution to my problem.

I attempted to reach out to the Allianz corporate contacts to see if anything could be done but received no response to either attempt. I then reached out to an old friend, Chris Elliott who, while not a fan of travel points, is an amazing advocate for those who have travel issues from any number of companies. He reached out to Allianz on my behalf, and low and behold, in just a few days…

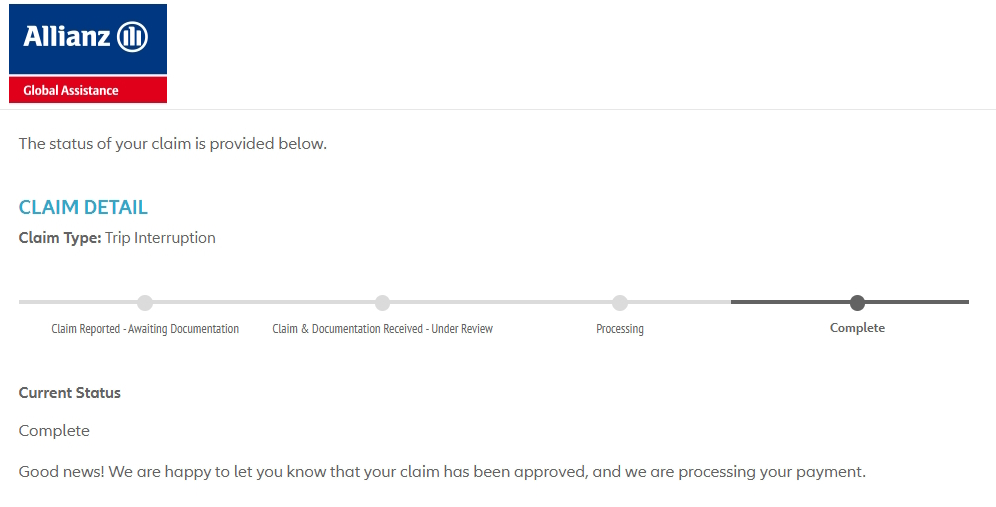

Suddenly my claim was re-opened and approved and I was told by the company: “We’re sorry that we provided René with the wrong information on the phone and we have approved his claim for $740.53. We apologize for the inconvenience this has caused.”

Thank you so much, Chris Elliott and, thank you also, Allianz, for honoring, with much extra effort, the information your phone rep told me!

I know many readers are almost by default Marriott enthusiasts just because of their huge footprint, but I am moving more and more to Hilton and Hyatt for my hotel needs. This recent BONVOYED! example is on the extreme side of what I have suffered but I seem to have many more issues with Marriott-branded hotels than any others. – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I was the Director of Forums for Chris when we had them, I still help him out from time to time. He does great things, and I use his contacts a lot also.

I don’t know if it’s still there but used to love the Westin Grand in Vancouver. I also share your feelings about Starwood. I lost my unpublished status with them when they were acquired.

Gone. It has been reflagged as a Hilton ironically.

I am also sad to see what has happened to legacy Starwood brands. I still have their card since the free night is great for putting up my brother when he’s in town. But I don’t really stay there anymore and only keep it open in case I need to travel somewhere that only has Marriott as the only option. Hilton was great when the Aspire first came out but now I don’t feel diamond is worth much in the US. Staying in foreign countries is when I get treated well. Now I am globalist and they have by far the best program as long as the footprint works. I have been upgraded to suites more this year as a first year globalist than all of my years of Starwood/Marriot and Hilton combined. I’m definitely maintaining my status with them.

When you called Marriott, they really refused to put you up in any other nearby property?

@Ben – They were willing to help book another property yes – but for more points. I would have had to make such a move had I not been told by Allianz that I was covered and go ahead and book something else.

I have had very mixed experiences with Allianz. Some good, some horrible and some just not understandable.

@rjb – This was my first ever negative experience with Allianz but happy they came around in the end.

Hi Rene

What hotel did you end up staying at? Did you work for you? Thanks

@Margo – Hampton Inn by the airport. It was fine but unremarkable.