Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a regular feature on Eye of the Flyer! This blog series covers “rookie” topics of travel or points-and-miles related themes — and attempts to break them down to a basic level. You can read up on all the previous posts HERE. Now on to this post’s featured topic.

Most of my purchases (and I assume yours, too) aren’t in the amounts of whole dollars (i.e. $100, $42, $14, etc.). Thanks to various prices, taxes, and fees, we have totals like $100.17, $42.76, and $14.50.

But nearly all loyalty programs don’t include award fractions of points. Whole numbers are much easier for everyone. For example, you may have 162,555 SkyMiles. Not 162,554.65 SkyMiles.

So what do credit cards rewards programs do with everything right of the decimal point on your purchases?

Based on everything we’ve found, it simply depends on how much you spend.

The half-dollar (.50) mark seems to trigger whether your points earnings are rounded up or down. . Everything at and above that .50 level gets you kicked up to the nearest dollar’s earnings. Forty-nine cents and lower knocks you down to the dollar’s “base” number, if you will.

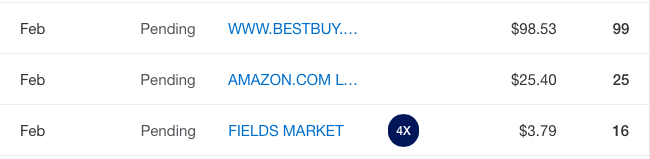

Here’s an example from the Points Summary of my American Express account:

The Best Buy purchase was $98.53 and rounded up to 99 Membership Rewards points earned. (Plus, I got $50 back thanks to an Amex Offer!)

You’ll see the Amazon purchase was $25.40. But that got shoved down to 25 points.

Meanwhile, the Fields Market purchase earned 16 points. I used my American Express® Gold Card — which earns 4X at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). The $3.79 rounded up to $4 — and that multiplied by 4X, earning 16 points. But what’s interesting here, though, is that 3.79 X 4 = $15.16. So it’s the original price that gets rounded up before any bonuses are triggered.

Chase Ultimate Rewards®: Slightly Different

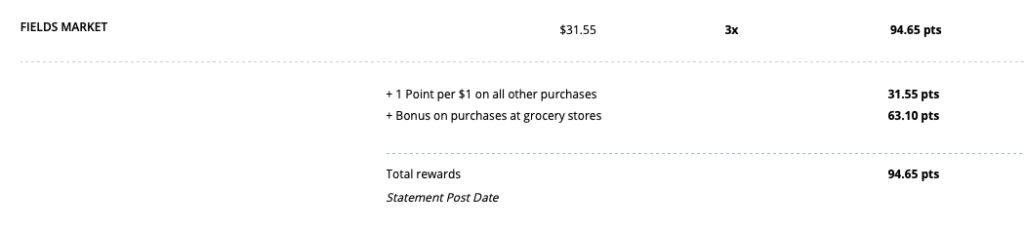

Chase Ultimate Rewards® awards point earnings to the exact cent on individual purchases. Here’s another example from Fields Market. I used my Chase Sapphire Reserve®, which earns 3X on groceries through April.

My $31.55 purchase was bonused 3X and earned 94.65 Ultimate Rewards points. The total amount of points earned will be rounded up or down when my statement hits.

Final Approach

This may seem trivial — but I asked several credit card holders if they think points get rounded up or down. They had no idea. So while earnings pretty much shake out even-ish in the long run, I figured it’s still something interesting and fun to explore.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

This may seem trivial …It ís

Jack! You hadn’t given us a snarky comment in a while. I was getting worried. Glad you’re OK, buddy. 😉