Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I would love to be out and about traveling. Flying. Visiting sweet airport lounges. Doing fun stuff like flying to Brussels for dinner. Ah, well.

High-end cards like the personal/consumer American Express Platinum are doing all they can to keep us as customers. To keep us paying the high yearly fee for travel cards when we can not travel.

Chris had a great post on all the credits they are tossing our way to incentivize us to stay. But the one thing many have asked about is this:

Can I get credit for more than one streaming service to use up all of the $20 monthly credit?

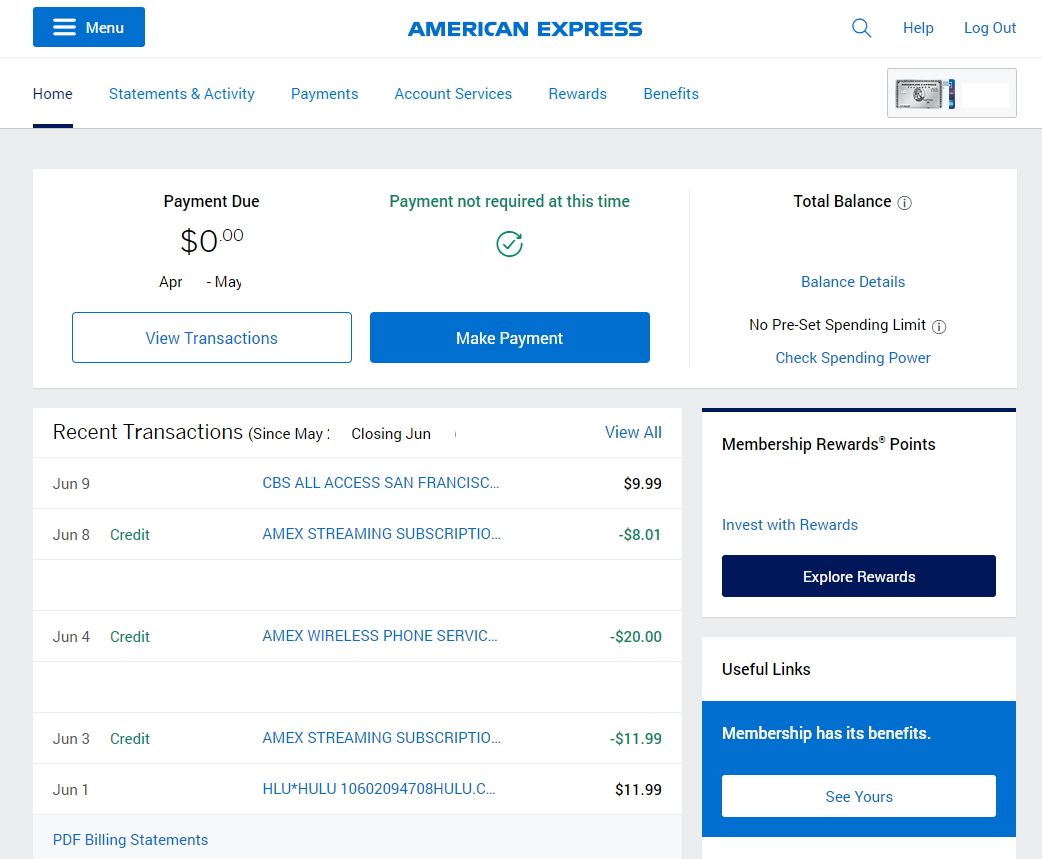

As you can see from the screenshot above – the answer is YES!

But notice you will not get MORE credit that the $20. In my case, I subscribed to HULU with no ads and CBS All Access for the month of June — and end up paying just $1.98 out of pocket after the Amex monthly streaming credit.

I am really impressed that Amex is offering both the cell phone and streaming service $20 credits. The streaming bills monthly so that is automatic now for me. As for the cell bill, I just put a reminder in my phone (hehe) to pay $20 on the 1st of every month to both my Amex Platinum and Amex Green cards (the latter gives me $10 per month). – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Do you know if these benefits are only for the primary cardholder or do all cardholders receive these benefits?