Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

OOOUUUCCHH! A new Flyer Talker has posted about an issue that I have warned readers about for YEARS now. That is, the fact that your annual fees for Delta Amex cards does not count toward your yearly spend goals.

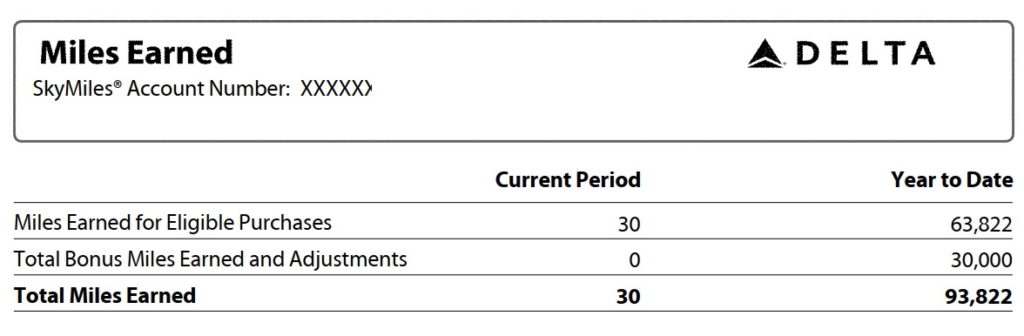

One of the big problems has been Amex seems to indicate on your statement (when you check the numbers at the bottom of the page) that you may have in fact spent enough when you have not. That looks the case for travistruett from FlyerTalk. Notice what the user says in part:

“Realized in mid-December I was much closer to the 250k [MQD] waiver than realized (due to business expenses on card)… only needed to spend 8k to hit it.”

Then travistruett says,

“I’m sitting at $250,310.81, can’t believe I pulled it off… I didn’t factor in the credit card fee of $450 which means I’m short by $140.”

Brutal! Just brutal. Is this Delta and Amex mega spend stuck? Will Amex or Delta work with the user to fix this 0.0006% mistake in spending? Maybe.

Delta has, in years past, done what is often called “soft landing” for folks who were close. Delta can, with the flip of the digital switch (see raw data files), fix it so travistruett has reached the ¼ million in spend for 2019. I would hold they would not play hardball for such a small mistake that Amex contributed to after all. What if Delta says no?

Amex can work with Delta to fix this mess if they want to. The flyer could, if they really wanted to push it, file a CFPB complaint about this as it clearly is a known and ongoing issue for Amex about mis-reporting your spend (they do tell you in fine print fee does not count, FYI). But I doubt that would be needed as I would think Amex would want to keep such a mega spender happy.

This post is timely now because of one big factor: the fact that you have only until the 29th of January 2020 to spend under the OLD spending rules (i.e. bonus SkyMiles and bonus MQMs) for Delta Amex cards and your fee may happen to be billing this month. If so, be sure you OVER spend by at least your yearly fee! – René

Delta SkyMiles Reserve for Business American Express Card

(learn how to apply)

Receive 40,000 bonus SkyMiles and 10,000 bonus MQM after spending $3,000 in eligible purchases on the Card within the first three months of approval. Given our SkyMiles valuation, 40,000 SkyMiles equals at least $400 worth of Delta travel.

Points Earnings (Through January 29, 2020)

- 2X SkyMiles on Delta purchases

- 1X SkyMiles on all other purchases

Points Earnings (Effective January 30, 2020)

- 3X SkyMiles on Delta purchases

- 1.5X SkyMiles on purchases after you spend $150,000 on the card during a calendar year

- 1X SkyMiles on all other purchases

Bonus MQM (Through December 31, 2019)

Enjoy 15,000 bonus MQM and 15,000 bonus redeemable SkyMiles if you spend $30,000 on your new card before December 31, 2019. Earn an additional 15,000 bonus MQM and 15,000 bonus redeemable SkyMiles if rack up another $30,000 on the card before December 31.

Status Boost (Beginning January 30, 2020)

Enjoy 15,000 bonus MQM each time you spend $30,000 during a calendar year. The most Status Boost MQM you can receive with this card is 60,000 MQM ($120,000 spend during a calendar year).

Delta Sky Club Access

Enjoy complimentary access to Delta Sky Clubs when traveling on a same-day Delta Air Lines flight. (Read our reviews of Delta Sky Clubs.)

Plus — effective January 30, 2020 — receive two guest passes each year to Delta Sky Clubs. A nice perk if you’re traveling with people who don’t have Delta Sky Club access through their own Reserve card or the American Express Platinum cards.

American Express Centurion Lounge Access (Effective January 30, 2020)

You’ll have free admission (provided the club isn’t closed to overcrowding) to American Express Centurion Lounges before a same-day Delta Air Lines-operated or -marketed flight. (Read our reviews of American Express Centurion Lounges.)

Upgrade Priority for Medallion® Members

Holding a Delta Reserve card serves as tie-breaker for complimentary Medallion® upgrades.

Complimentary Upgrades for Non-Medallion® Members (Effective January 30, 2020)

Non-elites who hold the Delta Reserve card will eligible for complimentary domestic upgrades (US 50) to Delta One, first class, and Comfort Plus — space providing, after Medallion® members and their companions have been upgraded.

MQD Waiver

Spend $25,000 on this — or across any of your Delta Amexes, provided you hold a Platinum or Reserve card — and don’t worry about the MQD requirements for Silver, Gold, or Platinum Medallion®.

Companion Certificate

Beginning the second year of holding the card, you’ll receive upon renewal a certificate for a free (except for taxes and fees) companion first class or coach qualifying fares on Delta. Read our Companion Certificate FAQ.

Global Entry/TSA PreCheck Fee Credit (effective January 30, 2020)

Receive a statement credit for your Global Entry application fee every four years or TSA PreCheck application fee every 4.5 years when paying with your Delta SkyMiles® Platinum American Express Card.

Delta Travel Perks

- Free first checked bag for you and up to eight others on your itinerary/PNR

- 20% statement credit on purchases made aboard Delta Air Lines flights (premium food, beverages, headsets, etc)

- Main Cabin 1 Priority Boarding

- Pay with Miles eligibility

Annual Fee

$450 the first year. Then $550 beginning the second year you hold the card.

Who Should Have This Card?

Business owners/independent contractors who are frequent Delta travelers and lounge access. Plus, if you can spend a lot of money on this card, you’ll love the Status Boosts.

Learn more now about the Delta SkyMiles Reserve for Business American Express Card.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Thank You René

Hi Rene- I spent $60,000 during the first week of January 2020 on the Delta Personal Reserve, however only the 60,000 spend miles posted. The bonus 15,000 miles for each $30,000 spend did not post. Usually the card spend and the bonus miles post instantly. Any thoughts on why through 01/29/20, the old card spend bonuses aren’t applying?

Thanks!

@Sam – See what Chris said when you asked the other day.

It seems pretty obvious to me that “miles earned for eligible posting” is the number you use. Am I missing some unknown difficulty here?

@Barry – Yes. See post. For years Amex has lumped fee in with your running total when it does not count.

Rene,

My coworker missed silver by about 150 MQDs Delta sent him the email you screenshotted above telling him since he was so close, the made him diamond, but actually only bumped him to silver when checking his statys in the app.

Rene

“Miles Earned for Eligible Purchases” cannot by definition include fees since, as you point out, fees don’t count towards mileage. I spent the exact amount to the cent using that amount to get my status boost and I got it. Also, on the statement of the month of my fee, this amount did not include fees when comparing to the previous month. This amunt is miles not dollars so it can’t possibly include fees. What could throw people is if they use the bold third line instead of the first line, but I don’t think that would have accounted for the error in the case you mention.

Hi, question for you, I’m planning on putting 120k on my Delta Reserve card this year, if i put another 30k making it 150, would I

then get another half a point for the 150k I spent (75,000 miles) or is it after you spend 150 you start earning 1.5/ dollar spend?

Thanks,

@Robert Morgan: Just a heads-up that benefit applies only to the Delta Business Reserve Amex.

Per Delta and Amex: “If in any calendar year eligible purchases made on the Delta SkyMiles® Reserve Business Card total more than $150,000, you earn 0.5 additional miles (for a total of 1.5 miles) on eligible purchases made after the $150,000 threshold is reached through the end of the same calendar year. If your eligible purchase qualifies for a category that has a higher mileage accelerator, only the higher accelerator will apply instead of the one-half mile per dollar. For example, if you make a Delta purchase after reaching the $150,000 threshold, you will earn two additional miles per dollar instead of an additional one-half mile per dollar. The close of the calendar year is December 31st without regard to the time of the year that the account is opened. This means that for the first year of Card Membership, the Card Member’s Eligible Purchases qualifying period may be less than twelve months. Eligible purchases can be made by the Basic Card Member and any Additional Card Members on a single Card account.”

After hitting the $120k, I’d switch to the personal Reserve (if you can spend the money and get more MQM) or switch to another card earning at least 1.5X or 2X.

@Chris I think you may just have provided the real answer for why you can’t rely on “Miles Earned on Eligible Purchases”. Based on what you just said I can see why you can’t always rely on eligible miles, but it’s not because of fees, but rather because of the bonus miles earned over 150K. If that is the case that would explain why he missed out (although he would have been a lot more than a couple of hundred dollars short unless he was using another card in addition to a Business Reserve). I wonder though whether those bonus miles would appear in line 1 (miles earned on eligible purchases) or on line two (bonus miles).

Sorry to post again but I’m really trying to help others here.

I realized that bonus miles are not included in the first line total so that’s not the issue.

I went and read Travis’s story in detail. What he did was track his spending by spreadsheet. He didn’t use the totals on his statement. I am 99% sure that if you take the miles earned total (line 1} on all your cards’ most recent statements, then manually add December spending not in statements, not including fees, and remember to deduct any refunds in the current cycle, then you have a reliable system. It worked for me.