Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

RAT teams (reward abuse teams). Claw backs. The dreaded Financial Review. These are unique times for many of us who have, for years, enjoyed the perks and yields from holding either the Delta Amex Reserve card and or the Delta Amex Business Reserve card.

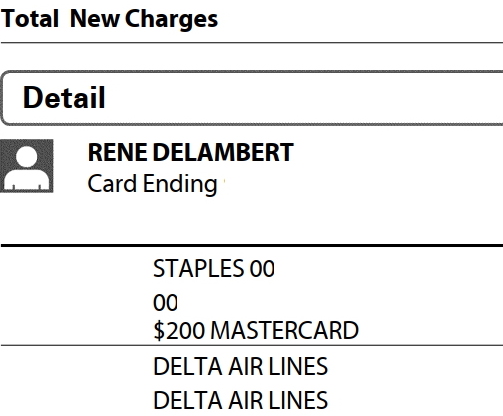

Why do I say unique? If you take a look at the screen shot above from one of my Amex statements you will see that I purchased a single $200 Mastercard gift card at Staples this past year. The charge produced what is often called “level 3 data” to Amex about the purchase that is not just that I made a buy at Staples but also just what the product I purchased was. Why does that matter?

For years now Amex has warned us that certain purchases will not either 1) yield any points when you use the card to make the purchase and or 2) not count toward spend bonus offers of either a new card or items like the Delta Amex bonus MQM and yearly spend waiver for being MQD exempt. But even though the language has been in our statement for years, these kinds of buys have worked. In 2019 things started to change.

For years now Amex has warned us that certain purchases will not either 1) yield any points when you use the card to make the purchase and or 2) not count toward spend bonus offers of either a new card or items like the Delta Amex bonus MQM and yearly spend waiver for being MQD exempt. But even though the language has been in our statement for years, these kinds of buys have worked. In 2019 things started to change.

Nationwide there are malls that operate under the corporate name “Simons Mall”. There is one in Mishawaka, Indiana near the South Bend airport. They sell visa gift cards up to $1000 each for a low fee of $3.95. Wow right! Well not so fast. As mentioned above, you can buy them, but they no longer give you points or credit (so what is the point – literally). I have not purchased a gift card from my mall all year in 2019 and have no plans to do so in 2020.

With the death of the above and level 3 data becoming more and more common, just what will work in 2020? It will take some testing on your part to see just what works best for you. There are some that are blessed and work just fine but are not instant.

- Paying taxes. This has worked for years and is 100% AOK with Amex. If you have a large chunk of spend to knock out, and can wait for a tax refund, I suggest you read up on paying your taxes with your Delta Amex card (or other Amex cards for that matter).

- Kiva. Many readers are still using Kiva with minimum cost (loss). Yes, it can take months or even a year to get paid back but it is also a way to knock out large spend over time i.e. making loans each and every month.

- Prepaying bills. Here again, if your utility companies, cell phone providers, internet and so on allow prepaying for months or even a year at a time – this can work well and help toward your spend goals. As a side note, last year, I prepaid my cell provider for a year and they called me and said I can not do that and sent me check back for my overage! 🙂

Well all of the above is good and well if you have the financial position to do that kind of spend and still PAY OFF IN FULL your card bill when it comes due (we never EVER pay a penny in credit card interest – EVER)! What about all those who want other methods, that is, what I call “creative spending”. What still works? It will take testing on your part and there are always risks to consider. OK, explain.

Buy even with level 3 data. My purchase above at Staples did yield points but I did not push it and I no longer buy gift cards at Staples with any Amex card. It is not worth the risk (to me anyway). I do not like the idea that at some point I could see a claw back. You may be more risk tolerant than me. What else?

Test stores that do not yield level 3 data. There are likely a ton of stores around your area that are big or small that may work. You just have to test and see what works.

Those are the simple things that are still possible solutions. Yes they take some testing but in 2020 this hobby is no longer ultra simple – it takes work. What else? The rest really takes time and work and risk.

Consider buying and selling. There are any number of folks who have taken the time to look for amazing bargains on Amazon or Ebay or coins and such and when the price was right buy and buy big. Then take the time to resell everything over the coming months and as long as the net cost is ZERO they have harvested the points for free (plus their time). Again, not for everyone but an option to consider. Same goes for reselling of discounted non-visa/mc gift cards from many locations.

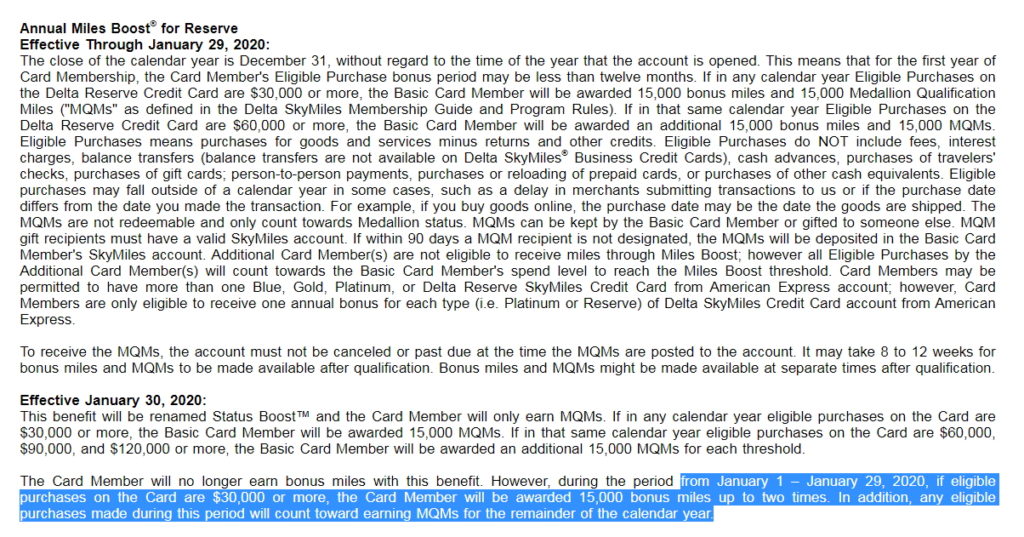

All of this really matters now due to what I have highlighted in the screen shot above about Delta Amex spend that POSTS as a completed charge from 1JAN to 29JAN of 2020. During this time we can harvest not just bonus MQMs but also bonus SkyMiles to help offset the cost of your spending. Charges that POST on or after the 30th of January no longer enjoy this mega dual bonus perk (but clearly we wil have the chance for more spend levels so there is that perk to consider going forward for some).

This post is not meant to say that spending $250,000 is easy in 2020 and beyond. While it can be done, it does take effort and cost. I personally will NOT (again) try for ¼ million dollar spend waiver for 2020 but I will put a large chunk of spend on my card to start the year to get the $25,000 waiver knocked out to lock in Platinum status (I have a lot of rollover MQMs) as well as earning more upgrades with the 25k+ spend done ASAP to start the year. Then I will likely, once again, consider partner mileage runs to rack up a ton of MQDs for minimum spend out of pocket (#ProTip – My pal ADAM can help you book an amazing “fun run” if you want one).

My last tip to keep in mind is that spending on your Delta Amex card on the 31st of December has posted for me on January 2nd or 3rd for many years now. There is a risk in this but for those who are brave (like me) and want to get spend started ASAP this may work again this year.

I will end with the talk about a spend waver for 2020. I would NOT count on any kind of Amex spend waiver for 2020. There are scattered reports of Delta reps suggesting to call in January and see what could be done. I have other data points that any waivers granted in the past will not return next year. I would plan for the latter and look for other ways to reach your medallion goals.

Are you going to get creative and mega spend on your Delta Amex cards in 2020 or are you giving up on status chasing at this point? Is all this still worth it to you personally? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Will downgrade my gold to blue.

Delta cards don’t hold much value for me, since I don’t travel with checked bags. Delta miles are of atrocious value nowadays.

@Chris – Thanks. I hope you will do the smart thing and apply for a NEW Delta Amex Blue card (for the bonus points) and then cancel your old Gold card for the 1x lifetime new card bonus (downgrades destroy your 1x lifetime shot).

I am aware the loss of 10k skymiles, however, I want to stay on the conservative side, for the sake of future higher subs from amex (I have yet to app for plat), and don’t cancel the gold after just 1 year.

I will call first and hopefully there is some retention offer on gold, that way I can hold on for another year. Lol

Hey Rene,

Sounds like you should prepay a year of cell service *again*. And again. And again. LOL.

I’ve pretty much given up on high status with Delta. That’s after 22 years of platinum or diamond. Now I’ll probably be a lowly silver (MM) for most years.

@Mark – It was so strange to get a call from Sprint “fraud” for overpaying. I was shocked. Oh I did the same thing with Comcast and also got a call. They said it was fine and just checking (but no check from them). 🙁

I gave up on Delta years ago. When I needed to travel, even here in the US, I would find Delta wanting 2 to 3x the points of AA or UA from my couple of local airports. I do think Delta has a fine product and I am only a few miles short of 1MM lifetime. With all their cards tied to Amex you soon find you have run out of getting easy points. Then, Amex clamping down so hard on gift cards means the act of getting points for Delta is going to be much harder than AA or UA or Alaska. I thinking hitching your wagon to primarily Delta is not going to be the best in the long run.

So I plan to pay my home owners insurance, car insurance and property taxes with my Delta Reserve Business Amex. Also on Carnival and Royal Caribbean cruises you can sign for money at the slots for no fee and then it’s billed to your room charge. Royal allows for 5k a day. If at the table or cashier royal charges 5% and Carnival 3%

I will also prepay my Comcast bill and my Tmobile auto pays to the card as well.

For several years, I have held a Pers Delta Reserve as well as a Pers and Bus. Delta Plat (primarily for MQM bonuses). With the changes, I’m going to get rid of one of the Platinum cards. Since I don’t use these cards for Supermarkets (soon to be 2x category for Pers Plat) or spend >$5K/transaction (soon to x1.5 on Pers Bus), I think I’ll jettison the Personal card. Any advantage to keeping the Personal and ditching the Business instead? Thanks!

@Dale R: The personal Delta Platinum Amex will award 2X at restaurants, but I don’t know if that appeals to you. Especially since you can pay the same annual fee ($250) and get the Amex Gold Card — which awards 4X at restaurants and 4X at supermarkets (up to $25k/year in spend). The no annual fee Ink Business Cash also earns 2X at restaurants and gas stations (up to a combined $25k/yearly in spend). While Ultimate Rewards can’t be transferred to SkyMiles, you can use them to purchase cash tickets which do earn SkyMiles.