Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

A few different readers recently asked René and me about a fairly specific credit card topic. The wordings varied a little but the heart of the question was this:

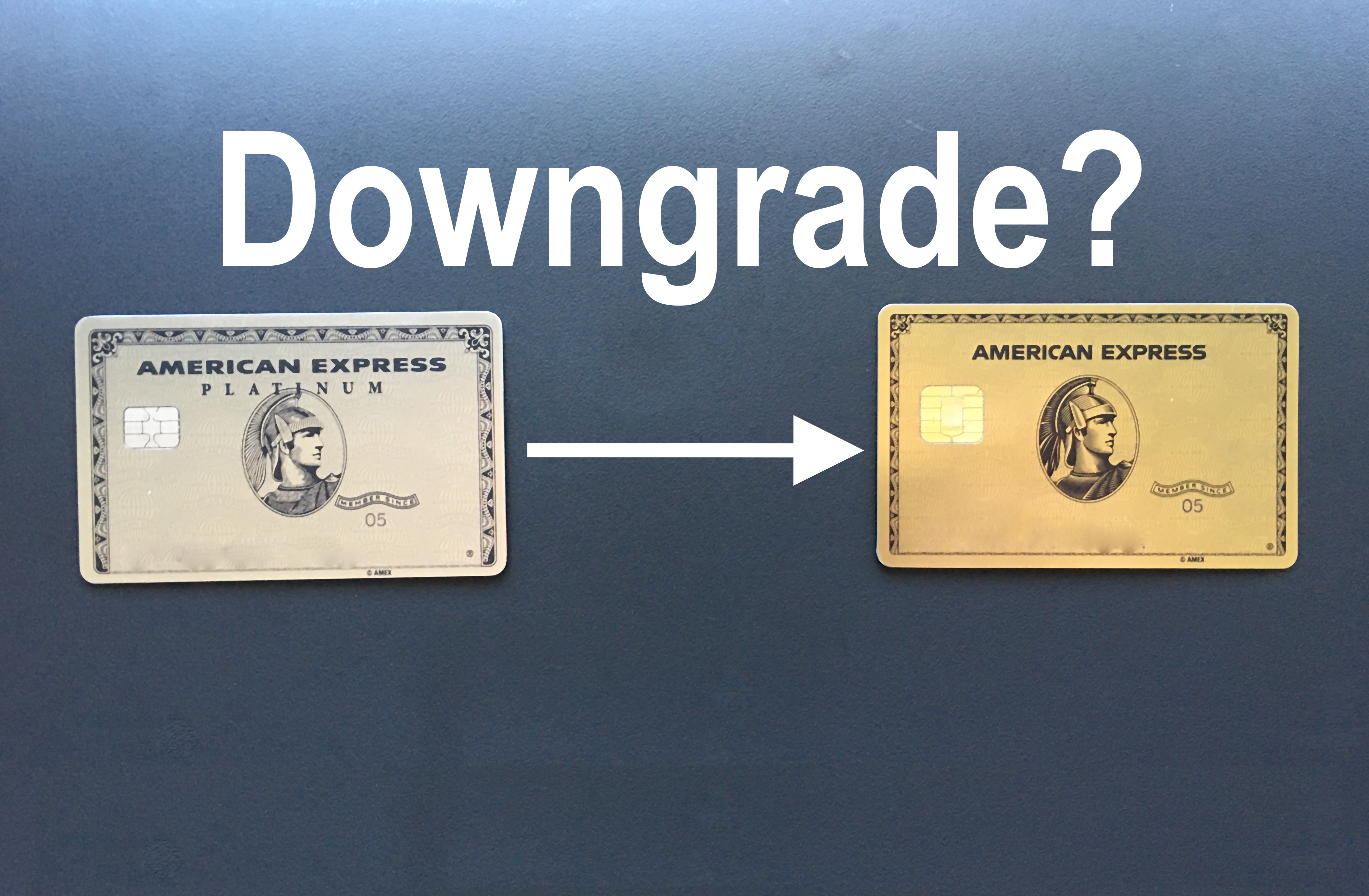

Should I downgrade my Platinum Card® from American Express to the American Express® Gold Card?

We figure other readers may wonder the same thing. So here’s our take.

First Things First: Don’t Actually Downgrade a Card

We highly suggest not downgrading one card product’s account to another. (In this instance, from the Platinum to the Gold.) Why? Because you’ll miss out on your new card’s 1x LIFETIME welcome bonus. So if you call American Express and tell them to downgrade your Platinum card to the Gold, you won’t receive the Gold’s bonus point offer for new cardholders (#ProTip: This same rule applies to ALL Amex cards like the Delta Amex Gold / Platinum / Reserve cards and so on).

In this example, you’re better off applying for the Gold Card and then canceling the Platinum (if you do, in fact, wish to downgrade).

Don’t forget: it can’t hurt to place a retention call (read about a recent experience) before canceling. You might get your annual fee waived — or significantly reduced.

Annual Fee Comparison

The Amex Platinum fetches a hefty $550 annual fee, while the Amex Gold Card is $250.

That $300 difference is definitely a nod in the Gold’s favor.

Points Earnings

There are only two times I use my Amex Platinum Card for purchases:

- Amex Offers available on the card

- Purchases with airlines (5X earnings). This includes tickets, onboard food and beverage, etc.

That’s it.

Aside from the 5X on purchases made directly with airlines, the Amex Platinum offers only 1X Membership Reward/dollar spent on all other purchases.

The American Express® Gold Card, however, offers nice points-earning options on every day spend:

- 4X on restaurants worldwide

- 4X at US supermarkets (up to $25,000 in purchases each year)

- 3X on flights booked directly with airlines or via AmexTravel.com

Now we’re talking!

Bottom line here: the Platinum’s points earnings can’t hold a candle to the Amex Gold Card‘s.

Travel Benefits

The American Express Platinum Card is loaded with travel benefits:

- Up to $200 in annual Uber or Uber Eats credit. (Enrollment required.)

- $100 Global Entry credit every four years.

- Get up to $200 airline fee statement credit each calendar year (Enrollment required.)

- Complimentary gold status with two hotel brands: Marriott and Hilton. (Enrollment required.)

- Complimentary access to airport club lounges such as:

- Delta Sky Clubs when flying Delta Air Lines.

- Centurion Lounge airport club access for you and up to two guests.

- Free Priority Pass Select membership

- Escape Lounges

- International Airline Program

- Select discounted first class, business class, and premium economy fares (via AmexTravel)

- Fine Hotels & Resort complimentary benefits such as:

- Daily breakfast for two

- Resort or spa credit

- Upgrades when available

- Guaranteed late checkout

The Amex Gold Card offers two travel benefits: $100 in airline fee statement credits each calendar year. Plus, $100 hotel credit on qualifying charges and room upgrade when you stay two consecutive nights at Amex’s The Hotel Collection properties.

If you like the Fine Hotel & Resorts benefits, you can enjoy something similar — but pay far less in annual fees. Chase’s Luxury Hotels & Resorts program is fairly comparable to Amex FHR. Chase doesn’t publish a list of which cards qualify. But I can personally attest that the Chase Sapphire Preferred® Card ($95 annual fee) and Chase Sapphire Reserve® ($450 annual fee) do. I’ve heard the Ink Business Preferred ($95 annual fee) also works for Luxury Hotels & Resorts benefits.

Head-to-head: the American Express Platinum Card wins this category hands down.

Dining Benefits

In addition to its 4X on worldwide dining, the American Express® Gold Card gives its cardholders a $10 statement credit each month that can be used at:

- Grubhub (use our link/promo code to save $12 on your first order!)

- Seamless (use our link/promo code to save $12 on your first order!)

- The Cheesecake Factory

- Ruth’s Chris Steak House

- Boxed

- participating Shake Shack locations

Stacking the Amex Gold’s 4X restaurant earnings with Dosh and Rakuten Dining can also yield some bonus cashback — on top of your points!

The Platinum Card offers no such benefit.

Bottom Lines

We can’t really give a one-size-fits-all recommendation here (i.e. “Downgrade!” or “Keep it!”); everyone’s budgets, preferences, needs, and spending habits are different.

People who love dining out should definitely have the American Express® Gold Card, regardless, because of the 4X earnings and monthly $10 statement credit.

If you travel a lot and actually use the American Express Platinum Card‘s airport lounge access, $200 airline incidental annual credit, $200 Uber annual credit, and International Airline Program, the card is definitely worth keeping for the benefits alone. You should have no problem recouping your annual fee’s worth.

But if you’re more focused on earning on points while saving money on annual fees — and can live without the Platinum Card‘s travel benefits or have lounge access through other cards — getting rid of the Platinum in lieu of the American Express® Gold Card is worth considering.

— Chris

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I agree, Chris, apply and then cancel. And I understand that our financial situations can change; however, I can’t help but think that if you have to ask if you should downgrade, you probably shouldn’t have applied for the Platinum in the first place. I’ve traveled for years as part of my job. It wasn’t until about 3 or 4 years ago that I could finally justify having the Platinum. Best travel card I’ve ever had.

You could also mention that you get 1.5 points on the Platinum for purchase of $5000 or more.

The Amex Plat becomes harder and harder to justify every year. Really it’s moving past a value proposition and toward paying for elite status & lounge access.

At least the Gold is a guaranteed 100k MR per year.