Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

We’re barely two months away from Black Friday, the official start of the holiday shopping season. Many of us will spend money shopping online at Amazon and other retailers during the days leading to Christmas, Hanukkah, and Kwanzaa. A number of great credit cards — many with no annual fee — will earn you bonus points for shopping online and in-person!

Let’s discuss some of the best personal cards for earning travel points/miles or cashback for shopping online!

We’ll discuss credit cards earning more than 1% or 1 point per dollar spent — which is pretty much the standard “bonus” for shopping online with most cards.

Why Are We Talking About This So Early?

Many credit cards come with welcome bonuses (extra cashback, points, etc) that must be earned by spending a certain amount of money during a designated period of time — usually three months. So applying now for a new credit card gives you plenty of time to be approved, receive your card in the mail, and use it for holiday shopping! (And who doesn’t need some extra money after the holiday season?)

Best Personal Cards for Amazon, Online Shopping, and Other Retailers

If you regularly shop certain big box stores (i.e. Best Buy, Nordstrom, Target, etc) you might have one of their co-branded credit cards that give you discounts or money back.

For other stores, though, or if you don’t own a store’s cobranded card, here are some options you’ll want to consider:

Chase Freedom Unlimited® Card

The Chase Freedom Unlimited® Card has no annual fee and gives you 1.5% back on all eligible purchases. (All information about the Chase Freedom Unlimited® was collected independently by Eye of the Flyer. It was neither provided nor reviewed by the card issuer.)

Capital One Quicksilver Cash

Capital One’s Quicksilver Cash is another no annual fee card and earns an unlimited 1.5% cashback on every eligible purchase.

Quick Analysis

The Chase Freedom Unlimited® Card‘s 3% cashback during the first year is great, especially for online shopping. If you reach $20,000 in spend during the first 12 months, you’ll receive $600 back.

However, the other cards will give you $150 bonus after spending only $500 in the first three months. You’ll need to spend ten times that on the Chase Freedom Unlimited® Card to earn $150 back. But 3% back for an entire year — especially on a no annual fee card — is pretty tempting, too.

Save MORE Money with Cashback Portals!

Don’t forget to start your online shopping at a cashback portal such as TopCashback, Rakuten (formerly Ebates), BeFrugal, or DOSH. Those rebates are separate from and stack with credit card promotions (i.e. Amex Offers) and points/cashback earnings.

Rakukten/Ebates and DOSH also have some great instore cashback offers, too.

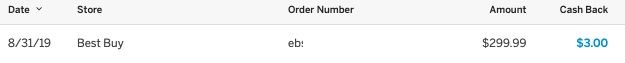

I made a recent purchase at Best Buy — and received $3 back thanks to the 1% instore cashback offer.

Questions or Recommendations?

Do you have or particularly like these — or other — cash back cards for shopping online? Please share your thoughts in the Comments section!

–Chris

Cover image: ©iStock.com/BsWei

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

You missed a few biggies including the Citi AT&T Access More card which gets 3x and any of the 2% cash back cards, including the Citi Double Cash card, which now earns 2x Thank You points. You mention personal cards only, but I frequently pick-up Amazon gift cards at Staples/Office Depot with my Ink Cash/Plus card, which gets 5x. You also forgot the Chase Amazon card which gets 5% from Amazon and the Chase Freedom / Discover cards which get 5x/5% on rotating quarters, including Discover for Q4 2019.