Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a regular feature on the Renés Points blog. This blog series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this featured topic.

Have you frozen your credit report? If you have not – WHAT IS WRONG WITH YOU?! We all should do this. With data breaches as regular as sunrise and sunset each day it is the height of foolishness not to take this precaution. Plus, there is this from the US government:

“Starting September 21, 2018, you can freeze and unfreeze your credit file for free.” – consumer.ftc.gov

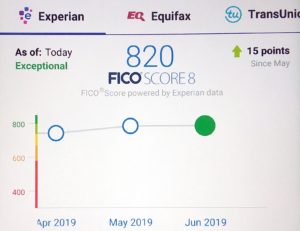

So there is no cost for you to take the wise step of freezing nor any cost to unfreeze whenever you want, how ever many times you want, for as long or as short a time as you want from Experian, Equifax and Trans Union.

But what if you are going to go for a new round of travel cards. Just how long does it take to unfreeze your credit report? In most cases it is almost instant but it is recommenced to give it at least 1 hour before you apply for new credit. Do note we are warned it can take up to 3 days but I have never seen this to be the case.

Should you just unfreeze one of the credit reporting agencies? You definitely can do this if you are sure whatever bank is only going to pull from one single agency. Capital One is a bank that will pull from all three.

Should you manually re-freeze your credit when you are done? You can do this or just set the un-freeze for a specific date range so the freeze will go back in place after those dates. The latter is my choice as I set it one day after I know I will be done with new applications.

Do soft pulls or soft inquiries work (vs. a hard pull when you apply for new credit) when your credit is frozen? As an example, if your credit is frozen, you can not get offers via the “CardMatch” tool that shows targeted offers to you (like the now and then 100,000 point Amex Platinum Card offers).

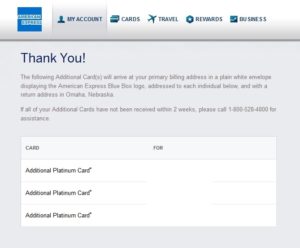

However, once I unfroze my credit, and re-tested the CardMarch tool I instantly was shown a number of targeted offers for me. While banks may not be able to perform soft pulls with your credit frozen, the credit reporting agencies still seem to be able to perform soft pulls with your credit frozen. But what about adding AUs or an Authorized User to an account. Does that work when their credit accounts are frozen?

Most times, there is no need to unlock your credit report to add an authorized user to an account. If in doubt you can reach out to the bank and ask before you request new AUs to your account.

Can you apply for new cards with your accounts frozen? Sometimes. For example, I have many data points of Amex, when you are an existing client, allowing for new card approvals without unfreezing your credit.

Another thing we all should do, at least once a year, is check our credit reports free with Experian, Equifax and Trans Union. Maybe right now set a yearly repeating alert in your phone to remind you say on January 1st to get it from one of them. April 1st from another and finally on September 1st from the third one. This way you are keeping on top of your credit report each and every year. Oh, and you do not need to unlock your credit to pull this yearly free credit report.

All of this matters because new travel card bonus offers, despite ridiculous rules like 5/24 or 1x lifetime bonus points or pooling cards into a family of bonus offers, are still one of the best and most lucrative ways to travel the world for pennies on the dollar and enjoy travel perks most only dream about! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.