Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

American Express provided another reminder about why it’s important to always pay your bill on time.

dFellow BoardingArea blogger Grant does us a wise service by reading those seemingly innocuous notices included with credit card paperwork. He noticed something interesting on his most recent American Express Blue Business Plus Credit Card statement.

“Effective September 1, 2019, you will need to pay your bill by the payment due date, otherwise you may forfeit any Membership Rewards Points earned that period.” – Travelwithgrant.boardingarea.com

What a bummer to rack up a big bill during a welcome bonus period, spend challenge, or just run-of-the-mill charges — and lose all those valuable Membership Rewards Points (or “MRs”).

All of us should pay every bill in full and on time. Late fees and interest charges pretty much negate the value of whatever points we earn.

Which Amex Cards Are Affected?

I don’t yet know if this applies to all Amex MR cards. But let’s be safe and assume it does.

Solutions! Don’t Overextend Your Credit — or Yourself

Don’t take on more credit cards than you can manage — financially and administratively.

Yes, there are almost always great credit card welcome bonuses. That doesn’t mean you must take advantage of them all at once. For that matter, limit yourself to one or two every three months. Maybe. If that. Unless you have a lot of money or are an excellent budgeter with fantastic organizational skills. This leads us to —

Pay Your Bill On Time. Always.

Was I ever late paying a credit card?

Yes. I admit it.

Busy-ness and poor organization caused me to miss a bill. And I paid dearly. Several hundred dollars dearly.

That hasn’t happened again!

Want to get into the travel points and miles credit card game but worry about paying your bills on time? Concerned about APR? Either commit to spending only what you can afford or maybe stay on the sidelines a little longer.

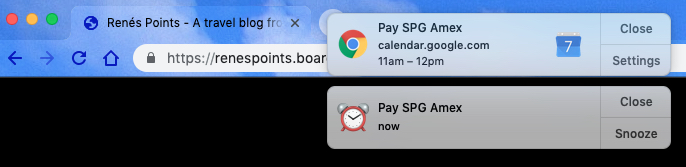

Set a Calendar Reminder — Or Three — To Pay Your Bill

Is your payment due on the 15th of each month? Set a recurring reminder on the 10th or 11th to pay your bill.

Maintaining a spreadsheet to keep track of multiple cards is another popular method, and René posted a sample one that you can download to make sure nothing gets missed each month.

Other Thoughts or Solutions?

Does this new Amex MR verbiage concern you? Do you have any other tips to make sure your bills are always, always, always paid on time? – Chris

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I leaned this lesson too after a few late fees. Now I just have auto-pay set up from my AMEX accounts and keep sufficient funds in a high-interest checking account. I have not missed a payment since. Granted, this really just shifts the “worry” from the monthly credit card bill to maintaining sufficient funds in my checking account, but I find doing that to be easier.

Why not just incentivise autopay instead of punishing late payment.

I turned on autopay on all of my chase personal cards. All 10 get paid out of our chase checking account automatically. I use quicken and paper statements to manage the rest of our accounts. I am a little embarrassed that it took me several years before realizing I could autopay with chase.

Why not set up automatic payment of the balance in full on the due date? It is easy to do on the American Express site. If you like, you can set up alerts to be notified when payments are made.

I set up “AutoPay” on my 20+ cards and have never had a problem with the automated system working properly, including Amex, Bank of America, Barclays, CapitalOne, Chase, Citi, Discover, US Bank, etc.

For a fee you can reinstate the points, I thin it either 30 or 50 dollars.

Turnips it into another revenue stream for amex.

Hasn’t this been AMEX’s policy forever ??

@Jack: The time I missed my payment, I still received my MRs.

If this has been their policy forever, I’m not sure why they’re just announcing it now. Then again, it wouldn’t be the first time a bank did something head scratching-worthy.

AMEX IMO is usually ahead of the curve. They probably see slower economy in the future and slow cc payments in the present.

I round up my payment (in full) the the next nearest $100, this way, I always have a credit balance, just my 2 cents worth.

Autopay is a problem if you put it too far from due date in the event you want to challenge a charge. I have one of those every year or two, and I consider that money “lost” if the cc company already has it when I initiate my challenge. Even though we all want our average daily balances low, I think it’s worth it to keep the autopay close to the due date. MY 2 cents.

; )

I disputed an AMEX charge earlier this year. AMEX give me an instant credit, but warned me that the credit would be reversed if their investigation sided with the merchant. The charge was under $100, so perhaps they only do this for minor amounts.

In Feb I was away so on return I sent Amex bills due 4-6 days out via Priority Post figuring I had enough time but they arrived 7. And 8 days later!! I went to post office asking why??? The gave me a printout showing it took 7 and 8 days they sId NOT A Guarantee!! Nuts so paid fees etc not sure if Post office slower n Amex not opening mail

Up on arrival ..

Hi Marty,

Why is it advantages to keep a credit balance?

Thanks,

Mary