Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

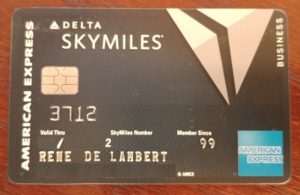

This past week I gifted a friend 15,000 MQMs. I am just about always done with my $60,000 Delta Amex Reserve card (learn more) spend goal by this time of the year, each year, because I always have large tax bills to pay and it is a simple quick way (at very little cost) to get my spend done. But once I have this my card tends to go into my “sock drawer” until 1JAN the following year.

Now I say sock drawer, but in reality it stays in my wallet because their is the rare time that I have to produce my Reserve card to get into the Delta Sky Clubs (since Sky Club membership is all but pointless in 2019+). Also, there are the now rare times an Amex Offers for You is only targeted for this card and I will use it even over the 60k yearly spend.

I have kept the Reserve card for so many years for the perks despite that fact that no new perks have been added to this card at least from the Amex side. Delta has made lots of changes some good and some bad. For example:

- You used to be able to bring a guest into the Sky Club with the Reserve card.

- With the +1 upgrade at your status level change both upgrade on coach BOGO certs

- The better chance for upgrades is now official not just a “hush hush” perk

- The 25k spend for more upgrades did not change with the ¼ million Diamond spend waiver enhancement

- You still get Sky Priority security line (if you don’t have TSA PreCheck already).

- You can still pay $175 for an authorized user to get Sky Club access (but no other perks).

So while the yearly fee for the card has not changed the perks have not really changed much either and the cut of guesting someone into the Sky Club still bugs me to this day and every time I fly with my wife.

But what if Amex decided, like they have with the personal (learn more) and business (learn more) non-Delta Amex Platinum cards, to raise the yearly fee on the cards from $450 to some higher number? Would it still be worth keeping this card then? Maybe – maybe not – it all would depend on one thing for me.

First off there is Sky Club access. Since even “members” (not really members anymore in 2019+) have to be flying Delta or a Delta partner to get in the card fee right now is a real value. Why in the world would anyone pay $545 for membership when they can pay $450 for the Reserve card and get MORE perks than real paid club membership. This is one of the reasons I fully expect the Reserve card fee to jump to at least $545 very soon (and a reason to get the card NOW before any jump in fee).

Right now I know I am getting more upgrades by holding the Reserve card but Delta selling upgrade for as low as $2.00 to others and thus all but robbing me of my loyalty to Delta is making this perk less and less valuable each year. If the fee goes up why keep paying when Delta will “pull the rug out from under you” if you will. I would have to think hard about keeping the card if the fee goes up.

So what would make me maybe pay more for the Delta Amex Reserve card (learn more) each year? A permanent change to allow a 3rd spend bonus. Even with a SkyMile (SkyPenny) now really only worth 1 cent each in value, getting a 3rd 15,000 SkyMiles and MQM bonus each year for spending $90,000 on the card cold make a higher fee worth it. I would not want to see it jump more than $100-150 as more than that I would have a hard time trying to justifying the new perk.

What do you think? Do you expect Amex to soon raise the yearly fee for the Reserve card(s)? Would you pay more for the card with no new perks? Would you pay more for the card if the 3rd spend goal were a permanent feature and if so how much more? Let me know! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

How about boosting the Skymiles to a 5 mile per dollar Delta spend on tickets like the non-Delta Amex Platinum card and include delay insurance like Citi Prestige. That might get it out of the sock drawer after $60k.

@Jeffery – Agree. That kind of change could help soften a price jump as well.

I’d pay more for this and also would like to see them lower the waiver from 250K to 125K for Diamond. I never had any issues with the amount of upgrades I got when it was 25K. Now you can pay for upgrades there is even less reason to stick another Diamond disqualifier on us, especially when there are people working around it with MS.

I’m just in the camp that the allure if chasing the upgrade is becoming less and less. I’m willing to do a little to position myself better, but at the end of the day it’s not what it used to be. First class cabins have become smaller as a proportion to total aircraft size. More people are buying discounted upgrades to first, further shrinking upgrade possibility. So at some point it might make sense to focus on other loyalty devices.

The DL Amex Reserve left a very bad taste in my mouth after reading about folks who spent $90,000 in good faith in 2018 yet were denied the additional 15,000 MQMs.

In 2018 was part of the target to receive a total for 45K MQMs for $90K spend which just pushed me over to 50K MQM and thus to Gold which still means something for me whom only travels a few times a year.

For 2019 received No promotion and now card had less value. Is there even a $90K spend for 2019?

Also lack of access for family to lounge for family. Breakfast still good these days but not $29 each or $75!

Would not pay extra for it…….

Increasing an already not insignificant annual fee would, IMO, be nothing more than a mask on the value of an MQM.

I fought tooth and nail to get my $90k bonus last year but going forward my Reserve is strictly a $60,001 card.

Better mileage values in my Amex Plat anyway.

Rene,

I concur on your capped $150 fee surge for a supplementary 15K MQM with a reserve card $90K spend threshold (I also love that that last run-on sentence means NOTHING to people who are not bona fide point-freaks). I would also pay a smidgen more than the current annual fee if Skyclub rules were refurbished. Your post, however, catalyzes 3 questions:

1. What is sed “at very little cost” way of paying taxes with AMEX? (I assume you mean like 2%)

2. As a Diamond and reserve card holder are we blocked from these paid upgrade offers I hear about? I’ve never seen one.

and finally, 3. When will I receive those gifted 15K MQMs?

Thanks for another great post brother and for keeping all of us “in the loop”.

@Derrick – See linked post but currently the lowest fee to pay taxes with a credit card is 1.89%. If you value a SkyPenny at 1 cent you are paying less than 1% to get the spend done quickly and inside the rules.

@Frankie, I had no trouble getting my extra MQM even though a lot of the spending was on Dec 31 and didn’t post until 2019. Is it possible that people not going them didn’t receive the targeted email and therefore weren’t due the extra miles?

@Derrick I get the paid upgrade offers as a Diamond Reserve holder.

I’ve been on the fence about keeping the Delta Reserve even at the current annual fee. While I know there are LOTS of variables, has anyone been able to estimate a “value” of the upgrade boost a DM gets with the Reserve card? I don’t want to give up the card just to find out what happens to my upgrade rate. LOL

I’m not sure it’s even worth keeping the card now. I’m basically paying for the 30,000 mqm’s and extra upgrade certs since I don’t have to use one of my diamond choices for sky club access. Also, if I hear about people being targeted for the $90,000 spend again this year, I will go ape crazy on AMEX. They shouldn’t be allowed to exclude you from offers when we all pay the same annual fee.

I wouldn’t pay more for it as for $150 I can just go get another Amex Delta Plat and get a 20k MQM’s instead of 15k. I would though have no problem spending an additional $30k to achieve $90k on the card for the 15kMQM’s as for now same thing when I hit $60k for the year goes in the sock drawer no other reason to use it I can get to $250K spend with additional Amex Delta Plat.

Not worth it.

They’ve offered me the 3rd tier benefit two years running but as I already clear DIA MQM’s I just leave my Reserve in the sock drawer… the only benefit worth a higher fee might be Resolving the 250k MQD spend to a low number, eg multiple spend points when charging flights on reserve card.

Rene, great topic. I receive the offer last year and easily sent the 90k. In fact, I just called them a few weeks ago to ask if they would make me the offer again this year but no such luck. I have 3 Delta Amex cards and I max them all and then move on. I don’t know why they don’t offer unlimited tiers. Amex makes so much in merchant fees, they don’t need to raise the annual fee, imo.

NOT Worth it and sounds like a bunch of Marketing fluff to me. Based on your chart showing $90,000 spend on AMEX to get the 45,000MQM & 45,000 redeemable miles. Here is why:

If I use the Chase Sapphire Reserve®, which still cost only $450 per year with the 1st $300 rebate in travel credit, spending $90,000 in travel gets me 270,000 Ultimate Reward points. If I just cash that in for statement credit (BTW, we all know is not the best way to use your UR points) will get me $2,700 ($0.01 per point). This mean $2,700 cash in my pocket which I can use to the buy a Delta Round trip ticket (LGA-SIN routing) to Singapore using cash not UR points, and it gets me 21,000 MQM on just one trip. The cash cost would be less than $1,000 ( I did it in Feb this year). If I purchase this same ticket with UR points, it will only cost me ~ 700 UR points. This means that I only have to do this twice and I will get rough around the same MQM and I will have (27,000-14,000=13,000) UR points.

BTW, my example above is flying mainline Delta using UR points. If I fly on a partner airline (like you suggested) such as Aero Mexico, I can probably get even more in return.

One may ask, the AMEX card gives me the complimentary Skyclub access… Yes, but for most of us Diamonds Medallion®s, it is already on our choice benefits already. Also, the Chase Sapphire Card gives me access to Priority Club. BTW, let’s now go down the rat hole and start comparing club locations around the world.

Oh, what about the BOGO CERT? Useless because the BOGO cert is only good for domestic flights and if you decide to downgrade and buy a coach ticket (which you can do) you are not eligible for the complimentary upgrade to first — at least that is my understanding.

What about the +1 upgrade perk — yes, that comes in handy only a few times when the flight are extremely full. For us mileage collector, it would be dump to fly during peak and pay the $$$ price; but I recognize we do have to do that some time. So, for those rare occasions, we can use the Regional to take care of that.

Honestly, not everyone can rack up hundreds and thousands of dollar in “Real” spending on their credit card unless you are a business traveler who has either a business account or can tax deduct your trips. For ordinary folks who just makes a decent salary and cannot deduct their mileage runs, spending over $100,000 on his/her credit card is rare and maybe even unrealistic!

All in All, I am more of fan of the Sapphire Card than the Delta AMEX Reserve.

@Roger – As mentioned in the post the BOGO certs are +1 upgrade eligible. I have just this year in fact upgraded with Lisa and me on one.

I could go along with a bit of an increase if they would add a +1 to the SkyClub. We now each have the Amex Skymiles so we can get in the club (among other things). We could then just do one.

Rene,

Why pay more for the reserve card when you can carry the Dl amex Plat for 195 and get the 10k mqm at 25k spend and have and have the domestic companion ticket, which usually makes the card more than pay for itself.

Gregg

I would not pay more for the card and do not need the additional MQMs.

For many, unless you’re more interested in miles than MQM, the stopping point for spending would be when you reach 75K MQM. Unless you rely on rollover MQM to make Platinum, if you can’t get Diamond without spending 250K and you can’t reach there MQD level, what’s the point? Also, why is there no spending requirement if your address is not in the USA?

I think Delta will offer another higher tier amex card in addition to the reserve card. I can envision a $650+ per year annual fee maybe even a $950+ fee. simply because delta knows their elites will get it, and also, delta publicly stated they plan on doubling their amex revenue in the coming years. We can probably assume that its credit card user base is fairly saturated by its high vale customers already, and so they need to find ways to either increase spend, or increase fees.

There are so many ways for delta to increase fees/amex revenue. I can envision having the diamond waiver only for the higher fee card, I can envision earning RUC with each $25k spend, I think finding alternative ways to FCM including amex revenue will be attractive to delta.

@evan I’d forgotten about Delta’s statement about Amex revenue. The 250K waiver is not doing much to help that unless there really are many people that have the ability to increase their spending that much, and Delta doesn’t encourage MS. I hope your predictions are correct.