Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

It’s soon that time of the year again, that is, the 15th of January is tax time for many of us who pay quarterly. For many others April 15th will be the time that you have to settle up and pay what is due. But one of the neat things about paying taxes is that if you do pay too much you end up getting a refund from the government (keep in mind I am not a tax advisor nor am I giving any tax advice in this post).

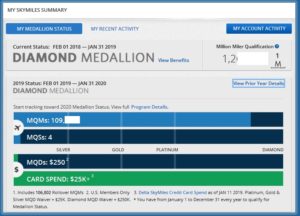

While on this topic many who are chasing Delta status each year have to reach it by a combination of MQMs, that is, miles flown plus yearly net dollars spent with Delta. The Miles flown is either via BIS that is your “butt in (the) seat” miles or with Delta partners a percentage of distance and fare class. Another quick way to earn a bunch of MQMs is from spending on Delta Amex cards, that is, the personal and or business Platinum and or Reserve credit cards.

Most readers know by now a few key parts of the above and that for Silver, Gold and Platinum Medallion®s you can become exempt from the MQD spending levels with Delta by spending $25,000 a year across your Delta Amex Gold or Platinum or Reserve cards. But just how do you meet this spend without needless spending?

One of the great ways, that comes at minimal cost, is via paying bills you must pay anyway – taxes for example. Yes there is a fee but one I can live with for the benefit of accomplishing a goal. And you could take it to the extreme if you wanted to. For example:

- You pay $30,000 in taxes and it costs you on your Delta Reserve card $561 in fees

- You get a total of 45,000 SkyMiles (with the 15,000 miles bonus) worth at least $450

- Your net result is your cost is just $111 if you value a SkyMile at 1 cent each!

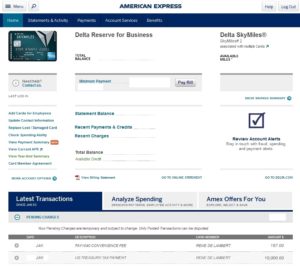

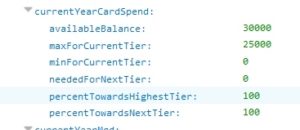

Now I did not spend that much this quarter but I think you see the point. I did pay a number of other bills (for the year) including things like prepaying some qualifying medical bills that I could then pay myself back from my HSA savings account plus as well as some creative spending (see this FlyerTalk thread for more info) to finish reaching my spend. I thus have not just the $25,000 MQD exemption done but also reached $30,000 for my 1st MQM and SkyMiles Reserve card spending bonus for the year.

Why do this so fast at the start of the year? I do hope all know that for ALL Medallion® levels that holding the Delta Reserve card AND spending $25,000 ASAP means I will get more complimentary upgrades than other flyers. Considering how hard it will be this year to get upgrades I want every advantage I can to always “turn left” if you will when I board a Delta jet!

Lastly, before I get a ton of comments about the value of doing this, if you are NOT chasing status with Delta this clearly is a really dumb idea. Yes there are any number of better travel cards that you can put this kind of mega spend on per year ( note: this post is likely not for you! 😉 ).

What do you think? Are you going to pay taxes, as well as other things, to reach your Delta Amex MQD exempt goal or for bonus MQMs and SkyMiles this year? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

This is fine except I would spend today anyway. My goal is Diamond. Would it be tax fraud to overpay your taxes just to meet your 250000K waiver? I know the fees would be outrageous and I don’t have a high enough limit. Obviously it would be better to just buy enough tickets to meet the MQD requirement!

I’ve been paying my taxes on my AMEX for the MQD spend waiver for 6 years now… Easiest way in the world to clear the waiver and get the spend bonuses!

Don’t forget that property tax payments can help out on this “spend” also. It all adds up and you have to pay them anyway.

@Mike – Great tip – Thanks!

Thanks to your continued detailed reminders of billing every little bill thru AMX i finally did my tax extimates last year partly inorder to avail the new $90,000 bonus level offered for the first time. The MQM bonuses definitely helped me continue my diamond status! I rarely mess with upgrades as I hate the nervous waiting and unending disappointment but i do love Diamond and thanks to you and Juicey Miles I can do it without the ridiculous $250, 000 Delta requirement!

@Steve, I am curious how you Rene was able to help you stay Diamond!

@BMG – Follow ideas here on the blog plus a custom mileage run on a partner for mega points.

I do this every year as well.

It was essential to reach the $250K waiver.

That nets a *minimum* of 350K miles if you don’t include the extra bonus miles from making diamond. (This was not only taxes; I am not that wealthy.)

My total costs for doing this were approximately $3,800.

So if I value SkyMiles at “only 1 cent” — and I don’t, redemptions in the past 12 months averaged more like 2 cents, though that was influenced heavily by a one way to Cambodia — my total cost was $300 (plus some reserve card fees, etc. though I value the companion tickets highly enough that it mostly washes those away).

I actually count the two 25K SkyMiles boosts for Diamond as part of manufactured spend so I really consider it more like:

“I got 400K SkyMiles for $3,800. I got two first-class eligible companion tickets for $900 where the redemptions were on tickets were coach was more or less $400 per trip, so even if I value those extra upgrades at pennies per dollar, the Reserve cards net out to free. Oh, and unlike my friend Rene, I didn’t spend 4 days of my year on Aeromexico.” 😉

@Mark – It is funny that in 2019 all kind of creative spending is working AOK. My 30k spend cost me net zero with all the bits I added in. #Winning!

property and income taxes…Yes!!

@Rene — but no Simon Mall for you, correct?

@Mark – I did not do any buys at SM no so not tested this year. YMMV when it comes to SM buys.

This is awesome!