Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Delta, this past week, took live the opportunity to donate money to them to “elevate” your status with them. The prices, as in years past, are truly mind numbing. I can not comprehend why in the world anyone would fork over this kind of money (see above offer one reader got) vs. simply flying somewhere fun on a mileage run with Delta partners in business class for fractions of that amount (need help – see this post). But is there a better choice? Yes! And the time to act is NOW!

I broke the news, from a private Facebook group, that there was in fact a shot at a one-time waiver. Later, RenesPoints readers found that on a case by case basis Delta was granting the waiver over the phone (via the medallion line). Finally, and IMO the best way to go about this, is that the Diamond Medallion® desk via reaching out to Delta on Delta.com was granting waivers to folks who asked.

- You were Diamond in 2017 (now flying Diamond in 2018)

- You have earned 125,000+ MQMs this year (for 2019)

- You have spent at least $25,000+ across all your Delta Amex co-branded cards

First things first – who can get the waiver? You must meet the above criteria. If you are not Diamond now it is highly unlikely you will be granted the waiver (I only know of one Platinum who got it vs. many who got a quick NO!). Will it mean an automatic YES if you have the above accomplished? No, but most are succeeding (#ProTip – If you got a no a few months ago – try again now).

But what if you would rather wait and try this waiver request next year i.e. after 1JAN19 and see if you can get it for 2020 instead of this year? I would not count on that happening. Notice in an approval e-mail for the waiver from Delta the wording that was included:

“In reviewing your request and due to your loyalty, we are making a one time exception (this will not be offered next year), and have granted you Diamond for 2019 Status through January 31, 2020. Please allow 24 hours for your SkyMiles account to updated.” – From Delta to a reader who was granted the waiver (bold mine)

So it seems that this year (i.e. for the 2019 medallion year) is going to be the only time this spend waiver, from the old qualifying standards, is going to be offered to medallions (bummer, cuz I was personally going to try this for next year).

I know a bunch of readers tossed in the towel after the changes last year to the qualification requirements and will either drop in status with Delta or have moved to other airlines – I understand. But either way, if you are going to try for the waiver, now is the time to act! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

The only thing worse than changing the DM spend waiver from $25K to $250K, is pulling the plug in the 11th hour. I jumped through all of the required hoops to maintain DM for 2019 without the waiver. From this point forward, every year on Dec 31st, I’m saving screen shots that prove I’ve maintained DM without the one-time exception. If and when I need it I’ll be forwarding my request to Delta along with those screen shots.

What’s fair is fair.

Do you think they will lower the spending requirement to maybe 150000?

@Sammy – I would not be shocked to see it lower next year.

I think they should tier the spending requirement to match the number of MQMs required.

Silver: 25K MQMs plus $25K Amex spend

Gold: 50K MQMs plus $50K Amex spend

Platinum: 75K MQMs plus $75K Amex spend

Diamond: 125K MQMs plus $125K Amex spend

This would thin the herd at every level and make each level more valuable to those who qualify.

I received the 2019 DM waiver even though I was PM in 2018. I originally submitted a request through delta.com a few months ago and was denied. After getting over the 125K MQM threshold, I tried again via the phone.

Not only did they approve my request, but they also asked me if I was sure I wanted to use the waiver this year given how close I was on MQDs (i.e., could buy my way up). They said I could use the waiver one time this year OR next year. No guarantee that they will honor it next year, but that is at least the message I got. I went ahead and used it for 2019.

@Dan – That is amazing and THANK YOU for the data point. Shocking! Then again the medallion line will say almost anything. Happy you were successful.

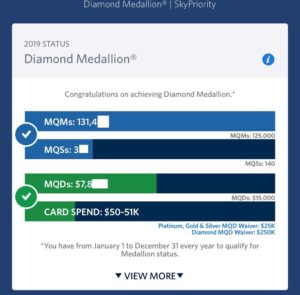

Quick question. For a person with 131k MQM, but only $50k spend, and who doesn’t get a diamond spend waiver, how much gets rolled over when they become platinum next year? Is it 56k MQM that gets rolled over? Or do they take 125k for diamond, roll over 6k MQM, then disqualify diamond for not enough spend and downgrade to platinum?

@Mark – See this post: https://eyeoftheflyer.com/2014/08/27/rookie-wednesday-understanding-medallion-rollover-mqds-mqd-exemption/

I spoke with at least 3 different people at the Diamond desk over the past two months who could not help me. They had no idea what an MQD waiver was. I requested a waiver through Delta.com in late October when I was over 125K MQM, $10K MQD, and $50K AmEx spend. I was denied. Per Rene’s suggestion, I sent another email through Delta.com last week. A couple of days ago, I got an email saying the request had been forwarded to the higher ups. I’m now nearly 150K MQM, $12K MQD. I’ve been DM for 3 straight years. Why are they offering a waiver to a current PM like Dan and not a DM? They probably believe I can hit the $15K MQD, but unless I add some gratuitous trips, I won’t. Why does Delta keep testing my loyalty?

Reserve MQM bonus question – I see from one of your other posts that if you meet the $30k spend mid-month, you cannot claim your MQMs sooner. If my next statement close is Jan 5th, I assume that means the 15K MQMs cannot be applied toward obtaining 2019 status, since I will not receive the bonus MQMs until my statement closes in January?

@Jacob – See Q4: https://eyeoftheflyer.com/2017/12/08/2017-2018-delta-year-end-qa-mqms-rollover-choice-benefits-skybonus/

But is Diamond really worth it? Aren’t you bettyof rolling over 50+ MQMs to next year? I’ve gotten lots of upgrades being Platinum. Sure I could get more bring Diamond but the extra 50k will get me well on my way to Platinum for 2020. What do you think?

Are Diamond benefits that much beythan Platinum?

What’s the best way to see where your card spend lies? I have multiple delta branded AMEX cards have have most of my spend from the beginning of the year on my platinum Amex and the last few months on my reserve. The delta app doesn’t update often even thought it changes the “as of” date, amex’s Number doesn’t match Deltas and i’ve Got one more statement in 2018 that hits in 2 weeks. Would love make sure I’m not $$ shy and miss on getting PM this year.

I, unfortunately, spent the last week traveling (to spend MQD’s) to get to Diamond status again for next year. I decided not to take the chance of not making it… Delta must love me. btw, I’m a 2M miler that didn’t travel a lot last year as I’m slowly retiring, but never sure I’m not going to get back into the game.

@Pete, check your spending on the AmEx site. Choose the year to date option and subtract any fees or credits.

I asked the Diamond desk 5 days ago. The diamond representative was very nice. She checked for herself on her computer but nothing came up. She said she would check with the “back room”. She came back a little while later and told me that I was waived to diamond status for 2019. I had 126k mqms,123k card spend and $7000 MQDs. I had tried earlier in November but had no joy.

Good to see some PMs from 2018 are getting upgraded after requesting. I was initially denied, but might now try again. I will end this year with ~145 MQM, $8500 MQD, and a combined $75k on DL Amex (Reserve and Gold)…

Unfortunately there’s still that part of me saying I could roll over enough miles for PM in 2020 if I don’t push for the upgrade to DM…

More data point: based upon what some folks wrote here, I called the Diamond desk to request a waiver today. (I’ve been waiting for a response to the 2nd written request through Delta.com as explained above). The rep reached out to Skymiles – they told me that I may have to wait up to 3 weeks for a response. I am certainly not getting the love some folks are. Now it’s a game of chicken as I decide whether to blow a couple of thousand dollars on a Delta One flight transcon or wait for them to give me a waiver.

It looks like I’m shy by $960 MQD or $1600 for the Delta Amex waiver for PM the $1k elevate your status seems like a rip off and I only have 6 days for

My last delta Amex statement in 2018. Sounds like my only option is $1600 of early Christmas shopping. Anyone else more creative?

Help!

I troubled by the $250K spend requirement (and I will never reach MQDs because I work for a company that requires frugality in airfare spending… I don’t fly first class on the company dime like some do.. to wit, my 2018 spend will be less than $9000).

I will have all of the requirements based on 2017-2018 rules. So I plan to ask for the waiver.

But what really frosts my windshield is the fact that I am a CHARTER DIAMOND and I have maintained the status every year since. I guess that doesn’t make me completely special but I bet it culls the herd somewhat. Does it make me loyal. Well, do you know how hard it is to maintain Delta loyalty out of DCA? Not easy, I tell you. Connections every time.

Even $125K-$150K is putting too much pressure on me. I got the card because a $25K spend is easy enough. And the $60K spend to get the extra MQMs is helpful. Unless they have a reasonable level of spend to keep diamond I’m going to have to start rethinking my loyalty. Like I said, out of DCA it’s a mess. But I do it because I get to sit up front a lot of the time.

A charter diamond waiver would make me pretty happy.

PM waivered to Diamond for 2019. Called Platinum line got nowhere. Called Diamond line a couple days later and was upgraded on the phone. They did ask if i was sure i wanted it for 2019 because it would be offered next year and you are only eligible for one.

125,750 MQMs

$66,000 Amex Spend

@Steven – Amazing they are saying they will do it again next year! Shocker!

Just called and the DM Medallion® desk had no luck! The representative I spoke with had no idea about this and suggested I go to the “elevate your status” page on Delta.com… Guess I’ll keep trying different DM agents?

@Pat – Email via Delta.com best choice.

I also called the diamond desk and got the complete runaround. The representative said he knew nothing about waivers and that they were not being given. I emailed and we’ll see what happens.

I just called the diamond medallion line after getting a quick no via Twitter. The lady on the phone had no idea what I was talking about. She mentioned elevate your status and also offered to give me the corporate number to call. I did send an email via the comment/complaint link on Delta.com but those take a while to get responses. I am a first time DM this year and have 127000 MQMs, $9000 MQDs and $37K Amex spend. Any suggestions are welcome. Thanks

@Phil – Try email via Delta.com

I called Delta again during regular business hours ( my first attempt was at 2am EST). The rep first directed me to call Amex since “they control MQD waivers”. I told him that only Delta can grant status and he put me on hold to talk to someone who might know more. After 2 min he came back and said that he talked to the skymiles department and they granted me the one time waiver immediately. Thanks to this blog, I am a happy DM again.

@Phil – Wahhoo! Congrats!

Phil, has the 2019 Diamond status posted yet?

I have been flying Delta almost exclusively since 2004. I earned Platinum that year, and earned Diamond when it was kicked off in 2011. I have been Diamond ever since. I have 1.5M miles (which seems cool until I see all the 2M and 3M tags boarding with me).

It hasn’t always been easy to stay Diamond… two or three years I needed some mileage runs. Sometimes I paid for FC upgrades out of my pocket.

But I did it out of loyalty and because being Diamond is cool.

When I moved from ATL to the DC area three years ago it became harder and harder to be loyal… unless I’m flying to a hub I am always connecting… my most frequent destination is the Bay Area, which means I never get a direct flight.

So, this year I have 137,000 MQMs (I just earned the ones I needed last on Friday thanks to my Delta Reserve AmEx), $9,500 MQDs and only $65,000 AmEx spend. Two calls to the Diamond Desk have been painfully unsuccessful. I was directed to the “Elevate Your Status” page by both reps (like I’m going to give them $5,500 to get Diamond status). Twitter told me to check the website for the rules, sorry for your disappointment, stop being a crybaby.

I was also told by both Diamond Desk reps to voice a complaint on the website, which I did two days ago… no response. I imagine they are getting a great deal of these complaints.

Since my two major destinations are Dallas, TX and the Bay Area I am giving very serious consideration to switching to Southwest if I am not given Diamond Status in 2019… and it seems very likely that this will be the case. I will thumb my nose at Delta… With great bitterness and disappointment. This is NO WAY to treat someone who has maintained the kind of loyalty that I have.

Delta has decided that the business traveler who is fortunate enough to have no spending restrictions is the only worthwhile candidate for their upper tier status. Fine… I can take my business somewhere where it’s appreciated.

@DMC, yes. It posted before I even hang up the phone.

@Jerry, my second attempt with the diamond medallion desk was successful only after the rep put me on hold to talk to the skymiles folks. It appears to be luck of the draw with these calls.

Can you tell if this new DM requirement will reduce the total number of DM’s and first-class upgrades for 2019 DMs will be easier to get?

@Alex – Not if Delta keeps selling cheap upgrades

I want someone experienced in using Star Alliance partner airlines and wanting earn MQM and MQD’s on Delta to verify this statement made by “ThePointsGuy” in his November 12, 2018 article on this subject.

he claims following …

“Aeromexico in business class credit to Delta earning 150% MQMs per distance flown and 40% of MQD’s for distance flown. So if you were flying from New York (JFK) to Quito (UIO), a 8,068 mile round-trip journey, you’d earn 12,102 MQMs and 3,227 MQDs.”

I checked with Delta Diamond desk … and they said 40% of the ticket price is what you get MQD’s .. not the miles.

and MQM’s are incorrect too.

So would you help me understand what ThePointsGuy is talking about?

@Alex – Yes. See this post for more: https://eyeoftheflyer.com/2017/10/09/protip-the-2019-delta-medallion-elite-year-rewards-mileage-runners/

Also see this AeroMexico run to see the points you get for flown 8,058 actual miles: https://eyeoftheflyer.com/2018/11/21/new-york-to-quito-ecuador-aeromexico-credit-to-delta-business-class-844-delta-elite-mileage-run-12147-mqms-at-7cpm-plus-3239-mqd-credit/

I called Delta Diamond Dek to check on MQD’s about this reservation.

They said as a Diamond medallion member I will only get 40% of the dollar amount spent on the AeroMexico’s business class ticket .. so actual MQD’s will be only 40% of $836 ticket value.

@Alex – If you read the posts, you will see the facts vs what the Diamond Desk told you. As an example, as shown in the posts, I got $1,922 MQDs for a ZERO dollar base fare!