Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

This is going to make a lot of folks come unglued. Last week I blogged about the then rumor that Delta is getting a lot of complaints about the now almost 1 year old change requiring ¼ of million in spending across all your Delta co-branded credit cards (personal and business) to qualify for Diamond Medallion® elite status (plus accumulating at least 125,000 MQMs as well). Well this or the MQMs plus $15,000 in NET spend on Delta tickets.

But it turns out Delta must be really suffering from this change last year as I can now CONFIRM, on a case by case basis as posted, you can be considered for a waiver. Reader Stosh has been kind enough to walk us through his situation and what happened.

Rene – Hi Stosh thanks for helping with this post and for sharing with RenesPoints readers.

Stosh – Hi Rene, glad to help! You have been a go-to source for travel opportunities for quite a while for me.

Rene – So give me some background. How long have you been flying with Delta and how many years have you been an elite?

Stosh – I have been flying with Delta since 2011 and have been Delta Diamond for the last 5 years.

Rene – OK great. Have you most years qualified on BIS that is your “butt in seat” miles plus the Delta $25,000 Amex MQD spend waiver?

Stosh – For the first 2 years, I qualified as Diamond with BIS and MQD spend but for the last few years it has been completed with AMEX CC spend.

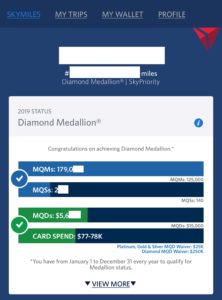

Rene – What about this year. What were your MQMs and Amex spend totals before you emailed Delta requesting the waiver?

Stosh – I had almost 180k MQMs and had spend over $70,000 on my Delta Amex Card.

“We are offering a one-time exception to members who have met the

Medallion® Qualification Miles or Segments and have $25,000 in eligible

spending on their Delta SkyMiles American Express credit card. I have

your account updated to reflect this exception and your Diamond

Medallion® status is now showing valid through January 31, 2020.” – From Delta (bold mine)

Rene – What was the result of your request to Delta?

Stosh – In about 24 hours Delta sent me an email telling me I had been granted the waiver and am now Diamond thru 1/31/2020!

Rene – One last question, because many will ask, you do live inside the United States right?

Stosh – Yes, I live about an hour from a Delta Hub here in the States.

Rene – Thank you so much, Stosh for helping us to confirm Delta is, at least for some, allowing this one time waiver!

Stosh – Thank you for sharing the information on the blog!

So there you have it folks, we are now confirmed on this. Next let’s speculate about why Delta is doing this and what changes we may see next.

As a blogger I get emails and comments all the time about long time (and often high spending) elites who have departed Delta in 2018 for another airline or gave up on status and simply fly whatever airline is the most convenient (vs. always choosing Delta even if they had to connect). My guess is enough have voted with their wallets and this has begun to have an impact on Delta.

Next we have Amex. Delta is really bragging about how many new cards they sign up each year with the co-branded card but they never talk about how many cancel or are retained. My guess is that this year Amex is seeing huge waves of Delta card cancellations. Remember that it takes YEARS for Amex to earn back value after paying out new card bonus offers. Folks canceling cards is not what they want to see happen and with impossible spend goals I think many have done just that.

So what’s next? While I have no real insider info (like I did last year) about what Delta will do I think we are going to see an adjustment to the waiver and I think it may become much more streamlined and simple. I think Delta will retain the net Delta spend MQD numbers but change – across the board – the Amex MQD waiver to a more reasonable number like $100,000 for all medallion levels. While still a really big number it is one that is attainable for many elites.

Plus such a number would drive many to focus all their spend on Delta Amex cards even if there is potentially higher yields using other cards for say dining etc. This could also motivate folks to hold say a business Delta Amex card and then the personal Blue Delta Amex for other spend. Think with all the negative SkyMiles devaluations in costs this year (at least 2 and the year is not over) Delta does not need the ¼ million spend fiasco adding to flyer discontent. Something has to give. Maybe the fix is just give certain disgruntled flyers one more year to think about it but I bet we see more changes very soon.

Lastly, as clearly mentioned in the title of this post, this is on a case by case basis. Another reader Duane on the blog shared his results:

Although I have a plan to meet this new requirement without waivers, I thought I’d see what would happen if I made a request. I currently have about 130K MQMs and have spent ~$150K on Delta Amex cards. Here’s the response:

****

Thank you for contacting us about the SkyMiles Medallion® Program.

While we certainly value your extensive travel with Delta, we are not

making exceptions for status at this time. If at the end of the year,

you still find you will fall short of the requirements for Diamond

Medallion® status, you may resubmit your request then.

We are very grateful for your loyalty and many travels with us, and look

forward to seeing and serving you soon.

Sincerely,

XXXXX XXXXXXXXXX

Diamond Desk

Thus you may be approved for the waiver right away like Stosh, or, you may be told get back to us in a few months and we will reconsider you then. Either way, you do have a shot if you meet whatever requirements Delta has to grant you this real non-published exemption.

Are you going to try to contact Delta for a one time ¼ million Amex spend waiver? – Rene

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Nice to see Delta realized they messed up. They lost this diamond to Southwest airlines

@Tim – How many years before were you Delta loyal before 2018?

Too late. Would have been good to know before I traveled a bunch on SWA and United this year. I’m only a lowly platinum, though.

@Justin – Had not thought about the “cooling” effect the $250,000 spend would have on Platinum members NOT going for Diamond and departing!

thank goodness i never wasted my time with an airline that pretends they’re #1 in new york and doesn’t even know how to fly nonstop from there to Tokyo, on any metal

you know … that pesky air-link between the #1 and #2 metros in the world by metro-wide GDP

Thank you for the way you have followed up on this so transparently, René: it’s very helpful. It’s an important issue.

I just qualified for 2019 Diamond via spending >$15K.

Not happy that Delta is giving away what I had to pay for. They should be ashamed (and fire their CEO)

3.2MM Lifetime

176K MQMs as of today

Spent $30k on Amex, then put the card in a drawer.

Went to Southwest and earned A List Preferred and Conpanion Pass 100% BIS.

Won’t ask Delta for waiver

@Kevin – Holy cow! Want to guest post on the blog???

The only thing of which I am convinced is that Delta will not tell Am Ex what changes, if any, it’s planning to make regarding the DM spend waiver. They didn’t say anything to Am Ex last summer when they decided to increase the waiver to $250K. So much for being partners.

All other requirements for Medallion® status are tiered. Why not tier the MQD waiver?

Silver – $25K

Gold – $50K

Platinum – $75K

Diamond – $125K

Who are these people contacting? i have contacted Diamond desk by phone and nobody knows anything about this or who to contact. I was on my way to qualifying when I developed cancer that will sideline me from flying for at least the rest of the year and thought this might qualify me for an exemption.

@Arthur – See: https://eyeoftheflyer.com/2018/08/20/rumor-delta-is-granting-wavers-for-the-250000-delta-amex-mqd-spend-requirement/

#MM and DM or PM last for 10 years here. Cancelled my DL Reserve AMEX after this $250k waiver insanity, putting that spend towards Chase UR and AMEX MR points now. Delta is a case study on how to alienate loyal customers.

It’s not fair to give a waiver to a select few, especially when so many have earned it already. I know I’m going to extraordinary lengths to keep my diamond status and it’s costing me.

I agree with another comment in different post that suggested, if you earn DM this year the hard way, then you should get the waiver until 2021.

Right on Anna!

ANNA is ABSOLUTELY CORRECT!! WE the DRONES should receive the WAIVER

Through. 2021!!!!!

ANNA is ABSOLUTELY CORRECT!! WE the DRONES should receive the WAIVER

Through. 2021!!!!

ANNA is ABSOLUTELY CORRECT!! WE the DRONES should receive the WAIVER

Through. 2021!!!!

3 Time a charm !!!!

What fraction of cardholders do you think can meet $100k in spend? That is still practically out of reach for most flyers, I think.

@JC – I think just over $8,000 a month in spend is a much more reachable goal than over $20,000 per month yes!

This did not work for me. At the end of October I emailed Delta. A very nice rep called me and said she’d send my request up to her supervisor. After 3 weeks I finally called them to get an update. The same rep called to say that my request was declined. She explained that her supervisor said some sort of promotion for folks who are short on their requirements will be announced in early December. No idea what that means – purchasing MQMs or a lowered MQD threshold. At time of request I had over 125K MQMs, $9500 MQDs, and $50K spend on my Delta AmEx.

@rene – any info on 2020 requirements?

@Catherine – Send a new request in via Delta.com. I am getting tons of confirmations from readers of approvals of waver. Also, Delta is stating the waver is ONLY for this year i.e. they will not offer it again next year.

This also did not work for me, unfortunately. I have 135K MQMs and am 2,400 MQDs short of DM with over $100K of card spend. Do you think it’s worth trying again in a couple of weeks? Purchasing the MQM/MQS/MQD bundle doesn’t make much sense. Any other creative options?

@YC – Yes try again via say email (on Delta.com) or do a AeroMexico run. One and done (almost).

Any idea if Delta is offering exceptions for their $250k MQD waiver for 2019 calendar year? Or are they considering reducing the $250k spend limit to something more manageable?

@GregCarter: It worked for a reader in January. And an email from the DM desk said “one time over the lifetime of a SkyMiles account.” (Read more in this post.)

I’m not holding my breath about Amex reducing the $250K spend minimum.

Any updates re waivers being offered for 2020?

@CL: I’m hearing no.

Thanks Chris. “No” as in Delta saying “no” or no new updates?

@CL: Delta saying no.