Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I tweeted the other day something that is now becoming obvious – SkyMiles had died. No really, it has and I will prove it to you. Delta has been on a long salt rich diet of destruction and the hypertension has led to a massive heart attack and they are all but a corpse lying in a bed waiting to be found. Maybe a morbid description, but an honest one.

Delta has gotten away with years of shameless treatment of frequent flyers by hiding the award charts, no notice award jumps and an utterly busted booking page that often does additive prices and Delta is just fine with this.

Then AMEX changed the game (and forgot to tell Delta). – Ooooppssieee!

If you have not made it a point to get the non-Delta AMEX Platinum Business card (learn more) and you fly Delta as your main airline you are making a massive mistake. Oh, and if you are saving SkyMiles you need to stop right now and they have now become only a rebate when you can get them for free from Delta. Let me explain with simple screen shots and the math will become self evident.

The key part as we walk through this narrative is that with AMEX Membership Rewards points (MR) you are, in effect, paying for airline tickets as far as the airline of your choice is concerned. This means you can earn points for the “award” ticket you are flying because the airline does not look at it like an award – it is a paid ticket (just like Chase UR points or FlexPerks points etc). Yes, it is remotely possible, you could “code” as a non-published fare and not get full points, but you are still earning points back and most likely full points.

Also a key part of all of this is the 35% points back (NOTE: was 50% back when offer launched) you get from AMEX for spending your Membership Rewards points on coach tickets with your chosen airline each year and any airline in first / business class from your business AMEX Platinum card (learn more). For our case I am clearly comparing Delta.

I could make this post 500 pages long but wanted to compare a long weekend in March just as a set of data points. I am looking at round trip pricing and direct flights to each location from Delta hubs. I think you will be shocked to see the results.

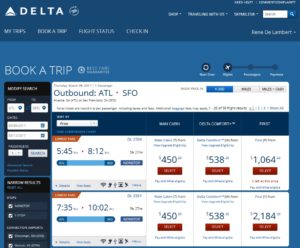

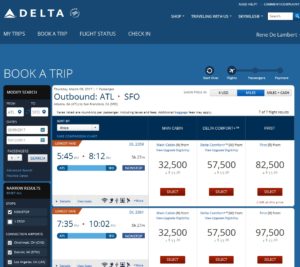

The first one is a long weekend away in San Francisco from Atlanta. Now if we pay with MR it will, after rebate, cost us NET 29,250 MR points vs if we burn SkyMiles it would cost us 32,500 plus a few bucks tax. Again, with all these, keep in mind with MR you EARN points back for flying, but not on Delta award tickets.

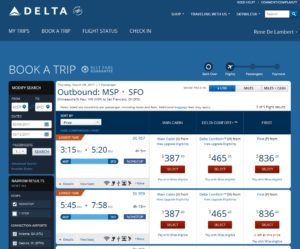

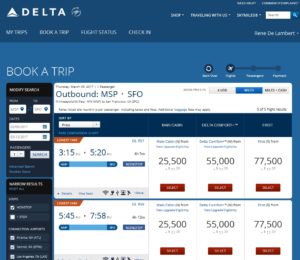

Next we have the same SFO trip from Minneapolis. In this case it will NET cost us 25,155 MR points vs the wacky 25,500 SkyMiles plus tax.

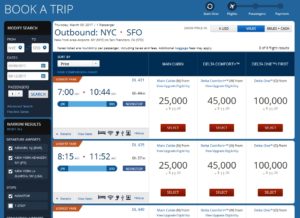

Then a coast to coast for those in NYC going to SFO. Would you rather spend NET 19,240 MR points or a LEVEL 1 Delta SkyMiles award for 25,000 plus tax?

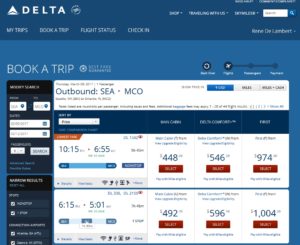

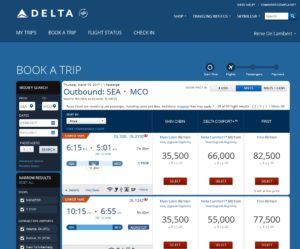

What about those on the west coast. Delta now just “loves” Seattle. How about Florida for this March long weekend? Just 29,120 NET MR points out of your pocket or you could shell out 35,500 SkyMiles plus tax.

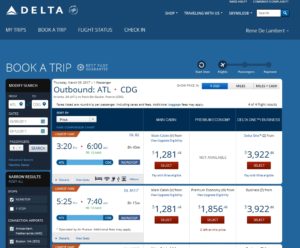

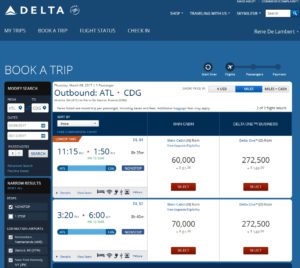

Now I know what you are saying. This is domestic and it is clear that SkyMiles, unless they are doing some kind of award sale, are no longer the best choice under so many circumstances. But the “real” value from SkyMiles is international trips like those to Europe. OK let’s do those. Look at the above Atlanta trip to Paris for this same long March weekend. If we burn MR points it is higher, that is, NET 83,265 vs the 60,000 SkyMiles but with SkyMiles you are paying $81 tax that is already built in to the MR points ticket. Oh, and again, we earn on the MR ticket that could, depending on your status and the MQD of the ticket yield 10,000+ SkyMiles back!

But that is coach. What about business class? Oh just take a look at these results. Yes, you are paying a HUGE NET 254,930 MR points, but just compare that to the totally ridiculous and insane 272,000 SkyMiles AND the $149 tax on top of that “bat crazy” award price! Are we seeing a pattern here yet? Let’s do one more.

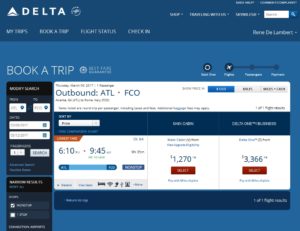

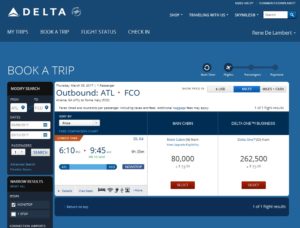

Rome is amazing. Same March long weekend in Rome from Atlanta and we are NET paying out 82,550 MR points vs the 80,000 SkyMiles plus $74 tax. What about business class you ask?

Well those numbers are shocking but not “that” shocking. You are talking NET 218,790 MR points but when you add back the possible HUGE SkyMiles bonus for paying for this ticket as say a Diamond or Platinum the price can drop down BELOW what a LEVEL 1 business class award would cost you (not that you could ever find one!). And, clearly, compare that to the ridiculous 262,500 SkyMiles award price plus $75 tax.

Folks, this is a game changer and a massive one. Delta has pushed SkyMiles closer and closer to “real” money at ~1 cent each vs what they had before that was real value vs paying cash. They thought they were being smart. Now look what has happened and will keep happening more and more.

What to take from this. Keep earning SkyMiles when you can get them for free from flying or other means. Do not earn them from spending on cards. Do not transfer them from other programs unless you carefully do the math and check other options. And for crying out loud if you have not yet got the non-Delta AMEX Platinum Business card (read a review) consider doing this ASAP! – René

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express. Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Rene, what about the dollars requirement? With the Delta card I can spend $25K I am exempt from that threshold.

@dale – There is no Delta tie-in for MQD exemption. If status matters you will still need to spend the 25k on a Delta AMEX to earn that.

This is exactly what I have been posting the last couple of days it also applies to AA at least for domestic trips and definitely for international Y. I have been booking F tickets for less than the price of Y seats for short hop trips I need to make for business. $350 F fares are a steal for 17,500 MR points. Same thing with AA F flagship JFK – LAX been eyeing that flight for 8 months no inventory except for one connecting flight at 8 AM. AA wants 50k miles cash price was $1,050 so a slight premium but I earn miles for that flight and no inventory management headaches to deal with . Total game changer for domestic travel. Plus always the option to transfer to airline programs as it is flex currency.

@UnitedEF – Txs for your AA feedback. One thing is crystal clear – The airlines have destroyed their own FF programs and there is no going back now (unless they start to change things back soon)!

Great analysis, but the headline is probably outdated, no? Membership Rewards (and Ultimate Rewards for that matter) points have been way more valuable than SkyMiles for a long time (just ask TPG), such that it made no sense to accumulate SkyMiles for any activity other than flying. The AMEX Bus Plat card move seems primarily designed to add more value to Membership Rewards points in order to compete with the new Sapphire Reserve card that has recently added more value to Ultimate Rewards. For a while now, the only real use for the Delta cards has been that they are still the only way to earn meaningful non-flying MQMs. Thus, as in the past, and as you have recommended, if you want those MQMs, you should spend the threshold amount and then put them away until next year.

@Lee – UR & MR have had great value but this to me is a total tipping point. I think SkyMiles has been on life support for a while but this has been the death blow (so the blog title works)!

So are you going to maintain your Delta status with the Reserve or Platinum spend bonuses or just rely on BIS flying? Or let it go altogether?

@Wes – As I was just sharing on Twitter. MQMs and elite status (and elite status spend) is a totally different subject from this one. If you value status you may be willing (like me) to spend $60,000 on a Delta Reserve card (or two). The SkyMiles are NOT the goal and are a side point to the MQMs that ARE the goal for the spend. Yes the SkyMiles still have value but are a rebate in the goal of elite status. I will say each year I stop my spend once I hit 60k as there is no longer ANY incentive to keep spending as no more MQMs can be earned. Thus I will still, next year, spend 60k but then shift the spend to earn more Membership Rewards points vs earning SkyMiles for spend. See?

This is very helpful. Does the Enhance Business Platinum offer the same benefits? The 1.5x on purchases would be particularly nice when paying my quarterly taxes.

@BobF – We are talking about the non Delta Platinum card here that is the Enhance Business Platinum. If your taxes are over 5k payment then yes you can get the 1.5x reward. Now your fee will be 1.89% so take that into account. But yes there can be value found doing that for some.

I agree. I know we are talking about the Non-Delta Platinum. I just wanted to be sure that the benefits you described are the same on non-Delta personal and no-Delta Business Cards.

@Bobf – The 50% points back ONLY applies to the business card not the personal card.

Rene, do you data points on the non-qualifying / bulk-fare coding that appears to be an issue (at least with UR, not sure about MR) in that even if the fare-class may look normal, it’s somehow a bulk fare – how common is it? Couple of related issues: do bulk-fares lose MQMs as well, or just RDMs? and have you run into the bulk-fare issue with J/F or just Y?

thanks!

@skdelta – You have to use this chart on Delta earnings (but again the chance is rare but could happen): http://www.delta.com/content/www/en_US/skymiles/earn-miles/earn-miles-with-exception-fares.html

.

Also keep in mind, there are times that you could end up earning MORE points on one of these fares 😉

I am retired but am still a Delta PM. I hold the AMEX Delta Reserve card. How can I comply with the business requirements of the AMEX Platinum Business Card?

@Lee – Anyone can get a biz card even if you just buy and sell on ebay. If your biz income is ZERO put that down. There is space for your TOTAL income they will consider for the card. Enjoy!

@Rene – thanks. From the charts, it appears that MQMs are not affected for ‘exception fares’, so that’s good!

Another interesting thing I wasn’t aware of — some sort of 10% extra MR discount tagged as ‘insider fares’ — e.g., DL has JFK-KEF business round-trip at $2055, the Amex Travel site offers that at 187K MR (with a tag-line of ‘insider fares’), so that would mean 93.5K MR post-rebate, so almost 2.2 cpm.

One thing I couldn’t figure out — for some reason DL offers the same price for refundable and non-refundable fare-classes on that particular route; on the Amex site, I couldn’t figure out if it offers the option to get refundable fares. That would make this even better!

@Rene – so with the amex bus plat offering 50% back what would make this better than the new Chase Reserve in terms of redemption only? Is it safe to assume that MR and UR would be equal in those terms?

@Johnathan – It makes it a very interesting match equation and, as I will post later, holding other MR cards that you can use with the MR Platinum biz becomes even more valuable. To me, it balances out for some the choices that would have been go all in on UR points to now maybe better to go all in on MR points. Or, like for me, a mix of the two for top yields and results. It really has made it fun again in many ways like it was before the airlines destroyed their FF programs! 😉

Excellent post Rene. I consider the title very appropriate. Keep up the good work. It’s time Delta is held accountable. Many thanks.

Great piece! Rene, would love to get your thoughts on whether this also makes Delta Diamond status is now far less attractive and one is better off with MSing and putting spending on EDP/Amex Platinum and PGR vs. Delta Reserve and Delta Platinum for those MQM.

As you mentioned, the main reason why this is even possible is because the U.S. airlines in particular have done this to themselves by devaluing miles and frequent flyer programs to a point where they are essentially useless.

I looked up business class fares to a few destinations and the redemption value for miles were just around 2 cents, except for exotic destinations like the Maldives where you could get closer to 3 cents in business class. For economy, one would be lucky to get more than 1.5 cents a mile.

For those who don’t care for airline status, this is a game changer in another way: you could optimize your frequent flyer miles and MR together. So fly somewhere on airline miles (say Paris, Tokyo or LHR), spend a day or two there and then take a connecting flight using MR or vice versa.

Because of the devaluation by US Airlines leaves us with two choices. The first choice is transfer miles to a foreign carrier that still offers better redemption option like FlyingBlue or Singapore Airlines for business/first, this is where Amex has the most airline transfer partners. The second is what Amex just nailed it with 2 cent redemption value for any airline in business/first or 2 cents in coach for the selected airline.

The good thing is we have a very straigtforward game now at least 90% of the time: optimize credit card spending to earn at least 1.5x miles for dollar spent and closer to 2 cents with all the category bonus and then get 2 cent redemption through Amex portal. Totally brilliant move from Amex!

My experience, particularly over the past two has been that business or coach, I have had a hard time getting more than 2 cents (that’s been my average also) per mile valuation. The best bang for the buck has been hotel cards because of free annual certificate after meeting minimum spending.

BTW, Travelcodex had a similar piece but not Delta specific.

Rene I have DL card for a few staff members, which nets me points on all. The other perk that comes in handy is the free bag on DL. Assume the MR perks still outweigh? Also, per your many posts – best way is to cancel DL biz Amex then apply for Plat biz Amex ?

@Kevin – It may be worth holding the card for other perks. I plan to keep my Reserve card for MQMs etc. Keep in mind the non-Delta Plat biz is a charge card (not credit) so no reason to cancel other cards before you apply ie not subject to 4 credit card max cap with AMEX.

For those wondering I have already booked tickets and have had the bonuses post back. Basically this is a cash ticket, your card is charged the full price of the ticket than you get a statement credit equal to the charged ticket price and then you will see a debit for the full MR points price and than a credit for half of the MR points. I just checked and the full price of the ticket shows in the receipt on my AA flight. It says I paid $1049 for my AA F transcon in P class. If you combine this with the gold 3x on air fare and 1.5x on platinum plus their everyday card it really gives the reserve a run for their money if not outright blow it out of the water. Now to change the FF number to Alaska

Gotcha; that’s my plan as well. I’ve still got the Reserve and a Plat Delta card that gets me to GM each year and then fly my way to PM using points from other cards. I got an offer in snail mail for 75K on the regular AMEX Gold that I’m about to pull the trigger on…I can’t get the Plat bonus again unless I get a hard copy offer in the mail like that one. I only use Skymiles for PWM and my wife’s tickets as I gift her status and she doesn’t need the MQM’s.

Timing for this couldn’t have been better. I was about to apply for another delta platinum. But I think I’ll just go straight amex business.

Great post! Now it is decision time. My DH has the Delta Reserve since he is Platinum with them. I have the personal AmEx Plat, but have been thinking of cancelling to get the Chase Reserve. Now, we may have to get the AmEx Plat Bus Card. Do you think it matters if we get it in my name with no status or his with Platinum Delta status?

@Mary – If you are talking the NON-Delta biz plat it matters little. If you are talking the co-branded Delta biz plat then you should get it for the one who needs the MQMs at unlike the Delta Reserve card you can NOT send the MQMs to anyone you want. Clear?

Do we know how long it takes for the 50% of the MR points to be returned? I’m curious if it varies depending on the amount spent or the airline in question. I love that we get the points back; I think it’s time to get an Every Day Preferred to get a good MR builder. 🙂

The big thing is that the 50% return applies for all airlines if you book in a premium cabin, not just your selected airline, so you might be able to double-dip with the MPX app (who can say no to Amazon?) and Delta One/First redemption opportunities.

@Hari – By the other comments from readers it is quick. Yes I can see now booking 1st with other airlines IF, again, IF I do not need the sweet MQMs bonus for higher fare class flying Delta! 😉

@Rene Very good point about the MQM bonus! It’s good to know that the return is quick – makes it easier to make multiple bookings that way!

I think skymiles are still useful when there are award sales from DELTA.

Like the 5000,7000,9000 domestic one-way fare sales.

@Norman – And thanks to MR biz card 50% rebate offer those will soon be the ONLY times a SkyMiles is worth more than a MR point! 😉

Thanks for your reply. I have a good many MR points. I have an AmEx Everyday (DH is an auth user) and the personal, non Delta, Platinum Card (DH is not an auth user). If we open the card in his name, will I have to be added as an auth user to the Business Plat to transfer the points? Will it be the same $175 for 3 users?

Thanks!

@Mary – Almost correct (need AU to transfer). The $175 for 3 AUs is for personal plat. It is $300 per user on the biz plat.

Does the 20% discount on Delta make this an even better value?

From the Benefit Terms:

“20% Discount on Delta Commercial Flights

For air transportation provided by Delta, Delta Private Jet Cardholder is entitled to a 20% discount off published fares for select fare classes in effect when booked.”

Does anyone know if Delta tickets purchased using Amex Membership Rewards Points also earn MQM’s?

@Jay – Yep. Most times just like cash but there can be times, with say a combo cruise etc package, where you earn on the “special fares” charts on Delta.com

Great article, thanks as always. I assume you do not earn MQMs if you use Membership miles to pay for all or part of your ticket. Is that true? Also, do you earn regular Delta miles? Thanks!

@Dean – You earn EVERYTHING including MQMs, SkyMiles and can do upgrades etc. As long as you don’t buy a E BASIC fare or a consolidator fare (normally as part of a combo vacation hotel / cruise etc).

The only real issue with your analysis on on intentional flights is that that the rewards redemption rates you quoted for travel for Europe are in Delta’s higher bucked. I booked a rountrip JFK-BRU ticket in September for 140,000 sky miles roundtrip, while I’d love to earn the miles to help push my PM status to DM, the skymiles redemption is a much better deal than 254,000 MR points. Also, possibly an even bigger flaw here is that Chase Ultimate Rewards® pts arccrue at 3/$ on travel and on the reserve card CURs represent 1.5 cents each when applied to travel purchases meaning if I did want to follow your advice to net MQMs off the ticket I get a better redemption value on my chase card (when factoring in the earning rate and not being tied to booking through amex to earn the pts)

@David – Keep in mind this percentage back changed from 50% to 35% on 1JUNE17. Before that date this was clearly a better value than it is now.