Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

We are less than 3 months away from all our hotel, airline and other elite programs resetting to zero. Well, that is not quite correct. One of the BEST parts about SkyMiles (some say one of the ONLY good parts left) is that elite points called MQMs rollover if you have at least met the minimum requirements for Silver Status that includes 25,000 MQMs for the year AND either having spend $3,000 in MQD spend or earned exempt status from spending $25,000 on Delta AMEX personal and / or business cards!

- Considering your MQM balance & strategies to consider

- Should I go for Delta Diamond Medallion® Status

- Should I go for Delta Platinum Medallion® Status

- Should I go for Delta Gold Medallion® Status

- Should I go for Delta Silver Medallion® Status

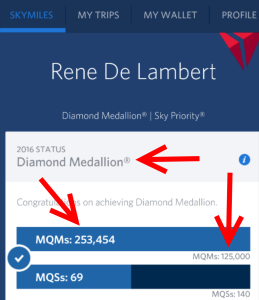

I am in great shape as far as that goes. I met the MQD exempt status in 18 days this year. I will again earn my MQD exempt status before the current medallion year ends on 1FEB16 (that is via spending in Jan16). I also will rollover more that 125,000 MQMs so I will meet the qualification for the 2017 medallion year almost instantly. But everyone is not in this “comfortable” position, so what should you do?

Let’s start with a question from a reader that just came in to “Ask Rene“:

“I am a [Delta AMEX] platinum card holder currently. I am looking to obtain Medallion® status with Delta to compliment my reward tickets and regular fare tickets experience. My goal is to upgrade and also select better seats. My head is spinning with all the options and Amex is not much help with this. It seems to me that the reserve is the easiest way to achieve a higher Medallion® status. What is your opinion on this? I charge a ton of stuff each year in excess of a few million each calendar year. Please let me know your thoughts.” – RenesPoints reader John

John, you touch on a bunch of great questions that work with today’s topic. One of the big reasons for a frequent, and maybe even not so frequent, Delta flyer to have Platinum (PM) or Diamond (DM) Medallion® status is for the perks it gives you when burning your SkyMiles. As a PM+ you get free award changes, all you want, up to 72 hours before flight. This is a HUGE perk and a reason alone to be elite and especially so if you have a boatload of SkyMiles to burn up. Let’s look at the next question from John.

All of us want more upgrades. Delta wants to sell all the upgrades from under us. Heck, keep in mind one of the absolute top people in SkyMiles all but told us in the DELTA SKY magazine that if you are a Diamond and want domestic upgrades you had better burn your most valuable Choice Benefits for Regional Upgrade certs. Folks, that speaks volumes to me as someone “plugged-in” to Delta. We do all know there a great many factors that determine your upgrade shot for any given flight but if you still want a shot at a decent upgrade percentage you should reach for at least PM status or consider pushing up to DM. Let’s move on.

I understand your head is spinning and Amex does not make all the options clear to you when it comes to Delta cards. Personally, I think all the Delta Air Lines choices to all but decimate the SkyMiles program have not been appreciated by Amex. Just a personal opinion, but my guess is it’s a right one. Anyway, unless you are reading this post today, that is, 5OCT15 you should check if the rules have not changed again. The current situation is this:

- Personal Delta Gold, Platinum and Reserve cards are all 3 unique products

- You can only get the new card bonus for EACH card once in your lifetime.

- If you upgrade or downgrade personal Delta Gold, Platinum and Reserve cards that counts as your once in a lifetime for both the current card and the upgraded or downgrade card so no bonus ever again for either card – EVER

- You can hold each and all of the cards at once.

and

- Business Delta Gold, Platinum and Reserve cards are all 3 unique products

- You can get the new card bonus if you have canceled a card, waited 365+ days, and get the card again.

- If you upgrade or downgrade business Delta Gold, Platinum and Reserve cards that resets your clock for each card.

- You can hold each and all of the cards at once.

Clearly it is VERY important to check what cards you have had and just WHEN you had them. Other important bits. Your MQD exempt spend comes from a combination of all spend on all of the above. If you add, on any of the above cards, authorized users their spend counts toward your MQD spend not the authorized users’ SkyMiles account and the same goes for earning SkyMiles. Authorized users do NOT count toward their ability to get new card bonus points.

Now back to John’s question about the Delta AMEX Reserve card. Yes, this is the way to, with just one card, earn the most amount of MQMs each year. If you have never had the personal card, or it has been over 365+ days since you had the business card, you can get 10,000 bonus MQMs with your first purchase. But keep in mind the ability to earn up to 30,000 more bonus MQMs by spending $60,000 is based on the CALENDAR YEAR so you would ONLY have until 31DEC to do that to get this year’s bonus. Still, for many, getting 10,000 MQMs for the $450 non-waived fee for the card is a great value and basically could be considered an EliteMileageRun without leaving home. That is very nice. Lastly, yes, the Reserve card is one of the tiebreakers for medallion upgrades and it is one of the many reasons I HOLD at least one Delta AMEX Reserve card always (in my case, the business one).

Now to John’s last question. Wow I think you are rather unique in that you spend “a few million a year” on credit cards. Good for you and that is a great way to rack up a ton of points. But please do NOT put them all on just one card. With that level of spend AMEX will love you. I would max out spend on:

A personal plus a business Delta Platinum card

A personal plus a business Delta Reserve card

By spending $220,000 in a calendar year across those 4 cards you are earning, on spend bonus alone, 100,000 MQMs without flying. That is impressive to say the very least. In other words you would just need 25,000 more MQMs to be Diamond Medallion®. Then, I would really consider looking at moving the rest of your spend to other cards like the non-Delta Platinum AMEX card as with Membership Rewards you have so much more flexibility and are not locked in to SkyMiles and yet you can still, if you want, almost instantly transfer as many of those points over to Delta whenever you wish 1 for 1.

Now very few of us have that kind of level of spend. However, some kind of combination of 2 cards would still, once you max out the spending each year, yield a huge boost to our MQM totals and elite level goals.

Lastly there are Elite Mileage Runs. Anyone who is talking about a mileage run and Delta nowadays is talking elite points. Since Delta is revenue based for SkyMiles earning there is no point in flying to collect those. But elite points are still distance and fare class bonus based so you can rack up a ton with mileage runs. This, in combination with AMEX card bonuses can be just what you need to reach whatever goal you have set for the year. Now is the time to consider that as getting a good price, that is, around 4CPM in coach and 8CPM in business class, get really hard to find in December when most folks start considering doing a “Fun Run”. Again, NOW is the time to look at your numbers and book a run if you need one.

John did NOT ask about the current Hilton 250 bonus MQMs promotion for this year. Hilton has run it each year. I have a detailed post from last year to make sure you sign up correctly if you want to go for that promo. I have not blogged about it this year as last year a bunch of readers had real issues getting the promised MQMs. For me, this promo is a top off deal and not one to count on. Sure the bonus points are nice but don’t bank on them until you see them!

I hope this helps John as well as everyone else. It takes time to meet credit card spend and you still have some time this year but that window is closing. Count your numbers. Count the costs. Count how much you will fly next year and consider if Delta AMEX cards <–LINK or EliteMileRun or some combination of all of the above is right for you. – Rene

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Great post. I’m in a quandry. I’ve been PM for the past 2 or 3 years and will finish the year with around 100K MQMs (including 30K from my Reserve AMEX card and 30K rollover). I could do a couple of MQM-earning MRs plus add a business flight or two that would barely make Diamond for next year. Downside would be starting next year with essentially zero rollover MQMs.

Should I just rollover what I have and be satisfied with PM, or go for DM? I fly MSP to ATL all the time and the upgrades are impossible for PMs, though my Reserve AMEX sometimes breaks a tie.

Not sure if one year of DM would be worth shooting the moon, with the risk of not even qualifying for PM starting out next year at zero.

Any advice would be appreciated!

@FLN – Another readers asked about the same question. I will have a post up soon to cover the topic of should you go for DM status. Stay tuned!

Question:

Not much Delta flying this year, and through CC MQMs and such, i am 193 MQMs from Silver… crap status, but still has some value.

Anyone have experiences being granted status when within VERY close proximity? (even if it required a phone call)?

Or should I be lining up some spend / flight to make that ~200 MQM?

Current Hilton promo would do it with one night… or a very cheap local flight..

TIA

@RS_WI – Don’t count on it. In fact count on the opposite! There are VERY, I mean, VERY rare soft landing events but I would compare them to winning the lottery (also a dumb idea IMO). Silver does have real value vs. no status if you are flying next year. I would book an EliteMileageRun and get it done and have some rollover if you are MDQ exempt as it sounds like you are.

I will be painfully close to reaching Silver. But, I live in ATL, so I know I’d probably never get an upgrade. Is there any advantage to having the Silver status, that would justify an elite MR? (I thought I was going to make it on normal travel, but got messed up on the lower-than-normal credit for flying Garuda B last month. Grrr.)

@mbh – Oh you bet ya. Silver is way better than nothing even in ATL. Maybe especially so in ATL. If you really “work” FO status the perks can be very nice. Think #TeamBoardLast, exit row, C+ day of flight, free bag and on and on.

Okay–thanks for the info. (I get the free bag with the card, but the others are good and worth a quick trip in Dec.!)

@mbh I was 6/16 in upgrades this year as a FO…so clearly it is not worth *nothing*. And I’m originating out of ATL most of the time, but flying odd routes/times.

@AT – Txs for input and out of ATL. Team that up with #TeamBoardLast and I bet you can bump that to 50% or greater with, well, we will save those for the Chicago Seminars 😉

I have the Delta Gold personal card and it is useless for MQM’s. If I call Amex, can I change it to the reserve and get the 10,000 MQM or do I need to put in a new application for the reserve and cancel the Gold separately? I already have the delta platinum personal and have maxed it out for the MQM’s

@Don – Correct best to get a NEW card. DO NOT UG. Bad things can happen with phone reps and you get nothing and have no recourse. Thanks for supporting the blog with our links btw for your new Delta AMEX Reserve card!

If I have two business Delta platinum Amex cards will I get the spend threshold ( 25k and 50k) for both cards? I met the threshold for a second card and haven’t seen the bonus. I getting a bad feeling. I’ve been waiting to call.

@Andrew – Officially you can only get the spend bonus for one of each of the cards. You would be better off having a personal and business Delta Platinum card. Then there would be no issues getting both bonus points for spend levels. I agree, I too have a bad feeling you will NOT get bonus points for card two that is the same card.

Great post.

I thought the tie breaker with a Delta Reserve card went by the wayside last year.

@Dale – Nope still in effect.

if close to getting gold or platinum worth mileage runs or if available and unused yet,cc sign up (through link on this page…),