Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

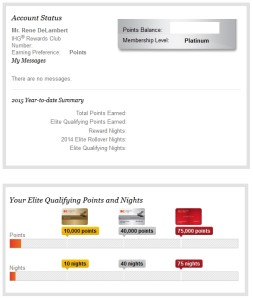

The above is a screen shot of my IHG rewards account. Thanks to my Chase IHG card, I get free Platinum status as long as I hold the card and that perk alone is worth the fee each year (let alone all the other perks for $49/year). Anyway, it used to be the top level with IHG but now is mid level after their recent introduction of an even higher “Spire” level (what a stupid name).

The point is, even though I do not stay all that many nights at IHG hotels, I get some nice perks for having some kind of status. Like what? When I had an issue and Delta put me up at a Crown Plaza I flashed my Platinum card and got breakfast free (they never do points on negotiated airline rooms, but other perks will often be extended to you – if you ask/beg).

But is it worth it to get low to mid level status with airlines / hotels / or car rental companies? You bet, depending on a number of factors. Let’s break them down:

- Cost

- Effort

- Frequency

- Value

This first one, cost, really is to me a key factor. What does it cost you in real dollars to get some status level. For example, with Delta, the lowest level is Silver. You need 25,000 MQMs + $3000 MQD spend. Or, you can get a Delta AMEX Reserve card costing you $450 per year and spend $60,000 on the card that will get you 30,000 MQMs + via the spend you are MQD exempt. Thus, without flying, you are Silver. Now if you never fly why bother, but if you fly a few times a year this, or the Delta AMEX Platinum for the lower yearly fee may be worth the cost for the perks that this entry level status gives you.

Then we have effort. Clearly with the example above it takes effort for most to spend that kind of money on a card each year 1JAN-31DEC. Others have no issues as they bill business expenses and meet the spend in a month. But if it takes a ton of work to get entry level status it may not be worth it. If it is simple, then just do it. I am an SPG guy, that is, I like SPG hotels. My non-Delta AMEX Platinum card gets me free SPG GOLD status just for holding the card. All I have to do is call and give AMEX my SPG number and it is just about instantly upgraded (I now have Platinum status via stays, but if not I would at least be Gold). So the effort of a phone call is not bad. Other cards like the IHG take no work at all and just holding the card does the job for you. If the effort is simple, please take advantage of the perk.

You can see each of these points tend to build on one another as does frequency. If the cost is high, and the effort is high, you had better get use out of the status. If you are only going to use it once or twice a year then the cost and effort better be close to nil! Take a hard look at the past year and the year to come and really see if it is worth it and that takes us into the last point.

What is the value of the status to you? I am very close to becoming a Delta million miler. Once I am I get free “annual” (until they change it) Silver Medallion® status with Delta. I do not have to fly or worry about MQD spend or anything – I just AM Silver. Now sure, Silver is not an amazing status to hold, but for no further cost or effort it is HUGE over no status. I mean, to me, being able to pick free exit row seats alone is of great value. Let alone a free checked bag and on and on. Even if I were only flying a few times a year I would love this. Then back to my IHG example. The Chase IHG card comes with a free night cert each time I pay the fee. That more than offsets the cost to hold the card. Thus, my IHG Platinum status is just free. Just about anything you get for free has some value.

I could break down all the different types of status I hold and the cost, effort, frequency and value I get for each, but that is not the point. The point is I do the math and see if it is worth it to me.

Lastly, we have rental cars that I have not touched on. If you simply follow BoardingArea blogs you will see chances to get mid or even top status with a number of companies. If you are already a Delta elite you can get very high Hertz status by requesting it (and then waiting for a while). Point being that even if you only use this now and then if it is free other than a little effort or a few mouse clicks, just do it.

Bottom line is there are perks, upgrades, free stuff and more to be had by flashing and taking advantage of low and mid tier elite status and I find, for my travels, it can be that little touch that makes an adventure just that much better! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

One other factor, that I guess goes under “value” is “what is the likelihood I will benefit from the alleged ‘benefit’?” In my case, it is that, with some effort, I could get to Silver with DL. BUT, I live in ATL, and just about every third person you meet is Diamond or Plat. Even gold gets you little in ATL. So, even if I am willing to fly out at 6:00 (a.m. or p.m.) on a Sat., I only have about a 30% chance of ever seeing an upgrade. So, tempting as it is to “have status,” I’ve had to accept that I need to put my spend elsewhere, and just enjoy the other perks I can get (in lounges, hotels, etc.). It’s clear that DL has no love for people like me.