Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Again, as I always say when it comes to posts like this, I open with some statements of fact. I do not hold DAL stock (nor any airline stock) in my trading or IRA accounts or my wife’s for that matter. I do not intend to buy any DAL stock now, or in the near future. I am just not that brave.

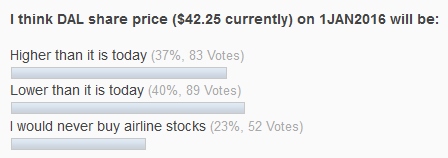

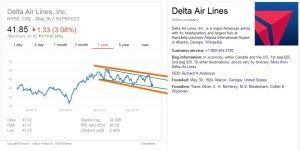

That said DAL, that is Delta’s stock, is in an interesting “channel” move right now and mostly downward as you can see. What is driving it? I would love to claim it is all because folks are wising up to the crushing changes to SkyMiles 2015 but (and I can see MJ on Travel giggling at me) we know that is not the main stock price mover. What are they?

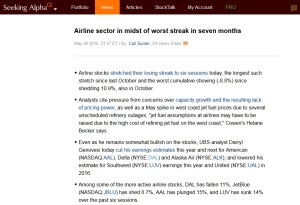

According to seekingalpha.com the biggest impacts are fear of the uncertain such as capacity growth, and, shocker, fuel prices. If you have not noticed, oil has been hovering around $60 a barrel. A move up to $70 or more will have an impact on all the airlines. A move down will take pressure off. We will see what happens next in that important area.

Now what does interest me, as it really is all about you and me this year, is competition world wide (a good thing for us as flyers btw) and more capacity means more empty seats. That also is a good thing for upgrades etc and just having an empty middle seat every now and then when stuck in coach would be nice. Oh and lower prices for airline tickets is always nice – right?

The other tiny little issue is then SkyMiles. The way Delta has cut & cut & cut the program there is no real saving grace to lure flyers to pick Delta over another airline like AA or Alaska that is paying more loyalty points this year for those who spend a little and a lot more with those who spend a bunch. Plus, unlike Delta, they are not punishing on the redemption side at the same time. Perhaps Delta should have thought through some of these changes if they ever need to use SkyMiles as a tool in the future to fill those empty seats! 😉

Anyway, as I say, I am no stock expert, but I can see trends and trend lines. I can see resistance for DAL in the 40 range and support in the 30-35 range. Again, not suggesting buying the stock but just interesting to look at and just what Delta will do to stop this slow decline in shareholder value.

What do you think? Where are we going from here? Do you think the changes to SkyMiles are having an impact now or will in the future? – René

.

.

Gold Delta SkyMiles®

Credit Card from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

While Delta keeps charging over $1k for coach class from MSP-OMA and the planes are oversold, $9k for Delta One from MSP-AMS and the business class is sold out, trashing their SkyMiles program and people still flooding their planes everyday ….. I don’t think there is anything to worry about DAL 🙂

Although AAL is also seeing weakness, an article today pronounced “American Airlines: The Most Undervalued Company Of The Airline Industry And S&P 500”

In every market there are gems…and I feel that AAL may win on both fronts over the long haul; investors & loyal flyers

I’m at the edge….been watching & queuing up AA Mileage Runs in anticipation of a Platinum Challenge (and have dropped my “DELTA” moniker)

I don’t know if skymiles changes are having a big impact on delta now, but it could in the future depending on what AA and AS do. For many fliers and the general public, delta’s changes haven’t really sunk in yet. Delta’s advantage over other airlines is a general perception that it is the best run airline operationally. AS could dispute that. To the extent that notion is true, that advantage won’t last for long as the other airlines (United might be a stretch) will surely catch up as they resolve their merger integration issues. With no significant operational advantage and an inferior ff program, why would anyone with a choice fly delta?

Delta is No. 3 of the big three airlines. Right now delta is punching above its weight. But delta seems to be having trouble with its plans to monopolize SEA. AS is expanding its routes into traditional delta territory in the east. AA interestingly added non stops between ATL and LAX which MJ tried out and found to be quite satisfactory. If AA and AS can use their ff programs as a competitive advantage over delta as well as exploit delta’s trust and integrity problem from stuff like hiding their award charts and faulty award pricing, it is certainly possible that delta’s skymiles strategy will backfire.

As the old saying goes, “How do you make a small fortune in aviation? Start with a large one.” A buy and hold strategy is dangerous for any security, but doubly so for an airline security.