Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

First, let me disclose this upfront. I do not own any DAL stock in my trading account, my wife’s trading accounts or either of our IRA’s. I have no plans to buy DAL stock this year (or any other year for that matter).

Having said that, these are interesting times. I have personally thought that the crippling changes to the SkyMiles program would at some point have an impact on DAL stock price as some would say enough is enough and jump ship to other airlines. I know for a fact many have. Yet this is clearly not the ONLY factor at play, but I do think it is a part. What else?

- The price of oil (clearly) and fuel hedging by Delta

- The competition from other airlines

- The strong dollar value vs others’ currency

- The economy

The good thing for Delta is the jets are still really full and they are completing flights (just about at all costs). But where does the stock price go from here?

Now I know just enough about stocks to be a hazard to all of those around me so please do not make any investment choices from my input and random musing in my head. Are we clear? Good.

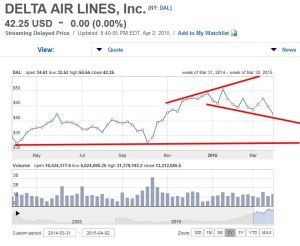

So looking at the chart for the past year we do see some up trends and down trends and some support levels around $30-ish. Despite so many analysts putting a $60 price target on Delta, going that high without testing lower levels was pretty unrealistic. Now DAL has a downward trend to break out from and many analysts are lowering their price targets .

Will oil go to $20-30 a barrel as some have suggested due to storage capacity issues in the USA and beyond or will there be another crisis that drives prices back to the $50-60 range that has a negative impact. Will there be more downward pressure on European ticket prices that have for so long been a cash cow for Delta? Will the sluggish economy stagnate or turn and force Delta to either park jets to keep flying full or end up with lighter load levels.

What about if the Delta flight attendants do decide to unionize, not to mention Delta already unionized pilots are currently negotiating higher contracts. Think of the impact it could have if they went on strike.

Lastly will Delta wake up and see that a loyalty program that rewards those who are loyal rather than punishing them may just be a way to get more people to fly Delta when they really need them to? Gosh, I would think this would be a good idea.

Anyway, I just really think it is interesting to watch the DAL stock price jump around. I know many readers who have done very well who got in to DAL under $20. Good for you. You are braver than I to still hold the stock at ANY price! – René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Net result of FCM may not be as great as those on Virginia Ave think.

People won’t stop flying Delta no matter what they do to the Skymiles program. The only passengers that complain about Delta are the ones that really care about miles. It would be interesting to know what % of Delta passengers (or overall passengers) really care about miles.. As I explained before there are 3 types of passengers that will keep flying Delta: 1) Business passengers: do not care about miles too much and fly Delta for convenience; 2) Hub hostages: have no choice other than flying Delta unless they sacrifice their flexibility and non-stop flights; 3) Budget/Vacationers: passengers that don’t fly very often and fly whatever is cheaper/more convenient. We have to agree that Delta has a great service, nice planes and good customer service. Thus, people will keep flying them. I hedged myself since the more the demolish the Skymiles program, the more their stock will go up. Thus, I am a hub hostage, have tons of Skypesos and own Delta stocks.

Deltas stock is trading off oil spot price. Sky mikes is playing zero factor in the current price. Transportation stocks are broken and this could be a great buying opportunity.

@Brad – We call them SkyRubles… 😉 Read the blog more 🙂

The changes to skymiles in some ways benefit the business traveler who are the bread and butter of their business — sorry the teams in ATL are not desperately trying to keep the MS/CC/XVT fare customers. I realize that the changes also can negatively impact the business traveler but by and large for those paying for tickets w/a corporate account there is no incentive to switch if Delta offer better routing options. So no, I don’t think changes to skymiles that negatively impact the points/miles junkies targeting <6CPM flights will affect their stock price, perhaps boost it even.

No way would I buy airline stocks. They do not care about their customer enough and when your core income base is unsatisfied (plus the general unpleasantness of air travel today!) – the basic fundamentals are unsound.

Recently I flew (upgraded with miles) business class from Australia to LAX. The grumpy stewardesses treated us all like customers at a cheap diner. If you spend that kind of money you do expect a pleasant experience. We must have all been upgrades, I can’t imagine anyone actually paying for those tickets!

Anyone who wants to become an instant millionaire should start with a billion dollars and invest in airline stocks (ANY airline stocks). 🙂