Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

I freely admit it – I am a hopeless point-aholic. When I see a deal my mind gets a jolt and my head starts to spin. Next my heart races and I start to think what if I scale this up! I take the idea, whatever it is, and start to run the numbers into madness and think how many points I could get if I did this idea to the MAX!

Then I step back, take a deep breath, and think before I act. This is not my first rodeo.

What can, and does, go wrong? Allow me to give you one example to start with. At last year’s Chicago Seminars a reader came up to me telling me that he had been banned and had all his accounts closed by a certain bank. I asked why? The individual told me he had deposited over 1 million dollars in money orders during the year (less than 10 months at that point) and asked if I thought there was a chance the bank would take him back. I think you know what I told him.

And you really don’t need to go “that” crazy to have bad things happen to you. Just the other day a reader told me he got a business card from a certain bank, instantly ran a charge to meet the minimum spend, and then suddenly ALL his cards from that bank were closed down. Ugh. Not good.

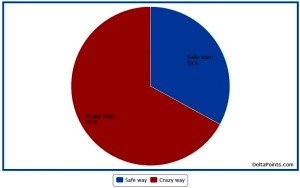

Folks, the state of the points game is very different than it was years ago. Sure, there are still lots of points to be had and I still go for new cards year after year reaping very nice point bonuses from their offers. But I also create balance. Balance really is the key to me to be safe.

For example, if you get a card, just meet the minimum spend, get bonus points, toss it into a sock drawer and don’t use it again, and do this over and over, how happy over time do you think a bank is going to be with you when you, say, call for a retention bonus points or ask for a new card again of the same flavor or another flavor. I think you see my point. They are paying attention (as a wise points man once told me).

Are there exceptions? Sure. And if you have been at this long enough you will learn what you can push and what you can not push. Bank of America is one example of one you can push. They are really just silly. You can, for now, get the Alaska air card over and over endlessly even when you already have several. Other banks, you really need to be careful with or you may find yourself under the dreaded “Financial Review” process.

So what should you do when you are starting to “make” points? I suggest scaling up. Also mixing up. Say you get a new card. What should be your FIRST purchase? Something normal. A tank of gas. Lunch. Groceries. Something normal. Then mix it up a bit as you work on the spend for the card. If you like the card, keep using it now and then. Even if you are not “really” valuable to the bank you want to at least look like you are valuable to that bank. Remember they are watching us.

What about some deal that come up? Should you scale up and go full out when something really good comes around? Maybe, but be smart about it. Perhaps you need to buy the deal on 5 cards rather than just 1 card even if you earn a little less on some but still get good value. Or, maybe you have more than one card that offers the same bonus points and can spread the buying around. The point here is excess can get you shut down.

Where is the line where too much is too much? If that answer were simple all blogs would be yelling about it. The line is an individual one and you need to be careful not to hit that line in your own point world.

Lastly let me leave you with this thought – life goes on if you do push it too far and get shut down or banned from some bank. I know one very senior point enthusiast who is banned for life from a certain bank. He does not care one bit about that! He has amassed a staggering amount of points from this bank and is happy to use the remaining myriad of banks to work with. Has it cost him deals by not being able to play with this certain bank? Sure, but there are worse problems in life to have. I mean, try NOT to be in this position, but if you find yourself there don’t think “it’s over”. There are other options and you will be just fine.

Got questions about a deal? Anything you still have questions about? Fire away!- René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Which bank? Does it start with a C and end with a hase?