Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

There are so many times I get emails from folks, not just at the first of the year, but all year long about how they can get some help to meet the MQD exempt spend on their Delta AMEX card. There are many ways that work very well that are either creative or just every day spending.

The other day my fellow BA blogger Gary had a post that reminded me I need to rookie this topic. Since he is not a big Delta fan he did not touch on what is important to us as Delta flyers is becoming MQD exempt vs having to meet the rather large spending numbers flying Delta. There is no way I will spend enough next year to keep my Diamond status, but that really will not be a problem at all and I will be done in the first few months of 2015. How?

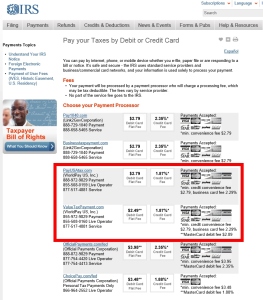

I have many ways I go about it that cost me very little but perhaps you are way too busy to do creative work to achieve this. Perhaps your time is worth enough that you just want something quick, simple and that works. Well then just pay your tax bill with your card (now it helps that you have a tax bill or can perhaps wait for a refund if you overpay). But having said that look at this. You can pay your taxes for as little as a 1.87% fee. If you happen to have a $30,000 tax bill and you pay that on your AMEX Reserve card you get:

- 30,000 points for spending $30,000 and 15,000 bonus points netting you 45,000 points .

- The 1.87% fee will cost $561 but you get $450 value of points = $111 net cost to you.

You can see the amazing results we can get by doing this. We knock out the $25,000 Delta MQD exempt spend threshold. We knock out the $30,000 bonus spend AMEX threshold and get both 15,000 bonus Skymiles and 15,000 bonus MQMs that can help you climb to a higher elite level. Since we can, as Delta AMEX card holders, use the pay with miles feature we get at a bare minimum 1 cent value per Skymile so we are getting $450 in value back. Thus, our net cost out of pocket is $111 to get this done this way.

Now I am NO tax expert. I am giving you NO tax advice. I can tell you I have done this myself in past years just not with a number as big as $30,000 (I did pay a rather large bill). So I can confirm this has worked just fine in the past and I plan to pay in January a rather sizable chuck of my taxes as well.

I would also have you consider this past rookie post to see if it is smart for you NOW to look at getting a Delta AMEX card or if it is smarter to WAIT until after 1JAN2015 to apply! – René

.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

PS – Don’t forget I am giving away a $100 Delta e-Gift card this week

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

How about just changing your address? Would an address in an unincorporated US terrotery such as Puerto Rico or Guam get you exempted?

@AL – Uh, NO! http://deltapoints.boardingarea.com/2014/09/07/dumbest-things-can-get-free-discounted-travel/

Better still, go through a portal to buy Amex gift cards. This should offset most or all of the fee associated with paying taxes mentioned above. I have used Amex GCs to pay via this route.

@Owen – Sure I mention that but for simplicity sake this works. Plus, the problem you run there is you are MAX able to get $3000 AMEX gift card. As you can see by the screen shot, my payment was just a little higher 🙂

Any idea is your credit limit on the Amex Delta card isn’t ~30k? Can you call them and ask for a “1 time increase” or prepay your account with cash without setting off alarms?

@Levi – Yes and yes. You can do two things. One is send in an extra payment. Say you credit line is 10,000. You need to pay $12,000. You send in $3,000 then you for a little while have a $13,000 credit line. Or, as you mention, you can call or online request a one time credit line increase for a large purchase or charge. Or they may just bump you up as well. They MAY do a credit pull so be ready for that!

For those that live in Florida we can pay our FPL bills with Western Union’s SpeedPay for a $3.25 fee. My bill averages $400 per month, which is $4,800 of spend plus the $39 in fees. this is less than a $.01 per mile.

Also if you have a time share mortgage with Marriott, you can call owner services and pay your mortgage with your amex for no fee.

@Gregg – Very nice! I love more and more options!

A great reminder of benefits and low cost of using your Delta AMEX to pay taxes. Much easier than a mileage run!