Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Note: I will be on vacation most of this week with my buddies in northern Michigan so I will have limited access to the blog and e-mail. I will be sure to follow up soon!

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

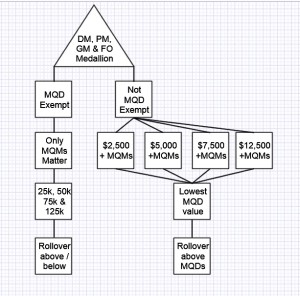

I get this question all the time so time to rookie this one out and make is as clear as I can and I hope the chart above makes it more clear. But I will break it down in text too. Let’s dive right in.

Scenario one is the best and simplest one. You have a Delta AMEX card (smart) and you very simply spend your way to MQD exemption. I had that done in two months and will do so again in 2015. So in this case only the MQMs matter. Thus:

- 25,000-49,999 you are Silver. You rollover every single MQM above 25,000 but under 50,000.

- 50,000-79,999 you are Gold. You rollover every single MQM above 50,000 but under 75,000.

- 75,000-124,999 you are Platinum. You rollover every single MQM above 75,000 but under 125,000.

- 125,000 and you are Diamond and you rollover everything above the 125,000.

Now you will only have your MQD exemption until 31DEC each year. Once 1JAN hits you keep the MQMs you rollover (for that year) but you risk losing them if you do not re-qualified for MQD exemption again the next year. Yes, you can lose all your MQMs.

Now let’s go on to the more convoluted non-MQD exempt rules. The simplest way to understand this is that the MQD spend is the lowest common denominator in this equation and is all important! Lets look at some examples:

- $1,000 MQD spend and 30,000 MQMs. You are nothing and rollover nothing!

- $2,500 MQD spend and 30,000 MQMs you are silver and rollover 5,000 MQMs.

- $2,500 MQD spend and 80,000 MQMs you are silver and rollover 55,000 MQMs.

- $5,000 MQD spend and 80,000 MQMs you are gold and rollover 30,000 MQMs.

And on and on from there. So again, without exemption the MQD spend is all important. As I talked about already the all import point is at least meeting the $2,500 level. You could rollover 200,000 MQMs from the year before and lose them all if you don’t hit that at least (or earn your MQD exemption, clearly).

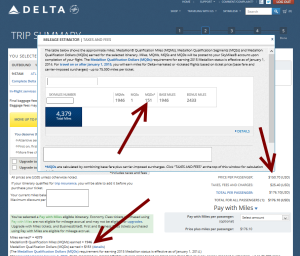

Other things to keep in mind. MQD is not the ticket price but the part of the ticket that goes to Delta as you can see above. Tax does not count. Extra bits do not count. Just the base ticket price as you see above.

Touching on MQD exempt spending now. AMEX spending counts per calendar year NOT the date you got the card and it is the POST date not the charge date. So, anything that posts by 23:59 on 31DEC counts in that year. After 00.01 on 1JAN on that year. Also, it is when you earned MQMs that count. So say your statement close date is 15th each month. If you earned the MQMs in the previous year, and say your statement closes 15JAN, and you earned say bonus MQMs, they will NOT count on the new year but in the previous year you earned them. However, all the spend, again, from 1-15JAN does count on the current year. Clear?

And just because it comes up year after year, the rollover has happened year after year in the first few weeks of January. Also, there is no rollover MQD spending. If you spend more than $25,000 on your personal, business or a combo of the both Delta AMEX cards you still reset to zero on 1JAN each year.

This so far is what is in place that we know about. Now a bit of speculation. Will rollover continue? I think so as adding the MQD levels has worked to thin the herd a bit. Will the MQD AMEX exemption go away? I doubt it for a number of reasons. First, AMEX is a huge partner and they are already very upset about the lounge access reduction for the AMEX Reserve card from Delta. Cutting the MQD spend exemption all the way up to Diamond would lead to MASS defection from the co-branded cards especially the high-end Reserve card.

So there you are. Did I miss anything? Feel free to comment below with questions as well as checking them for other info and Q&A from readers. – René

.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

.

Gold Delta SkyMiles®

Credit Card from American Express®

Click HERE for more info

. .

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

There are some interesting possibilities here if you can achieve lots of MQM without spending more than $5,000. Here is an example:

2014 – Earn 200,000MQM, MQD=$20,000, AMEX Exemption met – Status = Diamond until Feb 2016, rollover 75,000 miles

2015 – Fly 75,000 miles, MQD=$4500, AMEX Exemption not met – Status = Silver, but only after 2014 Diamond status ends in Feb 2016. Rollover 120,000 miles as a silver!

2016 – Start the year with 125,000 MQM, quickly obtain AMEX exemption and you are instant Platinum until 2018!

You can basically alternate full status years by intentionally only qualifying for Silver and not earning the AMEX exemption in the off years. In this example you have Diamond Status for 3 years by only earning 275,000 MQM.

Do upgrades like Economy Plus count towards the MQDs? What about purchasing food on a Delta flight?

@Jeremy – as shown in post only base ticket price nothing else.

Hi Rene,

You didn’t mention MQS’s and the fact that currently they don’t rollover at all. I am back to begging Delta to do this, particularly now that MQD’s are in play. I don’t understand if you qualify with MQD’s and both MQM and MQS are paths to different status, why wouldn’t it be reasonable to think that both MQM and MQS should rollover? Thanks.

@Bruce – the mqs love hate with DL is truly special

I have hit my MQD and will reach FO through MQS. Will additional MQD & MQS rollover or just MQM (which will be about 9000 miles short)?

Thanks for all you Do!

Kent

URG! Thank you for the reminder about MQDs; checking my daughter’s account, she’ll need our December flight to make the MQD level. Too clarify your paragraph above (for my little brain) If her return after JAN 1st, will the MQDs or MQMs get divided between 2014 and 2015? Or will all the MQDs get allocated to 2015 after the return flight? Thx

Another great post Rene! Can you add something about the bonus MQMs from the Platinum and Reserve cards? These are non-rollover, so which miles would roll-over at the end of the year if I have 10,000 from the card and 28,000 from flying? Thanks!

@dave – all mqms are the same source matters not.

What qualifies as a Delta purchase to get the $100 statement credit for the platinum card? I assume an inflight beverage would count but what if I am not flying on a Delta plane in the next three months? Is there anything else I can just spend a couple of bucks on to get the most of my $100 credit?

Also, if you meet the 25k spend requirement on a DELTA Amex card, but cancel the card after meeting that requirement are you still covered for the MQD or does that waiver go away? For example, if I meet the spend in July, but cancel the card in August do I lose the credit for going over $25k?

@Ben E – anything should qualify including a onboard drink etc. your MQD exemption will will NOT go away as once you earn it you have it. but why cancel before 11 months? you have paid fee! call and see what AMEX will do to keep you at that point and consider what to do at that point!

This was an awesome message. I really appreciate the MQM alert for rick of losing MQM in 2015 with the miles having been earned with the AMEX spend exemption. I will easily meet it again in 2015 but I did not know this. Thanks Rene for the heads up.

Still confused & would be grateful for guidance! Current statement=MQMs 7,239, MQSs 5, MQDs $1,798, Card Spend $18-19 K. I’m sure I’ll spend $10,000 before end of 2014 but

probably not be able to travel. Will everything roll over? I appreciate your advice!

@Debbie – once MQD exempt then the MQMs only matter so you will rollover only if above 25,000 MQMs etc as per the chart in the post.

Thank you for the response! Still trying to wrap my brain around the whole thing.

I appreciate your generosity with all the info. Best!

Ok, so I want to be clear as I am worried. As of 10/16/15, I have reached my MQD waiver for the 2016 qualifying year. However, my MQMs= 8,359 does this mean I will have to start over because I may not reach 25,000 MQMs by December 31, 2015?

@Jessica – Your MQD waver is for the current year. It will reset to ZERO on 1JAN15. If you do not reach 25k+ MQMs you get nothing and no rollover.

Hi Rene, all,

Great resource! I recently got silver on MQS’s and MQD’s although my MQM’s are ~2500 short of silver. What happens on Jan 1? Silver with no rollover? Negative MQM? 🙂 thanks!

@Fil – Since you are MQS flyer your MQMs don’t matter. Will reset to zero on 1st and yes you will be Silver.