Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Delta Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

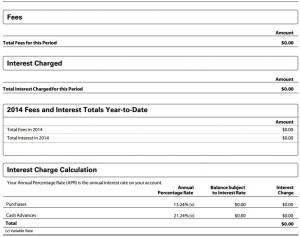

This will be the shortest Rookie Wednesday post EVER but I think it is needed. I will let my real, untouched photos and numbers from my latest Delta Reserve card speak more than I ever could.

If you EVER, I mean EVER, pay 1 cent in interest to the banks you are not #winning, you are losing big time. If you EVER cannot pay your balance in full on your travel cards – DO NOT PLAY THIS GAME as there is no way you can win. I will soon meet my 60k spend and just look at how much interest I have paid to AMEX this year!

Again, unless you have what I have in the first screen shot – grow up – and rethink what you are doing! This is a game for those who get that earning 1-3% is #winning; paying 14-19% in interest is #Losing! Are we clear? – René

.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

➲ Barclaycard Arrival+™

World MasterCard®

Earn 2x miles

on All Purchases

. .

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Of course this post is sound advice, but it doesn’t seem right to me to compare 1-3% MONTHLY winnings to 14-19% ANNUAL losings. 1-3% monthly equals about 12-36% gain annually without compounding. and 14-19% equals about 1.1 to 1.45% loss monthly.

@MikeOWave – There are many ways to earn much better returns. I wanted to stay simple and make the point and show the contrast of small gains can be wiped out by ANY interest paid to a CC. That’s all!

I agree 100%….you have to pay in full every month! Period…or it ain’t gonna work! No debt…no interest…credit card debt is the worst! Do yourself a favor and watch the cd “Maxed Out”…!

I have paid interest on a credit card exactly once. It was my very first credit card when I was a freshman in college. The payment (supposedly) arrived two days late to the processor and I think I was charged like $2.00 in interest and $15.00 as a late payment charge. (Yes, I’m showing my age because it was a looonnnggg time ago). I tried to get the fee waived but couldn’t because I hadn’t been a customer long enough. I learned a very valuable lesson and have not had a single interest charge or late payment since. And, I never used that credit card again and have never done business with the bank that issued it.

Is it just me, or are the graphics in this post teeny tiny – too small to read?

@Mike Palmer – The smaller photos help pages load much faster and really help on mobile devices (so many read the blog on phones etc). All you have to do it click on them and you will be able to see them full screen.

Rene – A little off topic. A while back when I clicked on your graphics, the enlarged image opened immediately. Lately, when I click on the graphic, I have to wait for another Delta Points window to open. Then I click the small graphic on it and it enlarges. Did something change? Its a minor problem, but when I’m in a hurry I just don’t click because of this. Thanks.

@John – check http://www.deltamileagerun.com that is how it will look/work after site upgrade soon.

Yep… I must admit awhile back I added due dates to my calendars so as to make sure I don’t miss a due date. Glad you chose to include this as a “Rookie”post!

Ah, thanks guys. I tried clicking the graphic, but just got a new page with the same size graphic. I see now I have to click again.

@Mike – yep on the NEW format, as soon as they get all the other stuff done 1st like moving the domain over, you will get a “slide show” and just have to click once then use next or back to see them all. Will be sweet like over at DeltaMileageRun.com . Really a much cleaner and slick way of seeing all the shots in a post.

I love posts like this. I definitely agree. Honestly I’m super paranoid so I usually pay it off multiple times a month, WAYY before the payment is due.