Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

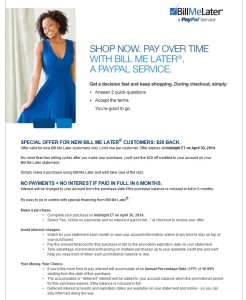

On many of Delta.com’s home page pages you will see the above ad for “Bill me Later” as well as at checkout when buying a ticket. Is this a good option to consider? Let’s take a look (this will not take long).

The offer is: “SPECIAL OFFER FOR NEW BILL ME LATER® CUSTOMERS: $20 BACK.” Hey who does not like $20 bucks back. But what is the cost to you to get this? The T&C are very telling and we should take a close look. It says

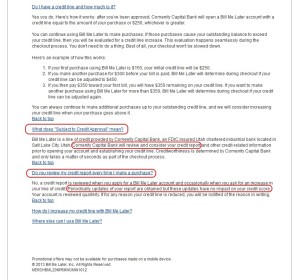

So you are getting a “hard pull” against your credit score to get the “line of credit” setup to buy your Delta ticket. Just as a comparison to the Delta GOLD Skymiles credit card, that is offering BOTH 30,000 Skymiles AND a $50 statement credit if you buy something Delta related and spend $1,000 in the first 3 months, you can see what an inferior offer the $20 credit “Bill Me Later” offer truly is.

Plus, if you notice the second highlighted post, they can do a “soft pull” on your account whenever they want. That really is no big deal as any lender can do that and as stated that part does not affect your credit score as applying for new credit.

So this week’s Rookie post was quick and to the point. Like so many things Delta markets, stay CLEAR of the “Bill Me Later”! – René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Good to know. I had wondered about this, so I think it’s great you made it so “black and white.”