Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

First off let me say I am not a tax expert and not telling you a course of action to follow. In fact my disclaimer at the bottom of each posts says as much.

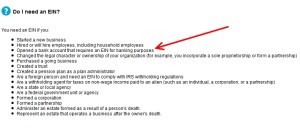

Having said that, there are many reasons someone may want to have an EIN or Employer Identification Number as a sole proprietor. One reason may be as simple as “banking reasons” or in many frequent flyers’ case to be able to get a business credit card (many banks are now requiring an EIN number to get a business card).

I have also talked to my tax guy to ask if there are any risks to us, in our case my Lisa, getting one for banking reasons. He said no and in our situation and the only thing is if she worked and made money from her activities she could get a 1099 form detailing that. Also, any income she makes as a sole proprietor we just claim on our normal 1040 form anyway.

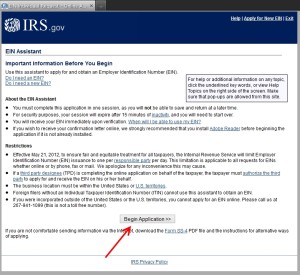

So how scary is it to get an EIN? It is amazingly simple and I will show you each step along the way.

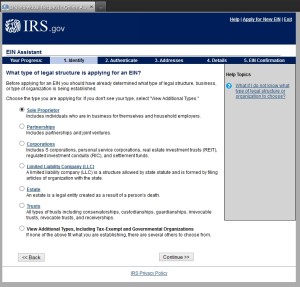

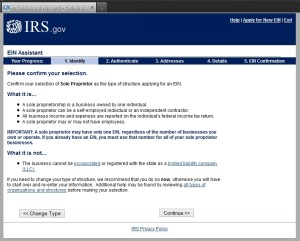

You simply pick what kind of business you are going to be doing.

As you can see in our case, sole proprietor is the choice.

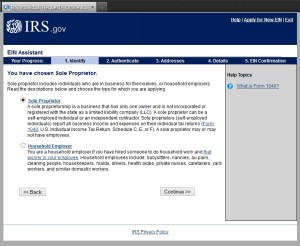

The next screen explains what a sole proprietor is and does.

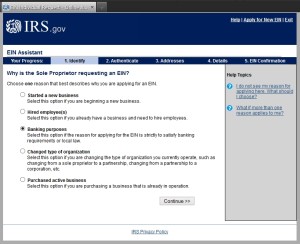

Then, if you are needing an EIN for only banking purposes, you choose that. If not, pick the right one for you.

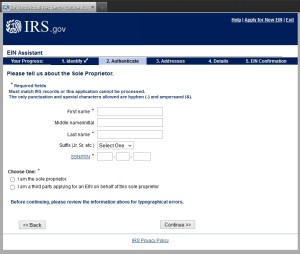

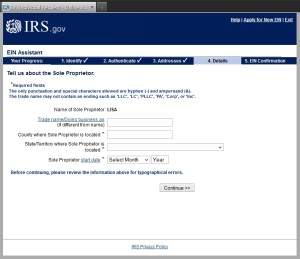

You then just fill in the blanks as requested

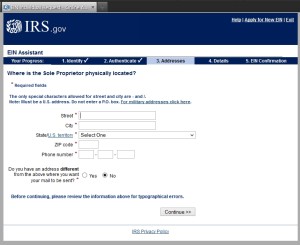

Same thing on the next page.

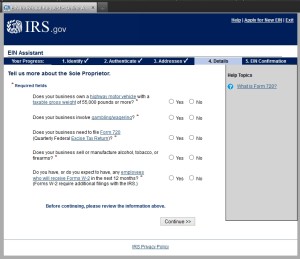

And you continue here as well confirming your name is right.

Check the right boxes and continue to the next page.

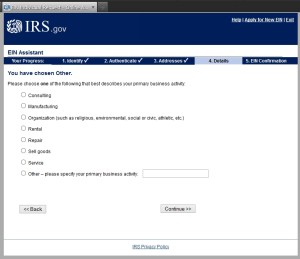

Choose your field you will be working in (in Lisa’s case, other).

If you do choose other, more choices, or you will have to “fill in the blank”

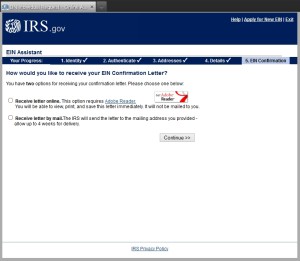

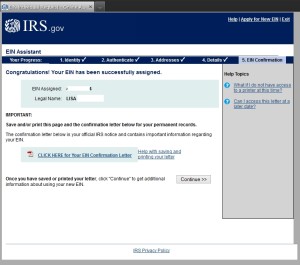

You can then get your EIN number electronically or in the mail (instant if you pick PDF).

You can then confirm all the info is correct before you submit your request.

Your EIN will be assigned to you and you can download the paperwork with the info.

That is it. You have now had an EIN assigned to you that you can use for whatever you need to use it for. If you are applying for business credit cards you can use the number immediately on the application. – René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Been meaning to do this for 14 years! Thanks DP.

You do realize that you *may* trigger notification of you state taxing authority when you do this as well? This may trigger all sorts of additional filings (and associated costs) with your state/local governments.

@Darth – thus check with YOUR tax person in your state. Now for me, if, and again a BIG if, I have to fill in a few ZEROS on a few more forms, maybe pay a $5 fee of some kind, to get say 1 million more points a year, uh, just maybe worth the effort 😉 but that is just me! 🙂

Excellent post Rene on how easy it is to get an EIN for tax/business purposes. Don’t forget you may also use it to qualify for Delta’s Skybonus program for businesses. I use my Delta Skybonus number for all my Delta flights since I am in business for myself and as a member/partner of a small professional services firm.

The IRS self-serve process as you described was very easy – and you finish with the EIN generated instantly and printable as a PDF as you stated. Who says the government can’t provide good service (at least sometimes)?

@Mark – OH good point on Skybonus. Txs – Rene

Which business credit cards are now wanting an EIN?

@Ryan – there are a few plus more importantly, for others, you can use your SSN# for card #1 and your EIN for #2 😉

@René — would this make enough of a difference for those credit card deals that say something like “you may not get the bonus if you have had a gold or platinum card within the past 90 days”?

@Pawtim – I would say NO unless readers have other info as you are still tied to your name only even with the EIN.

Ah, too bad! I bet you’re right though.

@Pawtim – I have HUGE news but can not blog it about EINs – will share at Chicago DO in OCT so be sure to be there!

I’ve been meaning to do this for a while now. But is there really any benefit besides keeping the taxes separate?

@Rob – you would have to talk to your tax person.

Thanks Rene! I have truly appreciated the “Rookie Wednesday” blogs. Even though I have been dabbling with points and miles for years I have been able to gain information which has helped me get to a whole new level. Thanks again!

@Scott – thanks for reading the blog! – Rene

Thanks for the guide Rene. Hopefully I’ll find you at a Do or FTU one of these days to learn the BIG news about EINs :).

not sure if mentioned elsewhere but i got bounced out and told to try again another time because I applied today (saturday) which is not in their working hours which are weekdays.

Rene – as of mid-2015 how much of this post is still correct? Would love to use this tactic to build up more points!

@Reed – Should be just the same as when posted.