Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Let me begin and set the stage for you and pour out a bit of a personal rant. While I don’t want to start a fight over what is right and wrong with the current health care situation in this country, I can say it is currently broken and my example is just one of many (you may have your own).

Here is what happened. My Lisa had two little moles she wanted removed. One was on her back and one on her forehead. Both were tiny and being removed for cosmetic reasons. Our personal family doctor did the procedure in his office with a local anesthetic from start to finish in less than 30 minutes and billed us $250 and insurance, while not covering it, recommend as in-network it should have been $198 and he adjusted to this amount. Our doctor said the moles were harmless and normal, but to be safe wanted to send the samples to the lab to be tested. Lisa agreed.

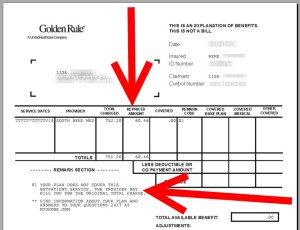

Then the Medical Lab sent us a bill. Are you ready? $752 for the testing a few grams of tissue. Seriously! But our insurance again said as in-network, had it been covered, it should have been $60. So, the Medical Lab choose to overcharge us by 12½ times what they should have as in-network charge. Oh, and they CAN bill anything they want and we legally would have to pay it. Had they sent a bill for 25 times the in-network rate, that is $1,500 we would have had to pay that if our insurance would not have. If covered, no matter what they charged, even $6,000 for the testing, they would have taken the $60 and that would be that.

We immediately paid the amount recommended by our insurance, on a points card, and expected that to be that as with our doctor bill. Not so fast – they wanted it all! I STRONGLY refused in a conversation with a supervisor and stated that I would never pay such an insane amount. We went back and forth and at last got a rep with the Medical Lab who agreed the amount was high and that if we could just send a copy of the recommended repriced amount as in-network, non covered, they would “adjust it off” and send a statement showing a zero balance due. In fact Lisa had this confirmed 3 times, but then things went very wrong! I get a call from the supervisor I spoke with months before saying no matter what we owed it all and must pay.

Now most of us in “point land” do not ever want ANYTHING negative on our credit reports as it can impact our chance at getting so many millions of points year after year. Lisa’s & my credit are both spotless and perfect; we always pay our credit card bill IN FULL and on time each month every month! But this was something on principle I was not ready to let go.

I told this supervisor that we had 3 confirmed conversations that we did not owe anything now and she insisted we did! But, thanks to Lisa writing down everything, who she talked to, the date, even the time, detailed notes on what was said word for word we had them. The rep from the Medical Lab had confirmed 3 times the amount would be adjusted to zero and they would honor the in-network insurance price for the testing. In the end they sent us a new statement with a zero balance due!

To be clear I would have taken this to any level and would not have paid this one. Personally I feel the amount, over 12 times what it should have been, was unconscionable, reprehensible and bordering on something RyanAir would do. I would have taken this one to court and no matter what would never have paid more than what my insurance company told me the price should have been.

What to take from this in regard to something that matters to you, since I doubt you will have testing ever done by this Medical Lab (I know I NEVER WILL EVER AGAIN), is just this – details matter!

Bloggers often tell you when it comes to offers, print the screen offer. Why? What you see on the screen is what the banks have to honor. If they make a mistake, you have them. If a rep tells you something, get their name, the time of the call, the date of the call and what you were calling about and what the rep told you. If you have an online chat, print it. Write down the date you apply for a card, print the date you are approved. Write down the date you completed the spend and if you can print a confirmation of this from the web site. The date you activated the card, and when you do, who you talked to to activate the card, that you confirmed the offer amount of points and the spend required to earn this bonus and that you are indeed eligible for the offer.

Other things. Be proactive. If points do not post, call and ask why. If they tell you wait 4-6 weeks and call back, again get this rep’s name and all the info and the do follow up at the 4 week point to not let too much time go by. Also be persistent. If it takes 6 months, stick it out for 6 months. Keep calling and asking until you get what you were promised by anyone along the way. Oh, if an airline rep tells you something, even if you seem to know this is not quite right, get their name and info etc. so you can enjoy what has been promised by the company rep.

This is a post about details; more details that can “win” your case. Say you are talking to rep one, you get sent to rep two. What place or city or department is rep two in? Are they a manager, supervisor, or other title? Oh, how long were you on the call in total. Were you on hold a long time? Did rep two agree with what rep one said or did rep two say something different? All of this can help you since if the company does not even agree on the rules how can you, the user, be expected to know them or have to be on the short end of the stick so to speak.- René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

My experiences with labs have not been good. I have lost track of the number of times we have been double billed by medical labs. Even if you cannot take the time to document anything else, document everything when dealing with medical labs.

Not clear if you went back and talked with your insurance company as well about the lab charges since it appears they were the one that rejected the billing claim from the lab.

I saw this happen too often when I was in private practice, and its a real hassle for everyone involved.

Typically, if the medical provider or lab has a contract with the patient’s insurance company, they can’t balance bill the rest of the amount to the patient (unless deductibles haven’t been met, etc)

Glad it sounds that you finally got it straightened out

@John – I talked to everyone. The bottom line is that our personal policy it was not covered. The amount they were trying to charge was insane and wrong. I will make sure my doctor NEVER uses them for us again (there are other labs in the area)!

What I’m told by someone in the medical field: It’s likely that the family doctor did not code the procedure correctly. If it’s coded in a way that makes the lab testing medically necessary, then insurance should cover it.

@Miles – I asked about that, the doctors office said they do not have a code for that and it is up to the lab in this case!

In this instance, it makes sense that the insurance company wouldn’t cover the claim because, as you noted, the reasons for removing the moles are purely cosmetic. If a doctor had instead recommended they be removed for medical concerns, then the insurance company would be obligated to get involved.

It sounds like the provider you visited is considered “in-network” (or in the insurance company’s group of providers for which it has contracted discounts). The amounts they provided you are what the services would have cost if the contracted rate were used.

Now since insurance wasn’t used, you will have to pay whatever rate the provider wants. There aren’t any rules on what they charge. Some reasons for such a high charge could include (1) the provider needs to account for the risk of nonpayment by a consumer or (2) the provider sets some charges higher to subsidize for other services (similar to how supermarkets might have ground beef on sale but they increase the price of hamburger buns to offset). To be honest, I’m actually surprised the provider agreed to lower the bill as substantially as they did.

In the end, it doesn’t surprise me that you were billed such a high amount because insurance wasn’t involved. If at all possible, next time I would try to find a doctor who would agree that the miles should be removed for health reasons. Then you wouldn’t have to go through this difficulty of negotiating on the price with the provider.

Also, just to be clear, “balance billing” is a term when members must pay for whatever insurance companies don’t pay. That wouldn’t have any impact in this particular case because insurance didn’t get involved. However, even if the insurance company did get involved, there likely wouldn’t have been any balance billing. Typically insurance companies negotiate for their “in-network” providers to not balance bill their patients and accept whatever the contracted rate is as payment in full. If this provider were considered “out-of-network”, you might have to worry about balance billing.

Keep up the good blog,

Chris

If the insurance say it should only be $60 then that must mean they have a contract with the lab. I think I would have gotten both the insurance company and the lab on the phone and let them figure it out. Because if the lab violates their agreement with the insurance co they risk losing their contract and all the biz with it.

My wife is a Dentist and the contracts she signs with insurance companies require her to bill at the scheduled rates even after a patient has met their maximum insurance benefits and even if they are not using their insurance for the procedure. I’m positive that is the case here, the lab was trying to bill you at their standard rate and not the negotiated insurance rate with the hopes that you would know what the negotiated rate should have been. Not only is this dishonest, it’s against the contract they signed with the insurance provider. I would talk to your insurance about what they did to ensure they don’t do this to their other customers.

@Aaron – txs for the feedback and ideas. It is funny how much of this can apply to the “points world” too! 😉

If you had initially said that you were worried about the moles, removing them would have been medically necessary and the removal and biopsy and removal bill would have been covered.

Why are you keeping the name of the lab secret? Shouldn’t they be publicly shamed?

@mhenner – i am not, the name, South Bend Med is on the recipt above. Not the point as the post is about details to get points etc.

The key problem here, is the medical establishment in the US is not required to publish a price list for their procedures. There is no reason an iron test should cost $10 at one lab and $1,000 at the lab across the street, except they can get away with it. If they were required to publish it, you would receive a quote at time of service and you would have a change to negotiate the problem in advance. Most medical issues are not “OMG I’m dying give me the cure!” In many other countries you wouldn’t see this ridiculous BS but it’s allowed here to bend the consumer over the counter and see who will and won’t fight it.

What scares me is that the US has moved from a manufacturing economy to a service and information economy. This kind of crappy service is rampant. Your caution about careful note-taking cannot be overstated. Get names, extension or ID numbers, ask for copies of so-called “policies” that are not on-line, send by registered mail, etc.

If this is the future of our economy, pray!

I had a similar issue with a walk in by my house. I was double covered by health care for about 3 months after getting out of college. My (at the time) current health insurance saw another one and denied the claim, and I went through the same type of situation to get documentation to prove I wasn’t double covered any more. They threatened collections several times, as well.

The lab was probably not in network.. Unfortunately, why would anyone question whether or not the lab would be… but that’s the thing now.. gotta ask if radiologists, anesthesiologists, pathologists, labs etc are in network… often they are different companies than the hospital or primary doctors…..

So your insurance did not cover the procedure because it was cosmetic. Your doctor did you a favor to adjust his fees down to what your insurance would usually allow. Unfortunately the lab has their standard fees and can charge what they want. What your insurance will pay for it has nothing to do with this conversation because the insurance isn’t involved at all in this particular case.

Luckily you were able to get someone to agree to an adjusted rate and took great notes to keep that rate honored over the long haul.

@Chris Stils – luck has nothing to do with it. The charge was immoral and outrageous and thanks to details I was able to get what I should have had all along. Same goes with points – details can save and earn you tons!

Rene, try https://play.google.com/store/apps/details?id=com.globaleffect.callrecord&hl=en

Very good Android call recorder.

@John – txs

Your “Be proactive. If points do not post…” paragraph is very timely for me:

Two weeks ago, I flew RT Delta LAX->FRA. I was booked thru CDG outbound, and JFK return. The outbound AF A-380 had a mechanical, so they put me on KLM thru AMS instead.

It’s been 11 days since the trip started, but I *still* haven’t gotten my miles and MQM for rerouted outbound. I got my return flight miles and MQMs immediately. And the outbound flights show in “My Delta”, but no miles, no MQM. I’ve been Tweeting DMs to @DeltaAssist. I’ve submitted an online form. I’ll keep hammering them ’til I get my points!

@Ken – yep worth the effort. Txs for feedback.