Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I have a question for you. Say you apply for a new travel card. Almost all cards have either a small or large minimum spend requirement before you get the points. Let’s take the above for example. I still love my Ultimate Rewards points. I am beyond thrilled that if you happen to hold, or held in the past, ANY Chase MasterCard (they are dumping MC like a hot chile pepper) you can get that card again as a NEW card with bonus like with all the INK cards etc. (if you hold one right now, consider a new one and apply soon they will at some point send you in the mail a new VISA card to replace your MC anyway). But on to my question of the day.

You see many times with Chase you have to call them i.e. do a reconsideration call to get an approval. I have to do it almost each time I apply for a card as I have or have had them all or have a ton of them so must talk to a human to approve me and or to move lines around as for some reason having tens of thousands of dollars of credit with them seems to put me at the top of their tolerance level (I do ALWAYS pay in full and ON TIME so really no reason to be afraid, but I digress).

So when you apply, just when does your “clock” start. This is sorta a murky area in the banking world but for a bench mark to live by, plan for the date a card says you are “approved“. This is not always the fact but for the most part it is correct and applicable. Now, please, just to be on the safe side, use the application date rather than this date. Why? Worst case you get done early with your spend. Better this than a day or week short right?

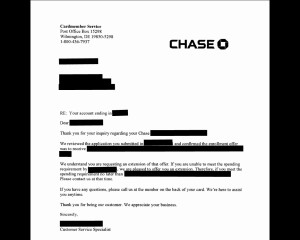

But can this set in stone date be adjusted? Notice a request by a reader to have that date moved; YES it can be done but you had better have some type of written or email proof of the extension (and this means more than just a rep of some bank saying so as that means NOTHING).

Other important bits to keep in mind. Under 99.99% of the circumstances the annual fee for the travel card does NOT COUNT as part of your spend. Here is where that is a major issue; the total for the yearly spend from cards “sorta” does includes that spend in your totals so you may “think” you are fine when you are really NOT fine at all. I always spend over by at least my annual fee on ANY card that I am trying to meet some goal. Worst case situation, I over spend by a little and let me tell you this is so much better than UNDER spending and being stuck without bonus points!

Back to the top of the post/day. I have so many times “got away” with free changes with airlines and hotels or whatever because I asked; I often asked again and again. If I get a no, I e-mail. If no again I put a letter in the US MAIL. I tend to never give up when the cost of a stamp can mean so much. You get where I am going with this – just what is it worth to you? As you can see, again from the letter to my reader above, it can mean a lot! Are you willing to do what it takes to score MAX points? I am! – René

.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Curious about the Ink Visa – I’ve got an Ink Bold still within 1st year – would strategy be to get the Visa now, and then cancel MC at fee renewal?

Any thoughts on If you have the Ink Bold, getting the Ink Plus instead or does it matter?

@Levi – my last round I had to close my INK BOLD to get my new INK PLUS OKed. I would hold it and apply 1st and offer to close to get new one approved as I did. Does work either way. Maybe you have a CHARGE card ie the BOLD and “want” a credit card the PLUS or the other way around.