Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Points are not worth that much. Now hang on, I am not saying they are not worth getting; I am saying they are worth very little PER POINT! Just about all the BoardingArea bloggers, especially those like Greg The Frequent Miler have it down to a science and down to the fraction of a point even.

But my point of today’s post is your time and you. What do I mean by this bit of self reflection? Let’s make a list and break this down one by one:

1 – Discipline

2 – Value & Time

3 – Purchase plans

4 – Goals

5 – Flexibility

To me, this list is what you should consider if you want to jump into this points game. Much of what we point enthusiasts do is “grunt work” that is, manufacturing spend, rebates, spending on focused items and even the time to click on little surveys that only award say 100 points at a time. That is just time and work. Lets look at this list.

1 – Discipline. I am SHOCKED, just totally SHOCKED each and every time I attend the Chicago Seminars each year and hear someone in the audience ask Rick I. what card he would recommended for someone to carry a balance on and collect points. WHAT!?! Are you kidding me? Carry a balance on a credit card? If you can even think that, let alone say it, you have no business in collecting frequent flyer points. You have more important financial concerns than points for a trip or vacation. Get your “house” in order then look to points. So, my point of the points is are you disciplined enough to never EVER carry a balance on a credit card? Many of the spend things we do earn 1% to 5% cash/points back. If you pay even ONE month at 14.5% credit card interest you lose big time! Clear?

2 – Value & Time. This is another big one. To do #1 perfectly takes time. My dear Lisa has a degree in Banking and Finance! That is a huge perk when I/we have 40+ credit cards active! Now clearly, we do not use them all (I have my favorites) but even so statements must be checked and a payment never ever missed! Not just that, what cards will I keep and pay the annual fee for and what cards will I downgrade etc. What is the value of your time to do all this for the points? Would you be better off just working more hours at your real job or maybe just having more free time for other pursuits over the time this hobby will take? Look long and hard at this and point #1!

3 – Purchase plans. Maybe this should be point #1. All of these are important. If you are looking to buy say a home, one of the biggest purchase items most make in their lives, a small bump UP in the interest rate you pay over many years can be HUGE. Is a vacation free or discounted on points worth that? No way. Not saying you can get ZERO cards if you are going to buy a house but you had better be exceedingly cautious. As one of the wisest people I know in the FF games always says all the time – “Your credit is one of your most important assets”!

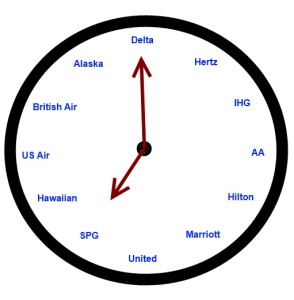

4 – Goals. Those of us who are all-in with points have points in all programs. I can look at flights on not just Delta but AA or US AIR or United. I have 100’s of thousands of points in all of them. When it comes to hotels, once I have air I can look at hotel options. Having said that, for most, you should be looking at a specific trip in mind and have you researched what cards, time, spend will get you to that goal. Points are not like a fine wine and do become worth less over time. For most you should earn with a goal in mind! I like spending my points on business and 1st class. There is nothing wrong with coach (do try for EC) and spending less points for more people to travel. When I spent points for tickets for me +2 golf buddies we all flew coach and got there just fine.

5 – Flexibility. This can make all the difference when it comes to points. If you work at a job where your vacation time is blocked off each year only around the holidays with basically no flexibly, your choice of points to collect will be limited to those programs that have no blackout dates and will give you MAX value at those redemption times (Ultimate Rewards for example). This is not saying you cannot use Skymiles at these times but you will often, even with crazy routes, be forced into mid or high level redemption making the value of your points worth much less than when redeemed at low level. Being able to first find low level seats and then asking for time off around those dates is much simpler.

Look at the above. Think all this through. Can you make sound decisions with the above in mind. To me unless you can say yes to all of the above, you should not play this game. All of us travel bloggers take the time to learn so much about the programs we take part in. One of the reasons I have almost NO Delta points is that I burn them as soon as I get them and know how to get the low level redemptions I want. I am not good at other airlines and that is one reason I have so many points sitting with other airlines. I need to apply the above to myself and burn more. I hope you see my point. Think, learn then act or just don’t. – René

Be sure to check back at 1:PM for SWAG Saturday!

▲Delta▲ SkyMiles® Credit Card

RESERVE/PLATINUM/GOLD

from American Express®

Click here for more information

.

.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Excellent points Rene! I totally agree with you that #1 is an absolute must! It’s not sexy or fun to pay down CC debt, but if you’re paying $20 in interest to gain $10 worth of points, it’s not working in your favor.

yes

@Rene,

I know within the credit card game, you are suppose to carry a balance of 0 (dont pay extra fees). What is your take on credit card transfer 0% or loans from credit card of 0%?

@lucky,

Do you do any balance transfer or mini loan from credit cards with 0% interest(APR) for up to a year? What is your take on that?

I received a mail from my credit card that I can received up to 7g in loan/balance transfer/ and not pay it back until 1 year from now.

1) Do I earn points when I make payment?

2) Can I use use this money to pay other stuffs like rent, mortgage, etc.?

3) Are you aware of any hidden fee/tricks from the credit card companies?

I want to take a loan or perform a balance transfer to help build up my credit, take advantage of free money, and earn some points.

(I pay all my bills on time and have the cash available to pay back the loan).

Thanks in advance!

@Bundy – wow what a comment. But good! 🙂

I just have no need on the 0% stuff EVEN if they offer them at NO fee. Most of the time they come with 1 or 2 or 3% fee then just dumb to do (unless you have some kind of way of making money on the money for the time and it is all ZERO cost to you).

As to your other questions. You will not make points on these types of advances / checks. What you could do is if you want to say pay off a student loan and they can give you money at ZERO % for some term is send the money to a card then buy Vanilla reloads, earn points, then send a bluebird check to pay off the loan. Then make sure you pay back the 0% deal before it is due!

There must be something about the psychology of getting something for nothing that makes this hobby attractive to people. Otherwise, you are right, it makes more sense to spend your time working harder at your real job. I used to think this was mostly a hobby for retired people but that’s not the case at all. People in this hobby do crazy things to get something for “nothing.”

Anyone who has 40 credit cards to track and manage does not not have another job. As someone who flies over 100,000 miles a year – on my own dime because we have had a commuter marriage for almost five years – I find this credit card points and miles game mind boggling. I enjoy my 1K status, first class upgrades when available, first class award travel overseas and the few other perks I get with my status but I am not obsessed with it. And Vanilla reloads and Bluebird checks – I just don’t get it.

Thanks Rene!

Sue, I also have a commuter marriage, house in CT and job/condo in MS. I have been doing this a year and it is starting to be a drag. What is your commute and how often do you do it? I am about at 2 weekends out of 3.

CB

I think I know the answer to this, but I’ve never researched it. My assumption is that you can’t find a rewards credit card with a low enough interest rate to make it worthwhile. But, hypothetically speaking, if I were prone to carrying a balance on my card (I don’t) I might look at it and say that I could either carry that balance on a card with rewards, or carry that balance on a card without rewards. I think that my first rewards card has a fairly low interest rate. It is a fee-free card and doesn’t get a high earning rate, but if I carried a balance I would rather do it on that card than one without rewards.

Again, that’s all kind of hypothetical and I’m just spinning my wheels a bit.

@cory – the biggest problem is that most point earnings are 1 or 2 or 3% return. Most credit cards are 12% or 14% or 18% APR so you can see there is just NO WAY to win without paying off your credit cards in FULL each month. Again, unless you can do this there is no point in earning points as the personal has bigger issues to address first.