Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

So I have reviewed both VISA and AMEX & MC. We have looked at the perks and drawbacks of them all. So what card will I use after spending so much time reading all the T&C of all the programs? First some info.

My wife is one of the smartest (& most beautiful) people on the planet. She made straight “A’s” in school and takes care of the dozens and dozens of credit cards I keep applying for every 3 months for both me and her. She does not complain (well much) and gives me so many good ideas when it comes to travel. One of the best things she has ever said, on a trip one time, is this simple statement: “if it costs less that $25 to fix, it is NOT worth getting upset about“! What brilliance. Simple, clear, brilliance. I tend to obsess over many details of a trip and in the past got upset over the small stuff. Ya know, that is just DUMB and silly. Thank you my bride, yes, if I can fix stress for $25 on a say $3000 vacation, then it is NOT a problem.

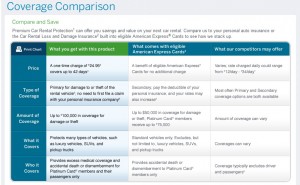

Now fast forward to the summary of the first two posts from how to pay for your rental car. Several readers touched on the fact that both the United card and Diners Club card offer what is called primary protection. That means, unlike the other cards we have talked about, if there is an issue, then it pays out rather than your insurance. Sounds good right. Well, not so much. Here is why. They only pay for YOUR car – NOT – the other car or whatever it is that you hit. A bunch of traffic accidents involve at least 2 vehicles, so how good is insurance that covers only one vehicle when both will be involved in the crash! Plus, guess what, most of the got “got ya’s” like 15 days max rent or $50k or $75k max primary payouts and more still apply. So, this is NOT a dream solution.

But now the key part. You MUST check your personal car insurance. USAA is just about the best car insurance on the planet and I doubt anyone will argue that point with me. They cover me on a rental, in the USA, just like it is my own car. The exact same coverage I have on my car. But also the same deductions.

But as you can see, ONLY in the USA (plus a few more US territories). When I go to rent a car say in Grand Cayman later this year, they will not cover me for one single Cayman dollar!

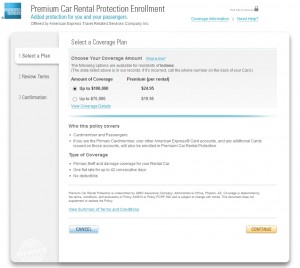

So, what do I do? Do I just pay the $15/day insurance coverage? No way. As some of my very smart readers touched on both days, AMEX has a program (Read the T&C here) you can sign up for HERE. They have a $24.95 package and one for $19.95 (in CA it is always $17.95).

The top package, that is charged just once when you rent, covers you for up to $100,000 and has so many less “got ya’s” than the std AMEX free policy. It is NOT perfect as you still are LIABLE for any other cars you hit. So we still don’t have PERFECT solutions, but we now have all the tools to make this all work. Here is how this will work.

Situation #1: You check your policy and it covers you in the USA. You then pay for the rental with your VISA card of your choice (or Diners Club) as between the VISA and YOUR insurance you are good to go under most situations if under 15 days. There is NO upcharge and you can be happy and say NO to the extra insurance costs. If over 15 days go to situation #2.

Situation #2: You have NO car insurance. Then, you get the AMEX policy for $24.95 or $19.95 that is a ONE TIME fee for up to 42 days of rental, AND, so VERY important, when you rent you DO say YES to ONLY the added liability charge/fee. You have full coverage for your car and stuff but must PAY UP for the liability in case more than just you are involved in a crash.

Situation #3: You are renting Internationally (not in Australia, Ireland, Israel, Italy, Jamaica, or New Zealand) . Then, you again get the AMEX policy for $24.95 or $19.95 that is a ONE TIME fee for up to 42 days of rental, AND again, so VERY important, when you rent you DO say YES to ONLY the added liability charge/fee. You have full coverage for your car and stuff but must PAY UP for the liability in case more than just you are involved in a crash.

That is it kids; it really is just that simple! If you need to rent longer that 42 days, on the AMEX plan, you can return the car, rent on a NEW contract, and be good for another 42 days. The only time you don’t fit in 1,2,3 is if you are in a country that AMEX will not cover you! The only way around this is to rent in a country next door and as you will have protection in those otherwise no coverage countries if you rented in another land (just how does one drive to Australia?).

AMEX, as others and I have talked about, is just the BEST when it comes to paying out on these types of claims. That IS peace of mind. A last thought about the above, when in the USA I have my own medical insurance, outside the USA, I like the added perks of the AMEX policy should I ever need it!

Some other bits of info to sum this all up. You will have to pay the AMEX International transaction fee as you still need to pay for the rental IN FULL with your AMEX so no points here unless they are Membership Rewards points. So what if it costs you a few bucks more; you are paying for peace of mind on a trip. Also, just about any AMEX card you have under your AMEX login will be part of this package. So, say you have BOTH a personal and business Delta Reserve card, you can pay with either one. If on a fun trip, use that card and you are set. If on business trip use that card and you are set and will be billed only when you use the card to rent a car! How great is that? – René

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

▲Delta▲ SkyMiles® Credit Card

RESERVE/PLATINUM/GOLD

from American Express®

Click here for more information

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Your analysis forgot to address the often ignored but major cost to relying on any credit card issued car rental insurance, the enormous stress & time spent dealing with and awaiting resolution of a claim.

Unfortunately, I’ve had rental car damage more than once & (since I carry no personal car insurance) have endured the process with AMEX, Hertz, Budget, National and MasterCard.

I can attest that even if your claim is approved the 6 months or more waiting period is hell complete with nasty demand letters & phone calls.

While I’m no fan of the ripoff prices the car rental companies charge for coverage, the ability to return a damaged car & simply walk away is priceless.

What happens in the situation where you have no car insurance but have the united explorer card which is primary insurance. Is. It a combination of one and two above?

@bk3day – i think most who have had claims with VISA & AMEX will attest that it takes a little time but works out well. I trust them both!

@Jim L – If under 15 days, in the USA, use your United card can say YES to liability add-on. As I clearly posted, primary is JUST for YOUR CAR! You still need liability if you hit another car. People hear the word primary and think they are all set. YOU ARE NOT!

Rene, I have the AMEX Plat and am enrolled in the Premium Rental Coverage. Under Scenario #2, do you know off hand how the added liability typically is per day?

Tusen Tack!

@Jim – it depends on the company. A good “range” will be $3-10/day. This number should be looked at so be sure to check this vs. the RATE from another company as the total package price should be checked. Learning all this is like the old teaser $9 airline seat price but after add-on’s is much more. So, one more step for us to check.

Thanks for the tip about liability insurance which I didn’t realize was not covered. I have used the Amex Premium Protection plan twice for minor scrapes to the rental car itself and it worked great. Obviously you fill out the car rental form when you return the car and the Amex form too. From then on Amex handles the interaction (hassle) with the rental agency. Amex lets you know via email what is happening (status) and if you need to provide them with additional info. Unfortunately the rental company may send you letters demanding payment but Amex says to ignore them and eventually they reach closure with the rental company. There is no deductible so the $20/25 dollars you pay is your out of pocket expense whereas you own car insurance probably has a couple hundred dollar deductible. I recommend it for peace of mind during and after your vacation.

Also I believe that if you rent directly with car rental companies like Hertz and Avis and use an Amex card with the Premium Protection enabled then Amex will notice the rental charge and automatically charge your card the premium protection fee. If you go through other sites like Hotwire or the Capital One Rewards site using an Amex card with Premium Protection, then I believe you need to call Amex to add the protection. Not 100% sure on this.

René, could you also enlighten all of us – frequent visitors to Australia & New Zealand – and write a post on how to best cover ourselves for rentals?

I myself always buy the full coverage, but the costs are almost prohibitely high.

Thanks!

Anyone got advice for someone who does not own a car and has no personal insurance? Does the Amex card work for me?

@Omari – see situation #2 that is for you.

The Discover Escape card also has primary rental insurance, but has the same gotchas as the United and Diner’s Club primary insurance. I personally always rent with this card because I get $0.02 / dollar spent in travel reimbursement and I get coverage that compliments my personal auto policy. I don’t use the card for anything else though!

I am with @nomad. Have a trip to New Zealand coming up and would like to know the best way to protect myself when renting a car there. Thanks!

I spoke to Hertz regarding a rental in France and they said that unlimited third party liability insurance is included in the basic cost of the rental. In other words, coverage is provided even if all insurance coverages are declined in favor of using AMEX credit card insurance protection.

@Linda – txs for feedback. For me, I think the extra plan just works and provides more that I can use if a real issue comes up like medical etc. For me, the extra few $$$ is money well spent.

Can I enroll my AMEX Bluebird card in the Amex Premium Car Rental Protection plan? I realize it’s not technically a ‘credit card’ but I usually carry a high balance on it a could pay my rental in full with it. It also has no foreign transaction fees, perfect for my international rental. It’s my only AMEX card.

Thanks.

@Missy – I do not know but will find out (unless another reader knows). Thanks – Rene

Returning to this topic. re Linda- yes and important. Third-party liability INCLUDED in base rate in every European country I know of, so that part at least is not a problem.

Re Italy- such a quagmire for rentals. Very interesting on Amex Plat that Italy is excluded, but Rene says: rent in a neighboring country. Typical is renting in Germany and driving into Italy: far lower rental rates. The AMEX terms DO say ‘renting in’ but do NOT refer to ‘driving in…’. So it does seem that renting in Germany and driving into Italy would be covered. But does anyone have any evidence here?

I have used both my AMEX DL Reserve and my Chase Sapphire Visa in Europe. When we rent in Germany and Switzerland, the rental car companies (Hertz and a few others European based, I forgot, we haven’t been there in a couple of years), states we aren’t allowed to take the car into Italy and a couple of other countries (I forgot, we haven’t been in Europe in a couple of years). It is written in the contract and they point it out. I asked why, they said that they have too many problems such as stolen cars and car break-ins.

They said we wouldn’t be covered by the credit cards if we traveled there.