Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I have rented a few cars this year and have got some killer deals. The first, from Advantage rentacar was just $6.49 a day base rate. Loved it and did get the “hard push” that I should take the full coverage for the car since I would have to pay my deductible if anything went wrong like “with the paint” (the paint? really? ok then). My next rental this year with Enterprise I got a soft push for the full coverage as well but in both these instances I said NO because between my USAA car insurance, that does cover me when I rent a car, and my Chase Sapphire Preferred® Card® card or even my Marriott card I am 100% covered (or so I thought).

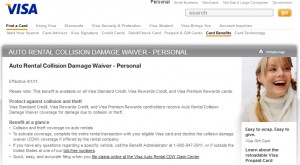

As you can see by the graphic from the Chase site, they flat out tell you to “decline the rental company’s collision damage waver coverage“. Well that sounds very nice. But, do you notice the little ” * ” by those words. Humm…. The card member agreement, HERE, does not talk about it much.

So the little star takes you to the above page. It says to take you to your “Guide to benefits” to find out more information. OK so what does THAT thing say? Here is where you need to understand the card benefits.

The rental coverage is NOT, again NOT, from Chase but from VISA itself. As we all know, there are many companies that use the VISA logo. The good news is that almost ANY VISA will do to get this perk. “This benefit is available on all Visa Standard Credit, Visa Rewards Credit, and Visa Premium Rewards cards.” You can download HERE a PDF of the full info I will be touching on next.

There are a BUNCH of “got ya’s” that you MUST think about. Here are the big ones:

1) “Any additional drivers permitted by the auto rental agreement are covered”

Make sure if you let ANYONE drive they are on the contract as an authorized driver (not that you ever let anyone else drive it anyway right).

2) “Only vehicle rental periods that neither exceed nor are intended to exceed fifteen (15) consecutive days within your country of residence or thirty-one (31) consecutive days outside your country of residence are covered. “

Only 15 days in the USA and 31 days outside the USA! If you rent longer, you should switch to another company or it may just be considered to exceed 15/31 days (but even this has risks – there is another tip I will cover later).

3) “For the benefit to be in effect, you must: Initiate and complete the entire rental transaction with your eligible Visa card, and decline the auto rental company’s collision damage waiver (CDW/LDW) option, or similar provision.”

I reached out to VISA about this, and they said, points or cash is all fine with Ultimate Rewards so either way is AOK. But I would to be sure pay something with your card to show points and card was used.

4) “You must make every reasonable effort to protect the rental vehicle from theft or damage.”

Even after a wreck, keep in mind you are responsible for THAT CAR!

5) “Theft or damage due to intentional acts, or due to the driver(s) being under the influence of alcohol, intoxicants, or drugs, or due to contraband or illegal activities.”

It is totally stupid and criminal to drink and drive but if you do, and crash, don’t expect VISA to pay for anything!

6) “Confiscation by authorities.”

I have been told nightmare stories from Mexico and other places. Watch out, outside the USA or if you are dumb enough to do worse things covered in point #5 while you have the car!

7) “Theft or damage from rental transactions which originated in Israel, Jamaica, the Republic of Ireland, or Northern Ireland”

Along with point #6 this is good info to know!

8 ) “expensive, exotic, and antique automobiles; certain vans; vehicles that have an open cargo bed; trucks; motorcycles, mopeds, and motorbikes; limousines; and recreational vehicles.” – “However, selected models of BMW, Mercedes-Benz, Cadillac, and Lincoln are covered.” – “This benefit is provided for only those vans manufactured and designed to transport a maximum of eight (8) people including the driver and which is used exclusively to transport people.”

Be careful what type of vehicle you rent. It may not be covered. To be safe, you can call VISA to see if your car is covered before you get there. If the company offers you another car, VISA is open 24/7 so to be rock solid sure you can call and confirm that your rental is in fact covered.

9) “You, the cardholder, are responsible for reporting your claim to the Benefit Administrator immediately, but in no event later than forty-five (45) days* from the date of theft or damage, or your claim may be denied.”

This sounds simple but they had better be one of the first people you call. And I would write down who you talked to and the reps employee “ID” number too!

10 ) “A copy of the accident report form.” – “A police report, if obtainable.”

This is important. I would always call the cops. Even in a “no fault” state, get a report to be safe.

So there you are. This is a great perk from VISA and if we know the above, we should be able to enjoy saying “NO” to the additional insurance when they ask you and say that it is covered by my card! But, is this the BEST choice? Should you use your VISA to always rent a car? Or, is say your DELTA AMEX RESERVE card a better choice or maybe a MasterCard? I will cover all this on Thursday! – René

PS see the next post in this series HERE & HERE!

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

▲Delta▲ SkyMiles® Credit Card

RESERVE/PLATINUM/GOLD

from American Express®

Click here for more information

.

.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

“Should you use your VISA to always rent a car? Or, is say your DELTA AMEX RESERVE card a better choice or maybe a MasterCard?”

No…use your Chase United Explorer card, as they provide primary insurance (i.e. you can put claims directly through to Chase, without going through your personal car insurance policy first).

Also, something else to be aware of is that in most cases, if the accident is your fault, credit card insurance won’t cover a penny.

@Jon – I will be covering that soon to but it is good to know all the facts on all the cards.

Disregard my last sentence above. I meant to say that credit card insurance will typically only cover damage to your rental vehicle, and not damage to another car that’s involved in an accident with your rental.

What about coverage for “Loss of Use” – the rental car company lost income while a vehicle is being repaired.

@Cary – yep good to go. See the what is covered in the PDF

Is this coverage for the rented vehicle? What about coverage for the other vehicle(s) and property(ies)?

Good information. I look forward to hearing more about this issue. Thanks!

AMEX platinum offers auto insurance above and in addition to any other insurance (like VISA in this article) for a flat fee of $24.95.

Does it make sense to buy that? They might cover the damage to the other car up to a limit.

@johnny – I will talk about AMEX, MC as well as Dinners Club Thursday.

I like the one-two punch of USAA and AMEX Preferred Accident insurance. It is worth the $25 per rental period to ensure I’m double covered for the rental car.

.

As for damage to other vehicles, Credit Cards do not usually offer any form of liability insurance, just comprehensive/collision to the rental car; however, a person’s personal coverage would kick-in to handle the liability.

.

Plus, it is important to ensure you are covered for loss of use, diminution of value, and administrative fees, which are all assessed after an accident by the rental agency. Many times, credit cards do not cover these.

.

Rene,, this is a great post, and I’m going to link to it on the Disney boards (disboards.com), as many of the Disney faithful could use this info, too.

@Chris B – txs for your great comments. AMEX has some things that will freak you out on Thursday. Be sure to come back. – Rene

@ChrisB @Delta Points

“person’s personal coverage”

Can you elaborate on this coverage? Will this cover when I am overseas?

@MichaelP – I will cover AMEX on Thursday. – Rene

Another thing – you may cover this on Thursday – but I believe that no card covers insurance on UHaul truck rentals or Budget Truck rentals. Is that correct? To make sure, I recently paid UHaul’s insurance rates.

@Mike – correct on just about all cards. All these are for std types of rentals. You personal insurance may not cover them either for that matter. So, calling on both would be wise.

What about in countries that require you to take the damage waiver, like New Zealand?

@G David

When I was in NZ I rented from Holiday Autos and YourWay, both included insurance in the rate.

Where did you find the $6.49 rate for the Advantage Rental car? I am using the promotion code you note and am finding rates of about $33 a day all in. That doesn’t seem bad at all, but isn’t anywhere near your rate.

Thanks!

Thanks for the timely reminder. Sadly, the Republic of Ireland does not allow coverage with a CC. Add that to the cost of an automatic drive, and the cost skyrockets. Anyone know of a good car rental agency or portal to go through for renting cars in Ireland?

Bottom line for a shor rental well worth buying the coverage from the rental car company. Way too much fine ring with the cc.

@Helen C – no, For me, under 15 days, any Visa will do fine if you have good personal insurance also. But, wait till you see what is up next! 😉

@Mary E – I rent several times a year at Dublin airport. I prepay on the Irish Avis site (avis.ie). The rate is much cheaper and includes insurance. At the counter they will try and sell you top-up coverage to cover the deductible. I always haggle and end up paying 8-10 EU instead of the initial 16 EU per day. Remember in Dublin that a small car often commands a premium price. I typically rent full size and get an Opel Insignia (local version of Buick Regal).

Thanks for info. It may be good to point out in future post which Visa cards have primary insurance coverage. In addition, there is upgraded 24.99 charge on AMEX which has better car insurance coverage (I believe it is AMEX’s version of primary coverage)

@Chris – there is a follow up post for Thursday and the final one, touching on what you are talking about and more, will be this weekend.

So… another big question – what about those of us who do not own cars and therefore have no car insurance (common in NY or SF).

I generally decline all coverage and just wing it with the Visa. I found out recently that I have been driving with zero liability coverage, at least for rentals in California. Yikes.

So I started paying the liability portion and winging the rest. I’m fatigued on the fine print now, but as far as I can tell if you are willing to cough up the $9-12 a day that liability costs, the Visa seems to handle the rest.

I do rent for a 60 day periodfrom Hertz when I go to FT Myers, FL. is there a card that covers the inital deductible for that long a period. I intended to pay with my Sapphire preferred MC next week.

@David – see the post tomorrow for more info! – Rene

@Tyrell: No liability. That’s a little scary!

I think the additional insurance is always a good idea but I’ve only been using Visa to purchase rental cars in Augusta, GA., but after learning this information I think I am going to star using my other cards. What cards do all of you prefer to use?

I heard back from Chase (I have the Ink Bold) the following. I wrote a Secure Msg:

I’ve been investigating the UR Mall, planning to rent a car probably using UR points . I’ve been reading the new Guide to Benefits y’all sent recently, but I haven’t found an answer to my concern about renting a car using points.

If I plan to rent it through the UR Mall, using UR points, and paying whatever extra charges there are (taxes or whatever) on my Ink Bold (it’s a business trip), am I provided with the Chase Auto Rental CDW as outlined in the Guide to Benefits? Or do I need to rent the car *paying* with the Ink Bold to get that coverage?

The Guide doesn’t say anything about renting using points.

The Chase rep wrote back:

Let me inform you that you will be unable to claim for the Auto Rental CDW if purchased using points. Please note that you must secure and charge the eligible rental to your card to get the benefit of Auto Rental CDW.

For more information or to file a claim, call the Benefit Administrator at 1-888-320-9956 (outside the U.S. call

collect at 1-804-673-1691).

A couple of years ago I was vacationing in Costa Rica and refused the extra rental car insurance. I booked a 4wd SUV due to the many dirt roads we typically travel, which resulted in a Hyundai Tucson, not exactly the vehicle I was expecting.

Long story short, I dragged the bottom of the vehicle in a few places and tore the plastic underguard. The rental company claimed there was $3600 in damage, which was impossible, but we were already home and had no recourse. Anyway my auto insurance doesn’t cover me in Costa Rica, but AMEX did. They covered every dime of damage to the vehicle, and I was amazed at how easy the process was. I carry my Visa for situations where AMEX is not accepted, but this experience has taught me to forevermore carry an AMEX in my wallet.

BUY THE RENTAL CAR INSURANCE OR HAVE LOTS OF HEADACHES——-Administrative fees, loss of use fees…etc…Visa will only pay for deductible of your reg insurance & nothing if rental is over 15 days. My rental was for 16 days while my car was in the shop, so they will pay nothing for cracked windshield not even the deductible. I will use VISA no more!

@Don – I sum it up that if over 15 days how that you need to see this: http://deltapoints.boardingarea.com/2013/02/23/summary-what-card-type-will-delta-points-use-to-rent-cars-answer-it-depends-on-123/ even then, you don’t need to pay the rental companys insurance, the AMEX deal is much better!

Thanks for this breakdown! I have a USAirways Barclay card (Mastercard) and it seems to be the same deal. Just trying to paddle through all the fine print!

Appreciate the tip about getting the rep’s name and ID number. Good idea too to find out what city they’re working in, and what the actual name of their department is. Coming from someone who used to work in a call center; calls can be routed here, there and everywhere and you might not get back to the same call center twice!)

@Amy – yes ALWAYS be careful with MasterCard as ALL MasterCards are NOT the same. Visa you know you are safe, some MasterCards you could be stuck!

It appears that Visa and MasterCard require you to decline the CDW/LDW to have the coverage. Do rental car companies offer only “liability” to cover another vehicle that I may damage in the event of an accident? If I were in the US, my personal auto insurance would cover the liability, but does not offer coverage internationally. It would be great to be covered by Visa or Mastercard for the rental car, but am I also declining liability coverage for other vehicles?

@Valerie – yes you can just pay for personal liability add-on

No third party coverage… Canadian Cards can have a $50K CDN$ limit. Bottom line… know your coverage and ask questions while recording your call if anything is unclear to you.

Lovely information. The tips are really helpful and also giving the knowledge about the things that we should do while paying for cars.

If I use a 25% off coupon when I rent a car and pay with Visa, will this car get covered?

@Tom – Discounts should not affect coverage as long as you pay balance with Visa card. However, if you have a code that is FOR insurance that could have an impact.

Hello

“Should you use your VISA to always rent a car? Or, is say your DELTA AMEX RESERVE card a better choice or maybe a MasterCard? I will cover all this on Thursday!” where is the post?? Thanks!

@Sam – Bottom of post see: PS see the next post in this series

I’m beginning to question how hollow the benefits these credit cards SAY they give you really are. I have Barclay’s MC and will be changing soon. They tout a travel disruption benefit where if you are delayed 6 hours or more, they will reimburse you for expenses. I had a delay of 2 days and eventually had to fly to a nearby airport due to weather. They denied my claim stating I didn’t meet the 6 hour delay despite 2 letters from the airline, receipts for expenses, proof, (with date), of ground transportation from one airport to the other to get my car, and a detailed explanation of what happened which I doubt they even read. It was only a $260 claim for lodging (I had used cash for food & the ground transportation).

Now I wonder when I rent a vehicle and deny the rental company’s coverage, whether my claim, should I have one, also be denied by Barclay’s. I had their Mastercard for over 20+ years and never filed any claim before. So 1st claim is DENIED. It met all the criteria set by Barclay’s (and yes, weather was one). I charge over $60k a year on my Mastercard, but pay it off every month. It’s time to look for another credit card.